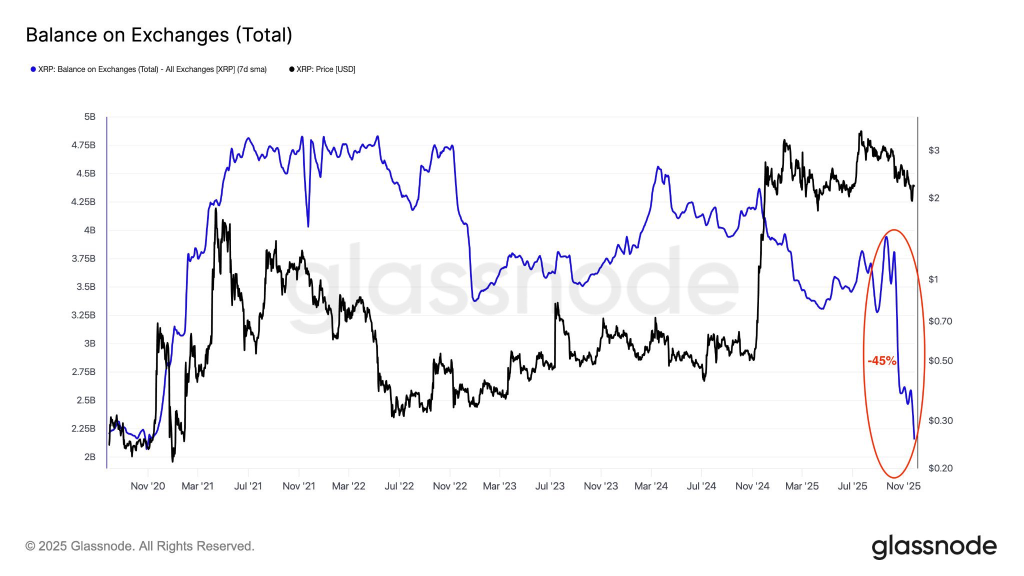

The XRP supply sitting on centralized exchanges has dropped at one of the fastest rates in the asset’s history, according to fresh on-chain data shared by XRP community member and crypto analyst Diana. In a new post, she highlighted two charts from Glassnode and CryptoQuant that together point to a deep squeeze in available sell-side liquidity just as ETF speculation around XRP begins to build.

The first chart tracks total XRP balances across all major exchanges. Since late September, the blue line representing the XRP supply on exchanges has fallen from around 3.95 billion tokens to roughly 2.6 billion. That is a 45% collapse in just about 60 days, or 1.35 billion XRP removed from public order books. Over the same period, the XRP price has swung sharply, but the structural direction of exchange balances is clearly down.

Diana notes that this is the steepest decline in exchange-held XRP seen in years. When that much supply leaves exchanges, it usually means tokens are moving to cold storage, DeFi, or long-term custodial solutions. In practice, it reduces the amount of XRP that can be market-sold quickly, which often makes the XRP price more sensitive to even modest bursts of new demand.

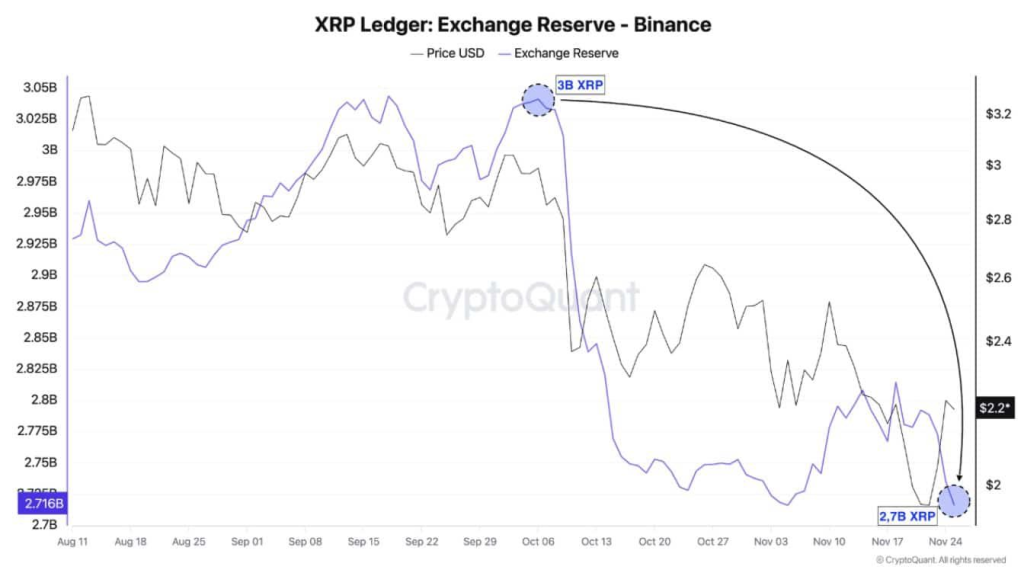

The second chart zooms in on Binance, still one of the largest venues for XRP trading. CryptoQuant data shows Binance’s XRP reserves falling from around 3 billion tokens in early October to about 2.7 billion by late November. That local drop lines up with the broader 45% collapse seen across all exchanges, suggesting the trend is not isolated to a single platform.

For traders, the combination of shrinking exchange balances and rising ETF chatter is what makes this setup interesting. If the XRP supply on exchanges continues to thin out while any form of ETF demand or renewed spot buying arrives, there is simply less inventory available at current prices. In that kind of environment, moves that might have produced a slow grind higher in the past can instead translate into sharp, fast price spikes.

Still, nothing in the data guarantees a breakout. Large holders may simply be de-risking from exchanges, moving into self-custody after the recent market volatility. If broader crypto sentiment remains weak, the XRP price can still struggle even with tighter supply on order books.

What Diana’s charts make clear, though, is that the structure around XRP has changed. There is now significantly less XRP parked on exchanges than there was two months ago. If demand returns in size, this is exactly the kind of backdrop where a real supply shock can start to matter.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.