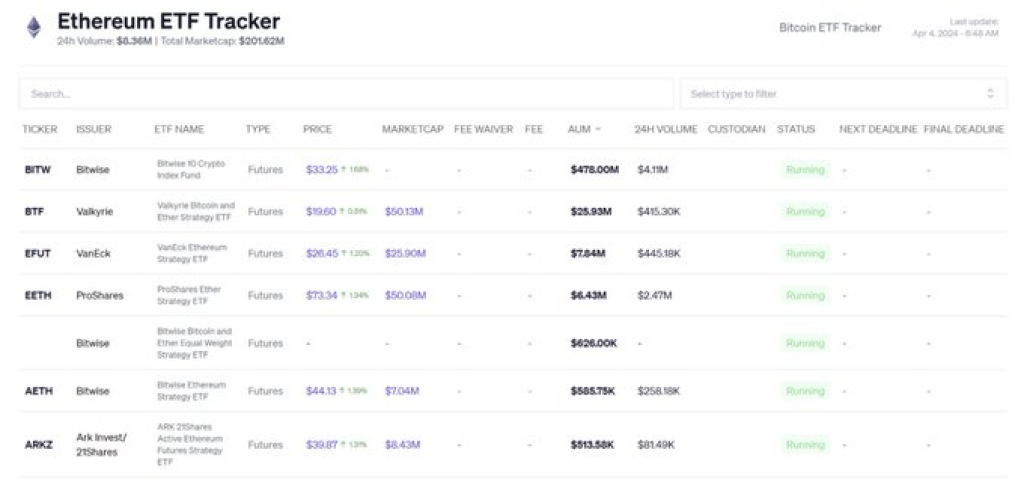

As the deadline for the U.S. Securities and Exchange Commission (SEC) to decide on the approval of an Ethereum (ETH) exchange-traded fund (ETF) approaches on May 23, the crypto community is eagerly awaiting the outcome. With Bitcoin (BTC) ETFs already approved earlier this year and boasting a total assets under management (AUM) of $62 billion, the question remains: Cryptonary questions: will an ETH ETF be next?

What you'll learn 👉

Regulatory Challenges and Security Concerns

The staking mechanism of Ethereum and the ongoing debate about its classification as a security pose unique regulatory challenges. However, the Commodity Futures Trading Commission (CFTC) has consistently maintained that Ethereum is not a security, and there has been widespread dismissal of the notion that the SEC would deny a potential ETH ETF due to security concerns.

Strong Backing from Industry Giants

Several industry titans, including the following, support ETH ETF applications:

- Franklin Templeton

- BlackRock

- Fidelity

- Ark

- 21 Shares

- Grayscale

- VanEck

- Invesco

- Galaxy

- Hashdex

This strong support from leading financial institutions further strengthens the case for an ETH ETF approval.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Potential Impact on Ethereum’s Price

The approval of an ETH ETF could be the bullish spark that Ethereum needs. Despite a year-to-date return of 81%, ETH has underperformed compared to other major altcoins. The approval of the BTC ETF had a prolonged bullish effect on Bitcoin’s price, and many believe that Ethereum could experience a similar impact.

An ETH ETF would provide institutional investors with a more accessible and regulated way to gain exposure to Ethereum, potentially driving significant capital inflows into the cryptocurrency. This increased demand could lead to a sustained price rally, further solidifying Ethereum’s position as the largest altcoin in the industry.

Expectations and Predictions

Despite the strong case for an ETH ETF, the current belief among analysts suggests that a delay is more likely than an immediate approval. Some argue that the SEC hasn’t proactively engaged with issuers about the approval process, which could indicate a lack of urgency on the regulator’s part.

However, it seems more a question of “when” rather than “if” an ETH ETF will be approved. As the crypto industry continues to mature and gain mainstream acceptance, the approval of an ETH ETF appears to be an inevitable outcome.

The upcoming decision on the approval of an Ethereum ETF has the potential to significantly impact the crypto market. While the bets are currently against an immediate approval, the strong backing from industry giants and the dismissal of security concerns by the CFTC suggest that an ETH ETF is a matter of time.

As the May 23 deadline approaches, Ethereum holders and the broader crypto community will be closely monitoring the situation. The approval of an ETH ETF could be a game-changer for Ethereum, potentially unlocking a new wave of institutional investment and driving the cryptocurrency’s price to new heights.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.