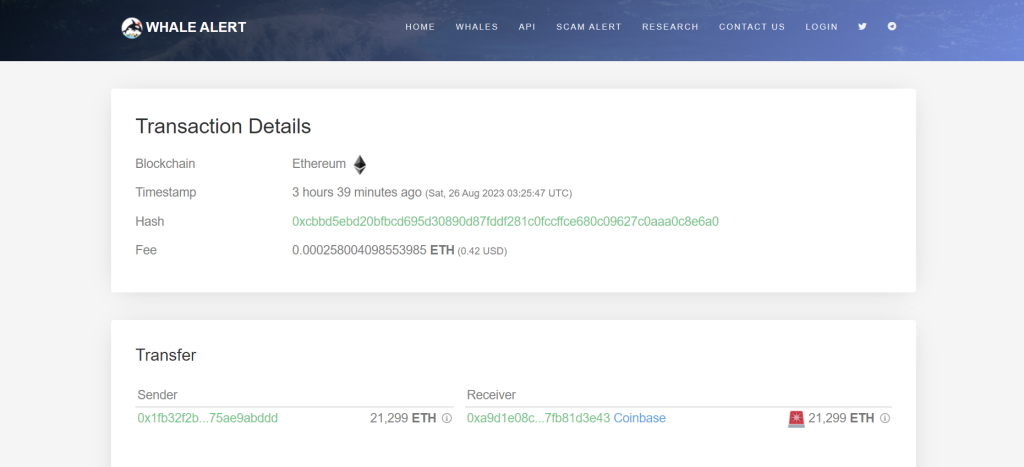

A large Ethereum transaction made headlines today when 21,299 ETH tokens worth around $35.2 million were moved from an unknown wallet to Coinbase, a major cryptocurrency exchange. The hefty transfer of coins on the Ethereum blockchain caught the attention of the crypto community and sparked discussion about the potential reasons behind the wallet-to-exchange transfer.

While the parties involved remain anonymous, the sizeable value of the transaction contributes to the ongoing intrigue surrounding the widespread adoption and use of Ethereum and its native token ETH.

What you'll learn 👉

Market Liquidity

Large transfers like this often signal a potential liquidity shift in the market. When a significant amount of any cryptocurrency moves to an exchange, it usually means that the tokens are going to be sold or traded. This can have a direct impact on the liquidity of the asset, making it easier for other traders to buy or sell the token.

Price Volatility

Such a substantial transfer can also be a precursor to increased price volatility. If the owner of the transferred ETH decides to sell, it could exert downward pressure on Ethereum’s price. Conversely, if the transfer is part of a strategic move to acquire other assets, it could stabilize or even boost the price.

Speculative Behavior

Large transfers to exchanges often spark speculative behavior among traders and investors. The crypto community may interpret this as a bearish or bullish signal, depending on the current market sentiment and other influencing factors like news and regulations.

Regulatory Implications

Transfers of this magnitude could also attract the attention of regulatory bodies. Anti-Money Laundering (AML) and Know Your Customer (KYC) protocols may be triggered, leading to potential scrutiny of the transaction.

While the transfer is significant, the intentions behind it remain unclear. It could be a high-net-worth individual looking to diversify their portfolio, or perhaps an institutional investor making a strategic move. Until more details emerge, the crypto community can only speculate on the implications of this transfer.

Conclusion

The transfer of 21,299 ETH to Coinbase is a noteworthy event that could have various implications for the Ethereum market and the broader crypto ecosystem. Whether it heralds a bearish downturn or a bullish uptrend remains to be seen, but one thing is certain: all eyes will be on Ethereum’s next moves.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.