A series of seemingly unrelated events have sparked a wave of speculation and intrigue. These events, when viewed collectively, suggest a massive shift in the crypto market may be on the horizon.

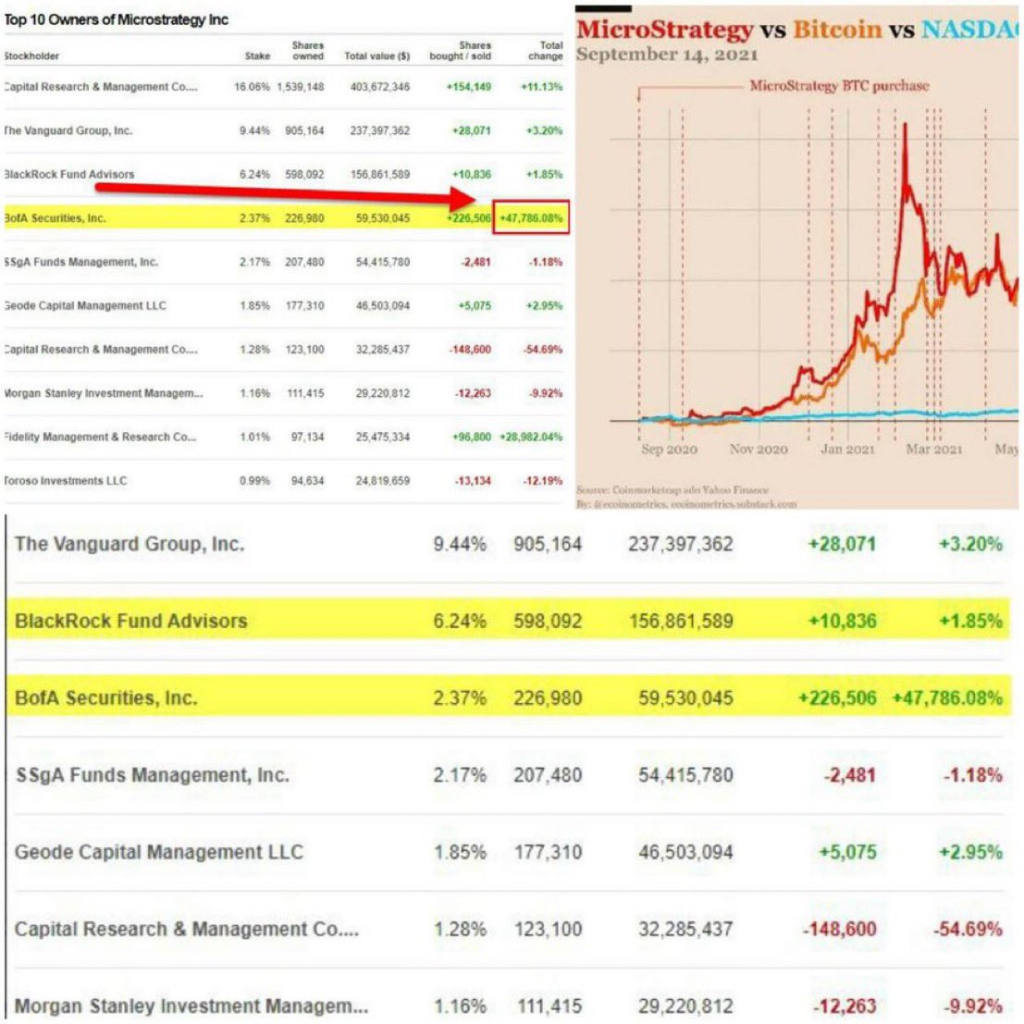

The U.S. Securities and Exchange Commission (SEC) has been launching lawsuits targeting various crypto entities. Simultaneously, BlackRock, the world’s largest asset manager, has been quietly amassing a significant amount of cryptocurrency during a period of market uncertainty, commonly referred to as the “fud” period.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Adding to the intrigue, BlackRock recently announced its intention to file for a Bitcoin Exchange-Traded Fund (ETF) using Coinbase as its platform. This move comes amidst increasing pressure from Hong Kong on banks to accept crypto clients. Furthermore, the decade-old controversy surrounding Tether (USDT) has resurfaced, adding another layer of complexity to the situation.

These events are not mere coincidences, but rather signs of a brewing storm – a potential bull market of unprecedented scale. Market observers warn not to be fooled by the current market volatility, but instead to seize the opportunity to accumulate assets.

The average retail investor is now more informed and has access to more tools than ever before, including social media platforms that provide real-time market insights. Those who are selling their assets in the current market are often labeled as ‘uneducated’. Anyone pushing against the current market trend is accused of being influenced by market makers.

The narrative concludes with a series of updates, including one announcing BlackRock’s official filing for a Bitcoin ETF, and another addressing recent regulatory scrutiny in France.

This narrative paints a picture of a crypto market in flux, with regulatory pressures, market manipulation, and savvy investors all playing their part. As the dust settles, one thing is clear: the world of cryptocurrency remains as unpredictable and exciting as ever. Whether these predictions will come to fruition remains to be seen. However, this narrative serves as a reminder that in the world of crypto, it pays to stay informed and always be ready for the next big shift.