After a prolonged downward spiral, the Bitcoin price recovered somewhat on Monday, November 26. It has thus risen by almost nine percent in the last 24 hours. Satoshi Nakamoto’s crypto currency is currently 4,092 US dollars.

What you'll learn 👉

Not only the Bitcoin price: Almost all Altcoins climb up

Ripple, too, is currently trying to counter the slump in the price. With a plus of ten percent, the XRP price is currently at 0.38 US dollars. According to our price pages, the “bank coin” is currently in second place among the crypto currencies with the highest market capitalization.

Ethereum, the supercomputer project led by Vitalik Buterin, recorded very similar price increases. At 9.7 percent, the Ether exchange rate currently stands at 117 US dollars and is still in third place.

Even Bitcoin Cash, which suffered a lot in the course of the Hash Wars, was able to make up some ground in the price performance. With seven percent plus, BCH currently stands at 184 US dollars.

EOS, the project under the patronage of block.one, was able to climb to currently 3.39 US dollars within the last 24 hours. The crypto currency number five has thus risen by almost eight per cent.

Only two losers in the top 100

Currently, almost all crypto currencies under the top 100 are in plus. The single losers are the Undertaker QASH and Dai. QASH lost 0.11 percent of its price and now stands at just under 0.20 US dollars. The Stable Coin DAI is the biggest loser of the last 24 hours with a minus of 1.27 percent. The crypto currency is now 0.99 US dollars per token.

The SIRIN LABS token recorded the strongest increase. The utility token increased by a whopping 97 percent and currently stands at 0.13 US dollars per token.

Technical Analysis of the Bitcoin price action

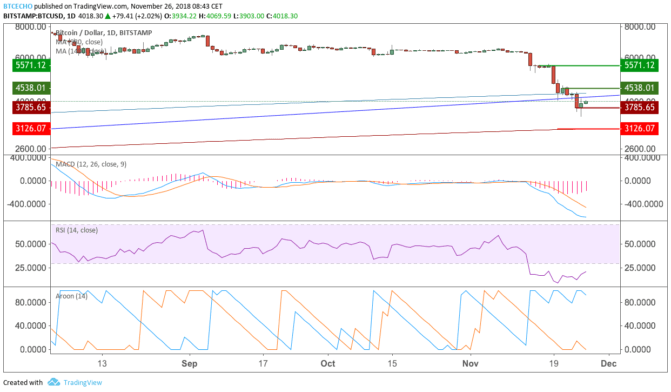

As pleasant as the youngest bounce is: Bitcoin is currently still fighting. The long-term support marked in blue, which has lasted since the end of 2015 and is at the level of the moving average of the last 140 weeks, is currently fiercely contested. The oversold RSI promises a recovery, which the price is currently experiencing.

However, both the MACD and Aroon indicators continue to speak bearish language. On this basis, even after the 10-percent bounce, a short position is more likely, where the first support of 3,785.65 US dollars can be used as an entry point, the currently tested long-term support of 4,163.55 US dollars valid since 2015 as a stop loss and the moving average of the last 200 weeks at currently 3,126.07 US dollars as a target.

However, in order to assume a real reversal and dare a long position, a rise above the resistance at 4,538.01 US dollars is necessary. In this case, a first target would be at 5,571.12 US dollars and the stop loss at the moving average of the last 140 weeks, currently at 4,332 US dollars.