According to crypto analyst Luke Broyles, even $3 million per bitcoin would represent just the beginning if adoption continues to grow exponentially. In a recent tweet thread, he laid out a case for why bitcoin’s upside remains virtually unlimited.

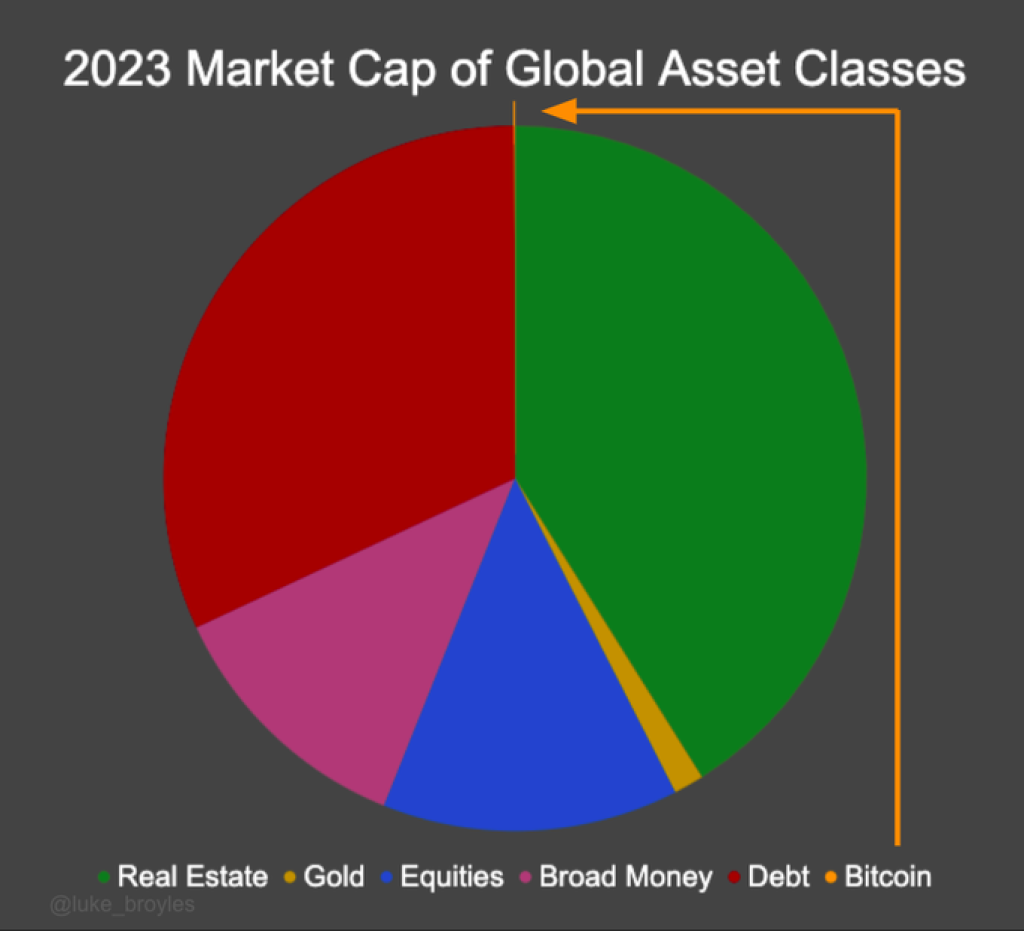

Despite bitcoin’s stellar performance in 2023, its market capitalization of roughly $500 billion remains tiny compared to the world’s largest asset classes, Broyles highlighted. With current adoption estimated at between 0.05% and 0.5% of the global population, 10% adoption would already represent a 100x increase in users.

At first glance, valuing bitcoin’s network 1:1 with its user base would put bitcoin at $3 million. However, Broyles argues this is far too conservative given that market cap trails price, not vice versa.

As evidence, Bank of America has estimated that each $1 chasing bitcoin historically added $118 to its market cap. This 118:1 ratio could expand radically, Broyles contends, especially if 100x more users are competing for dramatically fewer coins.

Rather than $3 million, Broyles speculates that $600 million per bitcoin would be plausible with 10% adoption and a 100x network value expansion. Despite sounding absurd today, this would be analogous to the internet’s value multiplying 100x from the 2000s as adoption hit 10% of the world.

Pushing further, Broyles ponders an eventual 80% asset allocation to bitcoin as it becomes viewed as the lowest risk, highest upside investment on a long horizon. Appreciation would allow most holders to achieve this allocation without liquidating other assets.

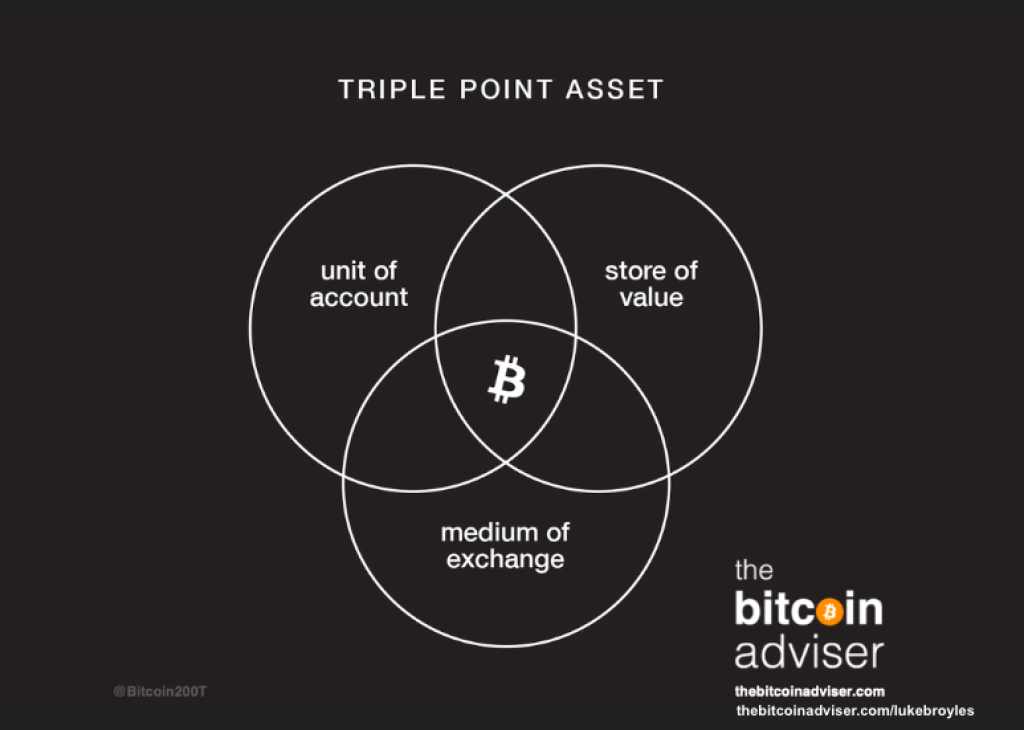

Finally, Broyles notes that bitcoin could become the first ever “triple point” asset, serving as a store of value, a medium of exchange, and a unit of account simultaneously. This would concentrate global economic productivity and innovation into bitcoin as a perpetually scarce asset, unlike anything before.

Read also:

- Are TRB Whales Stockpiling? Large Exchange Withdrawals Precede 43% Tellor Pump

- Top 5 Cryptocurrencies with Potential to Outperform Bitcoin

- Rollbit (RLB) Surges to New Highs as Analysts Eye Potential Rally to $1, but There’s a Catch

In Broyles’ view, it’s not unrealistic for bitcoin to ultimately absorb over 95% of the world’s monetary value, pricing it entirely independently of fiat currencies. If so, today’s speculative highs will appear almost free in retrospect.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.