As September rolls in, Bitcoin investors are bracing for a potentially rocky month ahead. Rekt Capital, a prominent voice in the crypto community, recently outlined key factors that could influence Bitcoin’s performance this month.

Here’s an expanded and refined take on those insights, along with additional context from Benjamin Cowen, the founder of ITC Crypto.

What you'll learn 👉

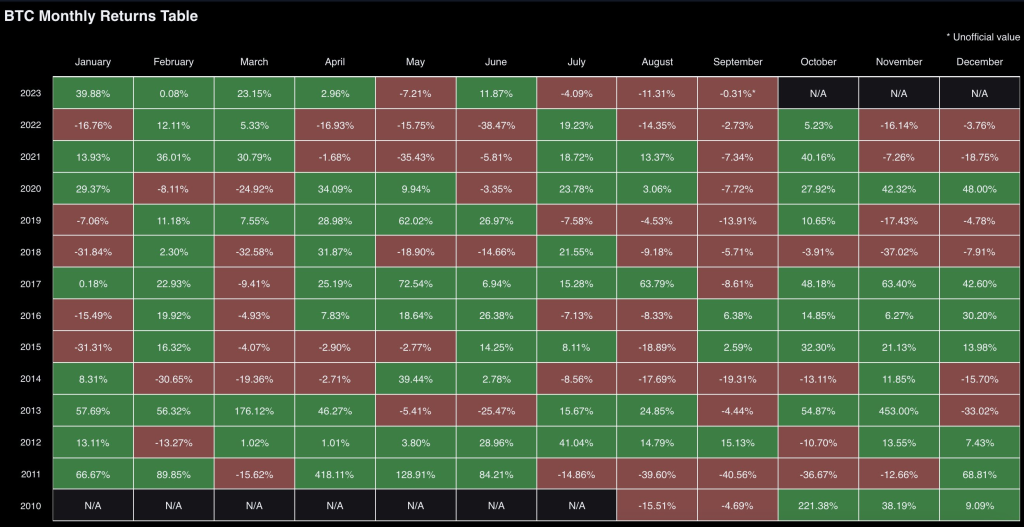

1. September: A Historically Bearish Month for Bitcoin

September has traditionally been a challenging month for Bitcoin. Historical data reveals that 8 out of the last 10 Septembers have seen a decline in Bitcoin’s value. The exceptions were in 2015 and 2016, where the cryptocurrency posted modest gains of +2% and +6%, respectively.

2. The Recurring Theme: A 7% Dip

The most frequent drawdown observed in September is a 7% dip. This pattern was evident in the years 2017, 2020, and 2021. Additionally, a 5% dip in 2018 closely mirrors this recurring trend.

3. Double-Digit Drawdowns: Rare but Not Unheard Of

While Bitcoin has generally experienced single-digit retracements in September, there have been instances of double-digit drawdowns. Specifically, in 2014 and 2019, Bitcoin saw declines of 19% and 13%, respectively. However, it’s crucial to note that 2014 was a bear market year, making it less comparable to 2023, which is shaping up to be a “Bottoming Out” year similar to 2019.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +4. A Massive Crash? Unlikely

Despite the historical precedent of September being a bearish month, the chances of a massive crash occurring are relatively low. This is especially true considering that Bitcoin just experienced one of its worst August drawdowns at -16%. The likelihood of back-to-back severe drawdowns in August and September is minimal.

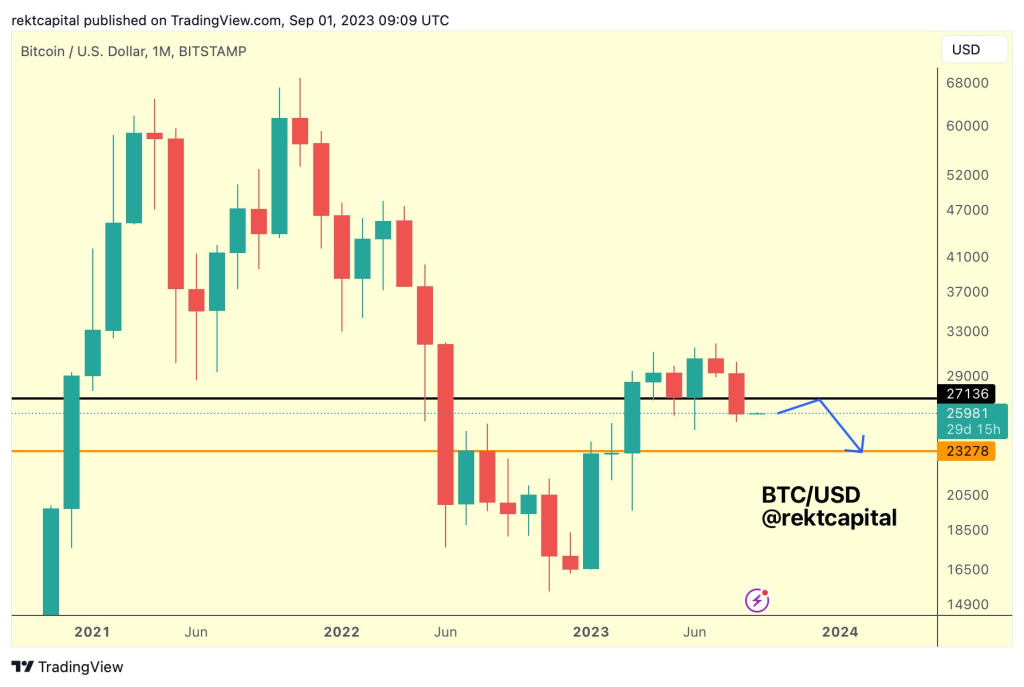

5. Projected Retrace: Between -7% and -13%

Given the historical data and recent trends, a drawdown of approximately 7% to 10% could reasonably occur this September. This would translate to a price range of between $22,500 and $24,000 for Bitcoin.

Benjamin Cowen adds another layer to this analysis by focusing on pre-halving years. According to Cowen, Bitcoin’s average return in August was -11.31%, closely aligning with the average of the last two pre-halving years at -11.71%.

For September, the average return in all prior pre-halving years stands at a staggering -17.29%, which would bring Bitcoin down to around $21.4k. However, if we consider only the last two pre-halving years, the average September decline is a more moderate -5.66%, or around $24.4k.

While September has historically been a bearish month for Bitcoin, it’s essential to approach this period with a nuanced understanding of past trends and current market conditions. Investors should be prepared for volatility but also remain open to the possibilities that defy historical norms. After all, in the world of cryptocurrency, the only constant is change.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.