The long-awaited Bitcoin halving event is now behind us, occurring last night at block 840,000. The supply rate of new bitcoins entering circulation has been cut in half, from 6.25 BTC to 3.125 BTC per block.

Bitcoin’s price reacted quite decently to the halving, rallying around 4% to trade well above $64,000 after dipping under $60,000 earlier this week as part of a pre-halving retrace and consolidation period.

Now that the halving is in the rearview mirror, crypto analysts are looking ahead to predict when Bitcoin could potentially peak in this new bull cycle before entering a bear market again. One of the top analysts weighing in is Rekt Capital, who posted his analysis yesterday on the X (formerly Twitter) platform:

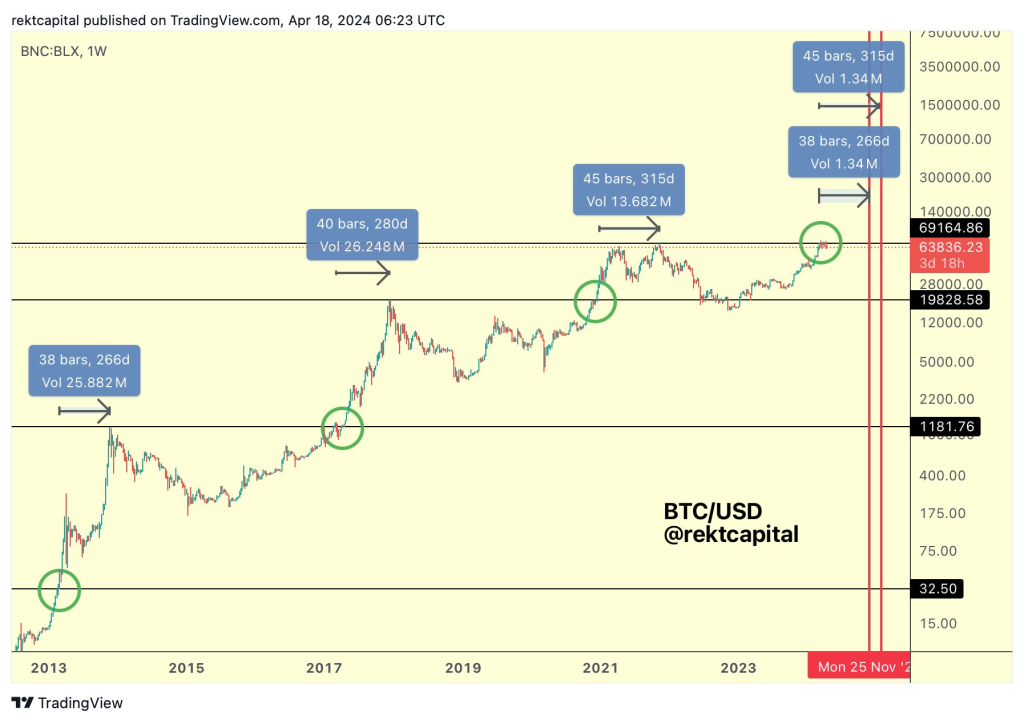

“When Could Bitcoin Peak In This Bull Market? Historically, Bitcoin has peaked in its Bull Market 518-546 days after the Halving (Chart 1) This is how typical Bitcoin Halving Cycles have progressed”

Rekt Capital points out that if Bitcoin follows the historical trends of past cycles, the peak of this bull run would arrive between mid-September and mid-October 2025, around 518 to 546 days after the halving on April 19th, 2024.

However, he notes that the current cycle is showing signs of accelerating compared to past norms:

“Bitcoin is showing clear signs of acceleration in its current cycle given how it reached new All Time Highs by approximately ~260 days ahead of schedule compared to historical norms”

The acceleration Rekt refers to is Bitcoin hitting new all-time highs around $69,000 last month – much sooner than similar milestones in previous cycles.

“That being said, Bitcoin has been experiencing a Pre-Halving Retrace for the past month or so. As a result, Bitcoin has been slowing down and decelerating the cycle by 30 days thus far and counting.”

The analyst acknowledges that Bitcoin’s recent consolidation has taken some of the wind out of the sails of the accelerating cycle, decelerating it by about 30 days so far. If the deceleration continues, it could push the potential peak further out.

Rekt Capital goes on to analyze an “Accelerated Perspective” on pinpointing a cycle peak:

“If we measure Bull Market peaks from the moment an old All Time High is breached… Then this perspective suggests Bitcoin would perform a Bull Market Top 266-315 days later from the moment it breaks its old All Time High”

Since Bitcoin broke to new all-time highs around $69,000 last month, applying that accelerated framework would point to a market peak arriving between December 2024 and February 2025 – 266 to 315 days after breaching the old cycle high.

In his analysis, Rekt weighs both the historical cycle trends and the potential accelerated cycle perspectives:

“In sum, both perspectives are worth considering throughout the cycle, especially if acceleration in this cycle persists. However, the longer Bitcoin retraces or consolidates during certain periods, the more the cycle slows down, pushing the inevitable Bitcoin Bull Market Peak further into the future.”

The analyst suggests that both the 518-546 day historical cycle trajectory and the accelerated 266-315 day trajectory need to be monitored. Continued upside momentum and limited consolidation could bring about an accelerated peak in late 2024 or early 2025.

However, if Bitcoin grinds sideways for an extended period like the recent month-long retrace, it will increase the chances of a more drawn-out cycle peaking in the second half of 2025 based on historical precedent.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +No matter which path plays out, Rekt Capital’s analysis indicates that the bitcoin bull market likely has over a year left to run its course before eventuallly topping out. The halving has reset the clock, and all eyes will now be on Bitcoin’s ability to break out of its current consolidation and resume accelerated upside to start driving toward those potential cycle peak targets.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.