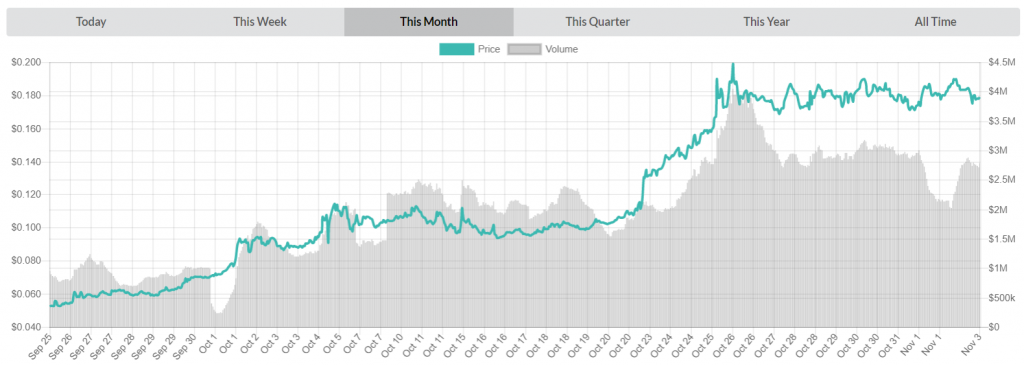

This last month was a very good one for the NEXO cryptocurrency. Opening the month at $0.052226, NEXO went into a strong period of growth which lasted almost the entire month of October. The peak of this move was reached on October 26th, when one NEXO went for $0.199025 behind a daily trade volume of $4 million. The currency has since resisted stronger consolidation as it mostly hovered around the $0.18 value.

NEXO can be purchased for $0.179524 USD (-2.45% drop in the last 24 hours)/0.00002816 BTC (-3.22% drop in the last 24 hours) at the moment of writing. This value is 58.70% lower than the currency’s all time high of $0.430669. That being said, NEXO has recorded a solid 101% rise during the last 30 days. Daily trade volume of $2,933,941 mostly comes from Hotbit, an exchange responsible for 89% of all NEXO trading. With a market cap of $100,533,353, NEXO is currently the 65th most valuable cryptocurrency on the market.

The Credissimo-created, crypto backed lending platform Nexo (which we wrote about before here) has been doing well as of late. Known for its compliance with the legal side of the matters (after applying to get all the required SEC permits/advice from day 1), the platform has been slowly expanding its lending portfolio. Its users were first introduced to the ability to use XRP as the backing of their loans, making Nexo the first and only crypto lender to onboard XRP as collateral.

XRP-backed loans are now available on the Nexo platform, making us the first and only crypto lender to onboard #XRP as collateral.

Get instant access to cash while keeping the upside potential of your XRP! #HODL #Ripple pic.twitter.com/YmYWSvW5Ov— Nexo (@NexoFinance) October 17, 2018

The platform lets users get fiat credit lines for XRP, with 8% per year charges. Moreover, the service utilizes BitGo, a custody provider approved by the United States Securities and Exchanges Commission. This partnership both expands XRP’s overall utility and gives Nexo more mainstream crypto recognition. In the same tweet thread from above, Nexo suggested that Litecoin-backed loans are in preparation as well.

Nexo also confirmed that they will be paying out the first batch of dividends on December 15th, with 30% of current company profits being shared with the portion of the 560 million NEXO token holders who decide to stake their NEXO tokens.

As a profitable enterprise from the very beginning, Nexo is paying out the first ever Dividend on a token on December 15! In an industry first we will share 30% of current profits with the holders of our asset-backed NEXO token! Eligibility requirements: https://t.co/cxTPkM4Djl pic.twitter.com/KD4kPXseG7

— Nexo (@NexoFinance) October 5, 2018

NEXO Token Holders are required to undergo one-time KYC verification just as they would do at any other compliant financial institution. NEXO Tokens must be held/staked in your Nexo Wallets at the ex-dividend date, which is 10 days prior to the dividend distribution date.

These measures ensure that the project and the dividend receivers are in full compliance with the law and are necessary to minimize threat of fraud and manipulation. Dividends are calculated in USD and paid in your Nexo Wallet in ETH and/or NEXO Tokens and/or USD stable coin. You can read the full introduction into the dividend distribution process here.

It was also confirmed recently that Nexo platform soon might start accepting BCH as collateral. Rather than selling their Bitcoin Cash to make their capital liquid, users can lock BCH into the Nexo platform; their coins can be retrieved once the loan has been repaid.

Preliminary results from the poll show strong support for Bitcoin Cash (BCH). Meeting @rogerkver in Tbilisi was a great opportunity to announce the upcoming addition of BCH as a collateral option for Nexo's crypto-backed loans! Check out the interview here https://t.co/4igDQ1q6It https://t.co/mewu2nY3QL

— Nexo (@NexoFinance) September 24, 2018

Both Litecoin and Bitcoin Cash seem to be getting added to the Nexo platform thanks to community input suggesting there is high demand for that.

There were other strong updates regarding the project in this previous month. An application form for becoming a Nexo platform liquidity provider was created. Individuals who choose to enroll into this program will be given a chance to earn 6.5% interest on their stablecoins, with Tether (USDT), TrueUSD (TUSD), Gemini Dollar (GUSD), USD Coin (USDC), Dai (DAI) and Paxos Standard Token (PAX) mentioned as the accepted currencies. Interest is credited daily, with the flexibility to withdraw at any time.

Currently, the minimum contribution amount is $100,000*, while Nexo is working on fully automating the process, which will bring the minimum down to $1,000 with the next Nexo Platform release. All provided liquidity will be used to provide Nexo crypto loans. An interesting feature (introduced in the future when the liquidity rises sufficiently) will be the 50% discount on your interest if you use NEXO as collateral/pay your loans back with NEXO. The project also confirmed recently that microloans in the range of $100 will become available soon.

A major Korean exchange Coinbit confirmed it will be listing NEXO token and adding a trading pair for it with KRW, enabling South Korean investors an easier way into the currency. There is also talk of including Coinbit’s native DEX token as a collateral on Nexo. The project has expanded its “buy Nexo” button onto several major platforms, includingCoinMarketCap, Etherscan, CryptoCompare, CoinGecko, LiveCoinWatch, Ethos.io and more.

As Nexo claims themselves, not many cryptocurrency projects out there have real world, working products which are bringing in actual revenue streams right now. Nexo sets itself apart in this area as the business is apparently booming. Their revenue data is not publicly available but Nexo claims to have processed more than $1 billion in loan transactions to date. It will be worth revisiting this cryptocurrency project once December 15th comes around, to check out how well the business is in fact doing. By then, there isn’t much which suggests that Nexo isn’t the next platform to dominate the cryptocurrency lending industry, this time in a law abiding, legitimate way.