In a recent and intriguing development in the world of cryptocurrency, a significant transaction was recorded on Binance, one of the world’s leading cryptocurrency exchanges.

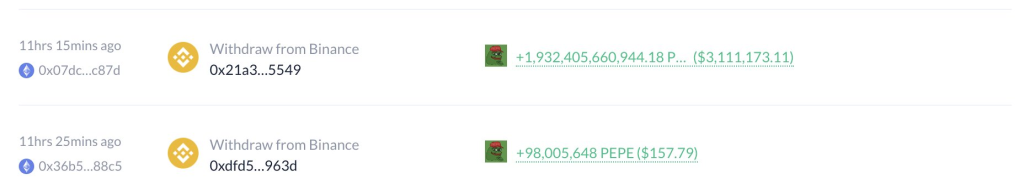

A crypto whale, a term used to describe individuals or entities that hold a large amount of a particular cryptocurrency, made a substantial withdrawal of 1.93 trillion PEPE tokens, equivalent to approximately $3.03 million.

The whale, whose transaction can be traced via this link, appears to have made a strategic shift in their portfolio. They sold off 97,735 LINK tokens, which are associated with Chainlink, a decentralized oracle network, and 9,883 BNB tokens, the native coin of the Binance platform. The total value of these sales amounted to approximately $592,000 and $3.01 million respectively.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +However, this move was not without its losses. The whale seems to have incurred a loss of around $342,000 in the process. Despite this, they proceeded to swap all their positions for a staggering 1.93 trillion PEPE tokens, valued at $3.03 million, and 227 ETH (Ethereum) tokens, worth approximately $424,000.

This move is a clear indication of the whale’s confidence in the potential of PEPE and ETH, despite the incurred losses from the sale of LINK and BNB. It’s a bold strategy that underscores the dynamic and often unpredictable nature of the cryptocurrency market.

The reasons behind such a significant portfolio shift remain speculative. It could be a strategic move based on market trends, a simple diversification of assets, or a bet on the future performance of PEPE and ETH. Whatever the reason, this transaction serves as a reminder of the high-stakes, high-reward nature of the cryptocurrency market.

Stay tuned for more updates on this story and other significant movements in the world of cryptocurrency.