Leading on-chain data provider, CryptoQuant, in a recent series of tweets, shed light on Bitcoin’s latest market dynamics. A thorough analysis provided by the well-known data analytics firm, supplemented by top-notch analyst @phi_deltalytics, highlights a decreasing selling pressure, high leverage combined with negative funding, and a weakening retail demand in the Bitcoin market.

According to the technical analysis expert, the short-term Spent Output Profit Ratio (SOPR) and the adjusted SOPR (aSOPR) for Bitcoin are currently testing the support at 1. These metrics demonstrate that active on-chain participants are reaching their cost basis, a level that often precedes a reduction in selling pressure. Such data suggests that the selling force on Bitcoin could soon be subsiding, potentially laying the groundwork for a more stable, perhaps bullish, market scenario.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Short-term Spent Output Profit Ratio (SOPR) and Adjusted SOPR (aSOPR) are two on-chain indicators that measure the profitability of coins that have been spent recently.

- SOPR is calculated by dividing the current price of a coin by the price at which it was spent. A SOPR of 1 indicates that the coin was spent at a profit, while a SOPR of less than 1 indicates that it was spent at a loss.

- aSOPR is similar to SOPR, but it excludes coins that have been spent as part of a relay transaction. Relay transactions are used to move coins between wallets, and they often do not reflect the true profitability of the coins being moved.

Both SOPR and aSOPR are useful indicators for measuring the overall health of a cryptocurrency market. A rising SOPR indicates that coins are being spent at a profit, which suggests that the market is bullish. A falling SOPR indicates that coins are being spent at a loss, which suggests that the market is bearish.

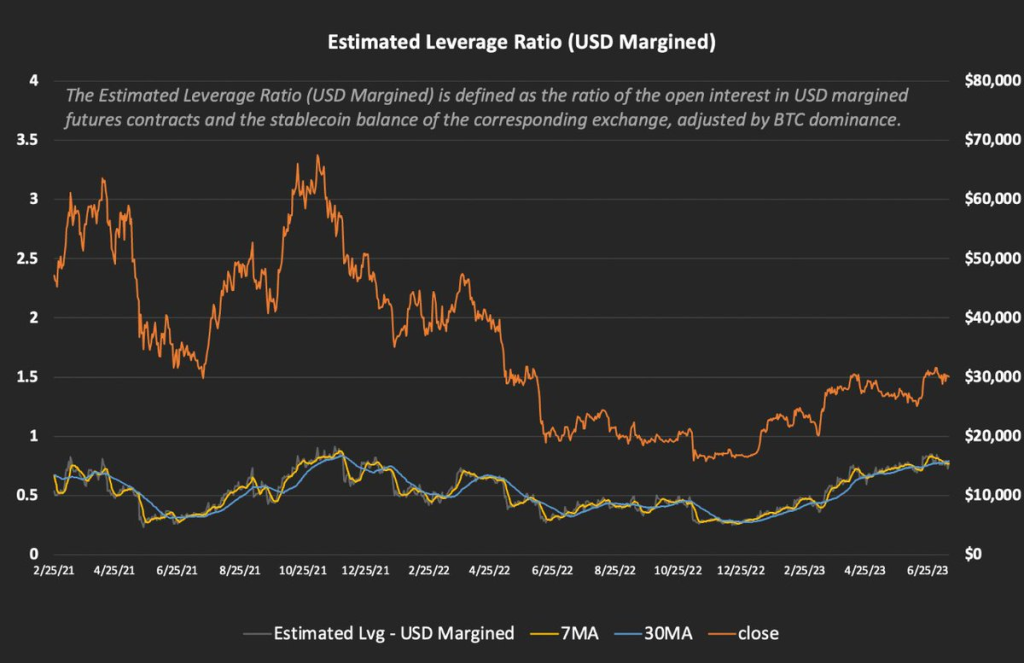

In an intriguing twist of events, the high leverage in Bitcoin futures, marked by a negative funding rate, is indicative of a volatile period on the horizon. The estimated leverage ratio for Bitcoin futures remains at a historically high level. However, the overall funding rate has turned negative, hinting that future basis trading isn’t exerting bearish pressure on the Bitcoin market. Paradigm flows reveal a bullish institutional bias, suggesting that the derivative market participants might be overly pessimistic.

A negative funding rate in cryptocurrency trading is when the longs (traders who bet the price will go up) are paying the shorts (traders who bet the price will go down) to maintain their positions. This happens when the market is bearish, and there is more selling pressure than buying pressure.

A negative funding rate can be a good or bad thing for the price action of bitcoin, depending on the circumstances. If the negative funding rate is caused by a temporary dip in the market, it could be a sign that the market is about to rebound. However, if the negative funding rate is sustained, it could be a sign that the market is in a bearish trend.

Here is an analogy that might help you understand negative funding rates better:

Imagine that you are playing a game of poker with your friends. You are the only one who is betting that the price of bitcoin will go up, and your friends are all betting that the price will go down. If the price of bitcoin goes down, you will have to pay your friends some money. This is similar to a negative funding rate in cryptocurrency trading.

CryptoQuant’s analysis also touches on an area of concern: the weakening retail demand for Bitcoin. An increasing number of stablecoin withdrawals, without a corresponding rise in deposits, points towards this trend. The firm interprets this shift as particularly alarming during peak bull markets compared to early bull markets, highlighting the importance of retail demand in maintaining market momentum.

Investors and traders are encouraged to follow these and other on-chain metrics closely, as they navigate the sometimes turbulent waters of the Bitcoin market. As always, market participants should conduct their own research and consider multiple sources of information before making investment decisions.