Zcash price has been on an absolute tear. While most of the crypto market is still bleeding after last week’s $19 billion crash, ZEC is up more than 21% today, trading around $280 and climbing. It’s one of the few coins that seems completely unfazed by the chaos.

As trader @Toknex_xyz put it perfectly:

“$ZEC doesn’t even know a market crash happened. While everything else is bleeding, it’s hitting new highs.”

$ZEC doesn’t even know a market crash happened 🤯

— Toknex (@Toknex_xyz) October 12, 2025

While everything else is bleeding it’s hitting new ATHs and now trading at $279 up 28%+ in a single day. We called it at $148

Privacy coins are running the show right now

They’re not just surviving the crash, they’re dominating… https://t.co/V6ATX7CCkh pic.twitter.com/gwmsEFk6lA

So, why is Zcash suddenly outperforming everything else?

It starts with timing, and the story behind it. The ongoing trade tensions between the U.S. and China, especially Trump’s 100% tariff announcement, have reignited the privacy coin narrative. In a world moving toward tighter surveillance and regulatory control, investors are rotating into assets that offer true anonymity.

ZEC’s zk-SNARKs technology, which enables shielded transactions, has made it the go-to option for those seeking “Bitcoin with stealth mode.” Across X, traders are calling privacy coins “a vote against dystopia,” and capital is flooding from collapsing alts into privacy plays like ZEC, XMR, and ZEN.

At the same time, institutional money is joining the party. Grayscale’s launch of the Zcash Trust (ZCSH) gave traditional investors a regulated way to gain exposure without handling custody.

$ZEC #ZCASH #HALVING #SUPPLYSHOCK pic.twitter.com/OnA25LxToe

— JIUJIDDUSU (@JIUJIDDUSU) October 12, 2025

That single move sparked a wave of buying, pushing ZEC up over 20% in one day. Endorsements from big names like Naval Ravikant and Solana’s Mert Mumtaz, who labeled ZEC “undervalued gold,” added to the momentum. Liquidity poured in, and suddenly Zcash wasn’t a forgotten alt, it was the headline act.

Technically, everything lined up too. After years of sideways action, ZEC price broke out of a multi-year resistance zone around $160–$180, confirming a cup-and-handle pattern that traders had been watching for months.

That breakout triggered a massive short squeeze, wiping out about $50 million in bearish positions and sending the price rocketing.

In just a few weeks, ZEC price has exploded more than 700% from its August lows, with volume tripling and open interest surging across major exchanges.

Fundamentally, the halving cycle is also helping. The 2024 halving reduced inflation to roughly 4%, easing miner sell pressure, while another halving expected in late 2025 has traders front-running the next scarcity wave, just like Bitcoin in its early cycles. Miners are also shifting their resources to ZEC, strengthening network security and keeping the ecosystem healthy.

And beyond the price action, Zcash’s technology is quietly evolving. New integrations like NymVPN and THORSwap are making ZEC easier to use for private payments and cross-chain transfers.

Upcoming features like Zcash Shielded Assets (ZSAs), essentially private ERC-20 tokens, could bring DeFi-style utility to the network. The Zashi mobile wallet and the removal of Zcash’s old “trusted setup” are making it simpler and more secure for everyday use.

Read Also: Why Is World Liberty Financial (WLFI) Price Down Today?

ZEC Chart Analysis: RSI Signals Overbought but Trend Still Strong

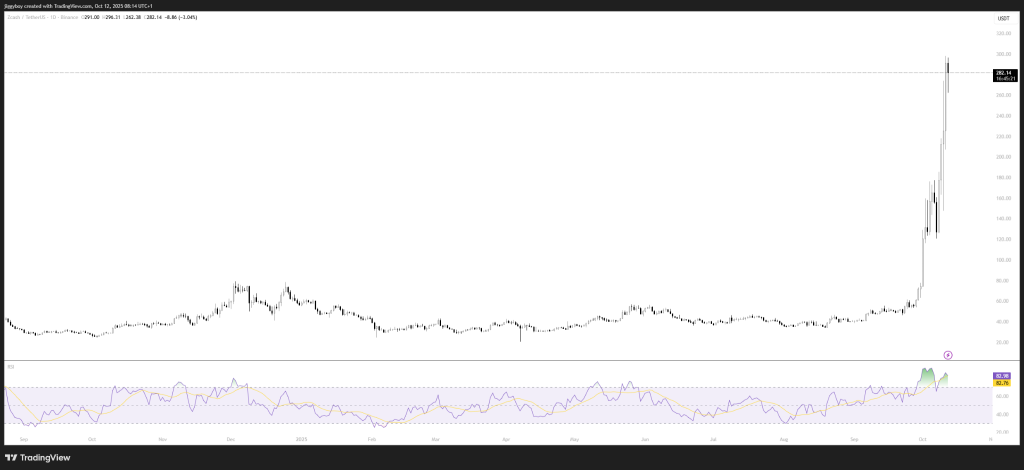

Looking at the daily chart, ZEC’s momentum is nothing short of parabolic. The price surged from around $40 in August to over $290, forming an almost vertical trendline. RSI sits around 83, which puts it deep in overbought territory, but that doesn’t necessarily mean it’s done.

In strong bull phases, assets can stay overbought for weeks before cooling off. If anything, ZEC price might need a short-term pullback or consolidation around the $240–$260 range before the next leg up.

Support now sits around $210, with major resistance at $300, the psychological line everyone’s watching. A close above that could send ZEC into price discovery mode, with analysts eyeing $350–$400 as the next potential target zone.

In short, Zcash price pump isn’t just random. It’s the perfect storm of macro fear, institutional inflows, technical breakouts, and renewed belief in privacy, all colliding at once. While the rest of the market is struggling to recover, ZEC is rewriting the story.

Privacy is back, and Zcash is leading the charge.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.