The crypto markets have seen contrasting movements lately, with Worldcoin (WLD) showing potential bearish signals and Ondo Finance (ONDO) experiencing a price rally due to increased adoption. WLD’s price has continued its downtrend, breaking below a key resistance zone, while ONDO has surged, driven by growth in its Total Value Locked (TVL) on the Ethereum chain.

What you'll learn 👉

WLD Price Analysis

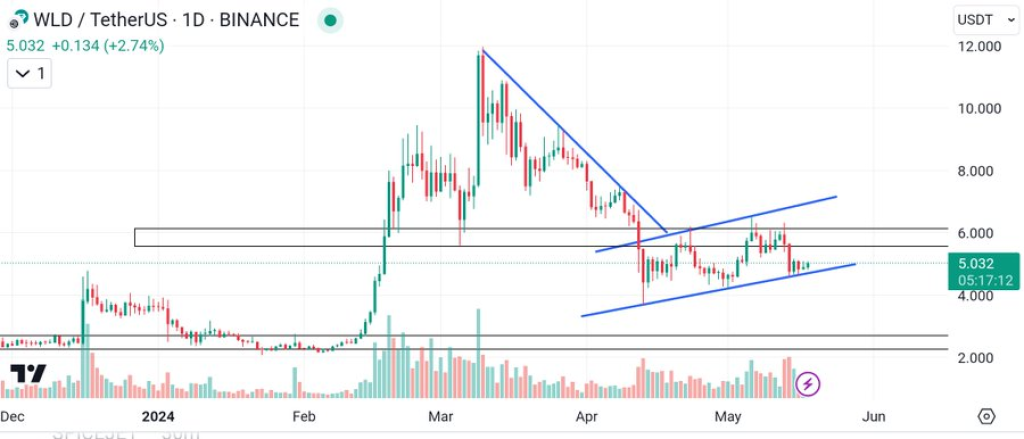

YG Crypto, a notable analyst, highlighted the bearish flag pattern in Worldcoin’s chart. According to his tweet post, WLD’s price has dropped below the key resistance zone of $5.63 to $6.13, signaling a potential bearish continuation. As of now, the price of WLD is $4.91, reflecting a 1.90% decline in the past 24 hours and a 15.33% decline over the past week.

However, market sentiment might shift, potentially triggering a price reversal. Investors should watch for a breakout above the resistance zone to signal a trend reversal, while a break below could indicate further decline. Monitoring trading volume is crucial to confirm the strength of any price movement. Increased volume on a breakout would suggest a strong market sentiment shift.

The key question remains: Are investors bullish or bearish on WLD? The breakout direction and corresponding trading volume will provide clearer signals of market sentiment and potential future movements.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Ondo Finance: Adoption and Price Dynamics

Gerhard from the Bitcoin Strategy YouTube channel provides an in-depth analysis of Ondo Finance, focusing on its recent performance and adoption metrics. A key factor driving Ondo Finance’s price increase is the substantial growth in its Total Value Locked (TVL). The TVL has more than doubled since March, particularly on the Ethereum chain.

This increase reflects growing trust and adoption among investors. Gerhard notes that Ondo’s price has risen from $0.28 to over $1, highlighting its notable growth trajectory. However, at press time, according to data from CoinGecko, ONDO trades at $0.9602. This represents a 6.60% decline in the past 24 hours but a 22.93% increase over the past week.

In the short term, Gerhard identifies potential volatility due to an upcoming increase in the token supply in mid-January. This could lead to speculative trading and price fluctuations. However, the ongoing accumulation by small and medium-sized retail investors indicates strong community support.

While whales have decreased their holdings by 3%, small retail investors have increased their holdings by 20%, and medium-sized investors by 12%.

Read also: Is Ethereum (ETH) at Risk Against Bitcoin? Why This Crypto Analyst Urges Calm Amid BTC Euphoria

Market Manipulation and Long-Term Outlook

Gerhard warns of possible market manipulation, especially in the Perpetual Futures market on Binance, which could lead to unstable price movements. Despite these short-term risks, he remains optimistic about Ondo Finance’s long-term potential, believing it can outperform Ethereum. However, investors should remain cautious of potential dips below $1 due to market manipulation.

The analysis of WLD and Ondo Finance reveals contrasting market dynamics and investor sentiments. While WLD faces a potential bearish continuation, the possibility of a trend reversal remains. On the other hand, Ondo Finance shows strong growth and adoption, with short-term risks that investors need to consider.

Hunting for a small cap coin that could explode 10x? We’ve unveiled a few last week alone.

Get all our future calls by joining our FREE Telegram community.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.