Pro-XRP analyst EGRAG CRYPTO has once again stirred the XRP community with a bold new price forecast. Known for his viral XRP predictions and a track record that includes a few spot-on calls, EGRAG’s latest post centers around what he calls “Candle 13” – and it’s shaping up to be one of the most important candles in XRP’s history.

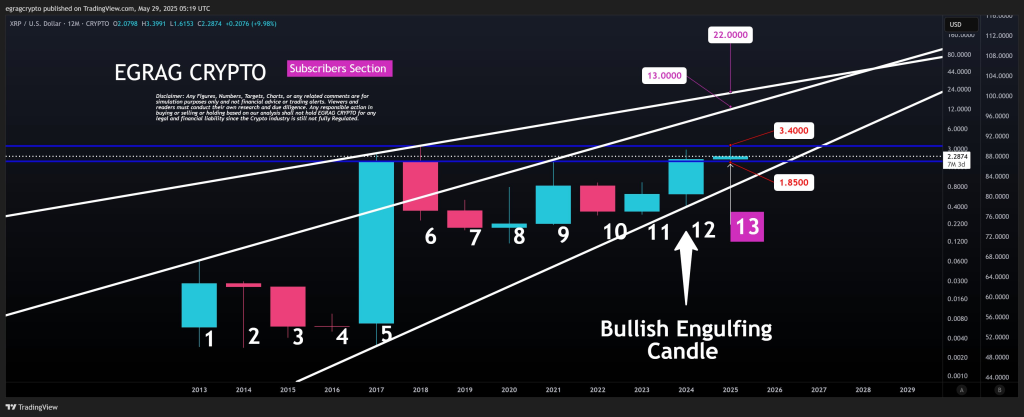

Using a rare 12-month chart, which maps yearly candles going back to 2012, EGRAG points to a powerful bullish setup. According to him, the 2024 candle (Candle 12) formed a bullish engulfing pattern. On high timeframes like this, such a pattern often signals a major reversal. Candle 12’s body closed above all previous candles going back to 2017, which EGRAG says confirms a long-term bullish shift.

The significance of this candle lies in its position and strength. A bullish engulfing candle on a yearly chart is not common. It shows that buyers took full control and reversed the market from previous indecision and selling. EGRAG also points out that this engulfing pattern started all the way from Candle 5 in 2017 and continued building through to Candle 11 – making Candle 12 a possible confirmation of a multi-year bullish trend.

Now we’re in Candle 13 – the current year. EGRAG believes this could be the breakout year. If XRP mimics the kind of move it made in 2021 (Candle 9), when the price jumped around 800%, we could see the XRP price reach somewhere between $13 and $22 by the end of 2025. He specifically calls out $13 and $22 as major targets, with $17 as a midpoint based on extrapolating a similar percentage gain.

He points out that this target range isn’t pulled from thin air. It sits directly between two long-term trendlines on his chart – Line 1 and Line 2 – which frame XRP’s multi-year ascending channel. These trendlines have been respected throughout XRP’s price history, and now Candle 13 appears to be approaching them again.

The body of Candle 13 is currently above a key level – $1.85. As EGRAG puts it, closing below that line by the end of the year could signal the end of this bull cycle. On the flip side, closing above $3.40 would confirm a breakout and open the path toward double digits. Until then, price movements between $1.85 and $3.40 are, in his words, “just noise.”

He highlights that a yearly close above $3.40 would send a powerful technical signal. It would likely confirm XRP’s transition into a new bullish phase, with Candle 13 representing the official breakout from years of sideways movement.

There’s also a strong psychological element. If XRP ends 2025 with a big green candle, it would mark a turning point in how institutional investors and the broader market view the asset. That’s why EGRAG highlights December 31, 2025, as the date to watch. It won’t just be about price – it’ll be about the candle formation itself, and what it means on the highest timeframe chart available.

Whether or not XRP hits those lofty targets, one thing is clear: EGRAG’s analysis keeps the spotlight on XRP’s long-term chart structure. His approach favors patience, zoomed-out context, and the belief that history often rhymes in crypto markets. And if it does repeat, his $13–$22 range might not be as far-fetched as it sounds.

Read also: This New Crypto Might Outshine Kaspa and XRP in 2025

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.