MNW, a coin in the supply chain sector, is making waves despite its relatively small market capitalization of $40 million. The coin has managed to secure significant partnerships with industry giants such as Coca-Cola and UPS, demonstrating its potential to disrupt the supply chain industry.

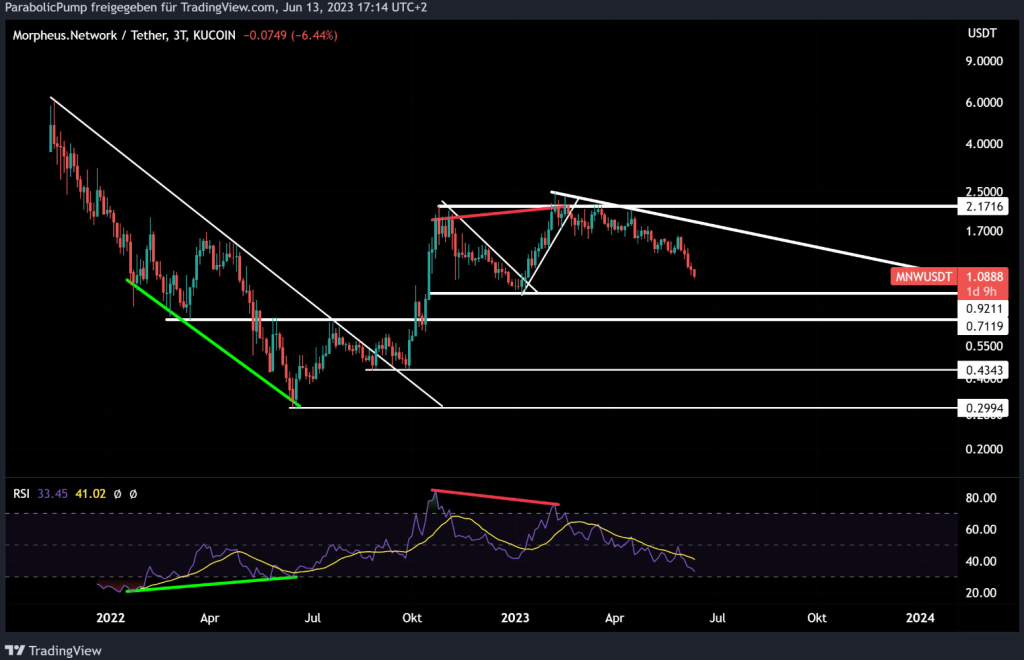

MNW’s performance in the market has been noteworthy. In September 2022, the coin broke its long-term downtrend, a move accompanied by a bullish divergence on the Relative Strength Index (RSI), as indicated in green. This technical indicator suggested that a price pump was likely, or at the very least, the downtrend would halt.

This prediction proved accurate. MNW broke out, retested the long-term downtrend line, and revisited the lows made in August.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +After reaching its peak, MNW experienced a retracement that lasted for a few weeks. However, this setback was short-lived. The coin embarked on another bullish run in January, which continued until February 2023.

For those interested in accumulating MNW, check out the following strategy:

- Buy the breakout of the downtrending resistance line.

- Set limit orders at around $0.92, but be mindful that if these lows are broken, it’s more likely that MNW will sell off more.

- $0.71 is another strategic area to buy.

Looking ahead, there is a strong sense of optimism about MNW’s potential. It is believed that MNW could achieve a 50x increase from its current position by 2025. Even a 100x increase is not out of the question, considering the coin’s small market cap. Such exponential growth is certainly possible

After reaching its peak, MNW retraced for a few weeks before embarking on another run in January, which lasted until February 2023. However, this uptrend was short-lived. The loss of the white uptrending support line marked the end of the uptrend.

Other warning signs included an overbought RSI with bearish divergence and large candle wicks to the upside, coupled with several failed attempts to push above the highs of October. These factors led to a sell-off that has continued since February, with MNW still in a downtrend.

The analysis of MNW’s performance and its strategic partnerships with Coca-Cola and UPS suggests a promising long-term outlook for the coin. As it continues to make strides in the supply chain sector, MNW is a coin to watch in the crypto space.

Stay tuned for more in-depth analyses and long-term outlooks on promising cryptocurrencies.