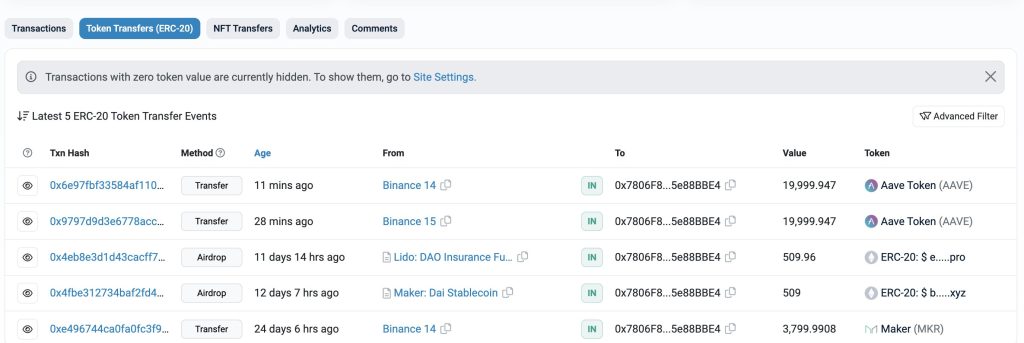

In a recent development that has caught the attention of the cryptocurrency community, two addresses, suspected to be owned by the same individual or entity, have made significant withdrawals from Binance, one of the world’s leading cryptocurrency exchanges.

Within a span of just 30 minutes, these addresses have withdrawn a staggering 108,961 AAVE tokens, equivalent to approximately $8.22 million. AAVE, the native token of the Aave protocol, is a decentralized finance (DeFi) platform that allows users to lend and borrow a diverse range of cryptocurrencies.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +This withdrawal is not the first of its kind. The same addresses have previously made another substantial withdrawal. On June 1, they withdrew 7,466 MKR tokens, which were valued at $4.72 million at the time. MKR is the governance token of the MakerDAO and Maker Protocol, another key player in the DeFi space.

The price of MKR at the time of withdrawal was approximately $632. The timing and scale of these withdrawals have sparked speculation and discussion among crypto enthusiasts and experts.

While the identity of the owner of these addresses remains unknown, the scale of the transactions indicates a player with significant resources and a deep interest in DeFi tokens. The implications of these large-scale withdrawals on the price and liquidity of AAVE and MKR tokens are yet to be seen.

These large-scale withdrawals could have a variety of implications for both AAVE and MKR tokens. On one hand, they could indicate a strong belief in the long-term potential of these tokens, suggesting that the entity behind these transactions sees significant future value in holding these assets.

On the other hand, such substantial withdrawals could potentially impact the liquidity of these tokens on Binance, which may lead to increased price volatility in the short term. It’s also possible that these movements could signal a shift in investor sentiment towards DeFi tokens, reflecting a broader trend in the market. As always, these events highlight the dynamic and rapidly evolving nature of the cryptocurrency market.