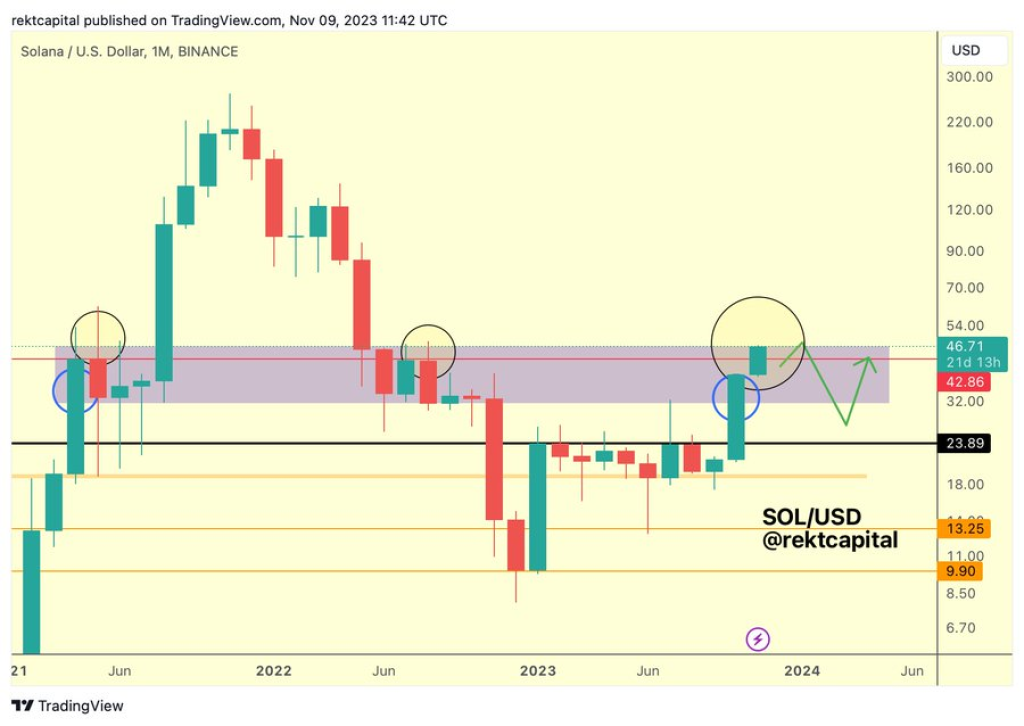

Solana (SOL) has reached a critical technical level around $42-$47, according to analyst Rekt Capital. This area marked both a breakdown in mid-2021 and failed support in 2022. Now SOL is coming up on it again, posing the question – will history repeat itself with more downside?

Looking at Rekt Capital’s chart, we can see Solana first reached this price zone in mid-2021. After initially breaking down, SOL retested this area after 3 months before breaking out. This kickstarted a major 4-month bull run.

When SOL returned to this $42-$47 zone again in 2022, it was unable to hold as support. Price proceeded to downtrend for months afterwards. With SOL once again approaching its historical resistance, the risk is high for a potential rejection and price correction.

What you'll learn 👉

Signs of Struggle Emerge

Evidence is mounting that SOL may struggle at this zone. The Relative Strength Index (RSI), a momentum oscillator indicator, shows some concerning overbought signals for SOL. On the daily timeframe, SOL’s RSI is currently at 82. Readings above 70 are considered overbought, indicating the rally may be overextended. Additionally, on the weekly chart the RSI is elevated at 77. SOL is becoming stretched on the longer-term timeframe as well.

RSI values this high suggest SOL is rallying too far too fast. The oscillator’s overbought conditions on both the daily and weekly charts point to fatigue setting in. This momentum divergence could foreshadow a price correction as SOL nears historical resistance around $47.

History Provides Blueprint

If past price action repeats itself, SOL may see a failed breakout at $47, followed by a retracement back below $30 before gathering strength for another push upwards. The historical significance of this zone means it may take multiple retests before SOL can overcome resistance.

Read also:

- Ripple (XRP) Poised for More Upside, Analyst Says This Level Is the Time To Be a Buyer

- This Token Could Be One Of The Biggest Gainers in 2024 – Learn Why Everyone’s Investing in Meme Kombat (MK)

- Which Cryptos Are ‘Likely’ To Rise Due to Upbit Conference?

While Solana shows long-term promise, its battle with previous support turned resistance suggests the path forward may be rocky. Bulls will want to see SOL decisively break above $47 to signal the downtrend is truly over. If history repeats itself, SOL could have more downside to come in the interim.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.