The long-awaited approval of a Bitcoin spot exchange-traded fund (ETF) in the US is one of the worst-kept secrets in crypto, with most expecting it within months. But will it lead to a “buy the rumor, sell the news” price drop like previous Bitcoin developments?

According to Pantera Capital’s Dan Morehead, this time is different—a spot ETF will fundamentally improve access for new investors, providing a long-term tailwind for prices.

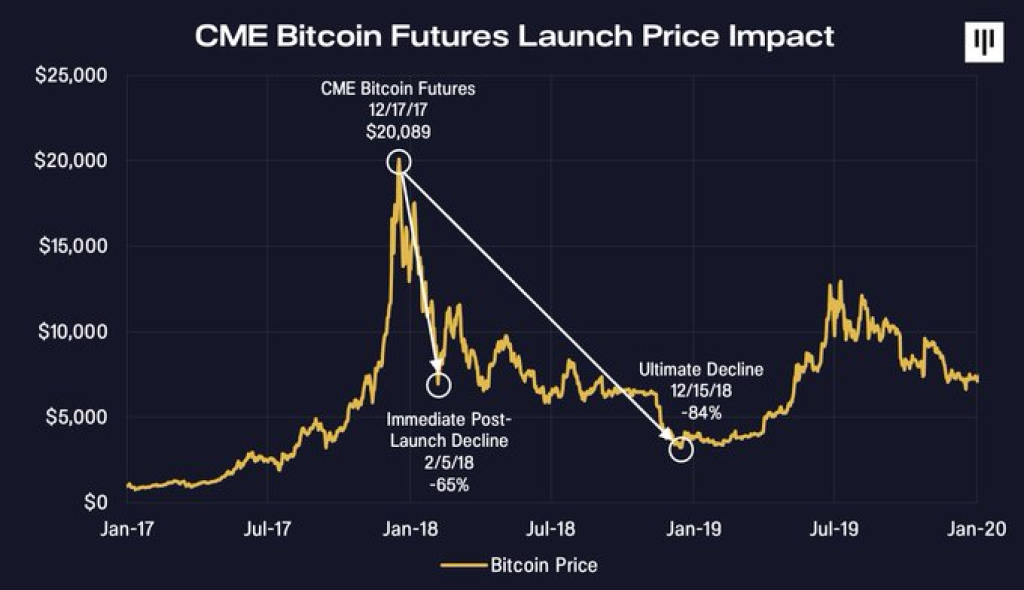

Morehead explains how CME Bitcoin futures launches in 2017 and Coinbase’s public listing in 2021 both resulted in Bitcoin peaking on the news day, then crashing over 75% in each case—the textbook “buy the rumor, sell the news” moves.

However, he notes that neither event actually impacted real-world Bitcoin access or adoption. Futures are only relevant to a niche group of traders. And Coinbase’s platform worked the same before and after its public listing.

Conversely, a BlackRock Bitcoin spot ETF would dramatically open the floodgates to fresh institutional capital from retirement accounts and passive investment funds, representing trillions in potential inflows.

Additionally, Morehead believes spot ETF approval is just months away, not years. He draws parallels to earlier moments when new assets like commodities and emerging markets became investable via ETFs and took off.

Read also:

- Litecoin Whale Activity Could Foreshadow Next Bull Run While Solana Flashes Sell Signal

- Shiba Inu Magazine Highlights Welly’s Commitment to Shibarium Blockchain

- Benjamin Cowen Predicts Bitcoin’s Rise to $100K by 2025; InQubeta Celebrates $5M Presale Triumph

In conclusion, Morehead makes the case that a Bitcoin spot ETF is a true game-changing adoption milestone for turning crypto into a mainstream asset class. Instead of selling on the news, long-term investors should anticipate buying on the rumor and the news.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.