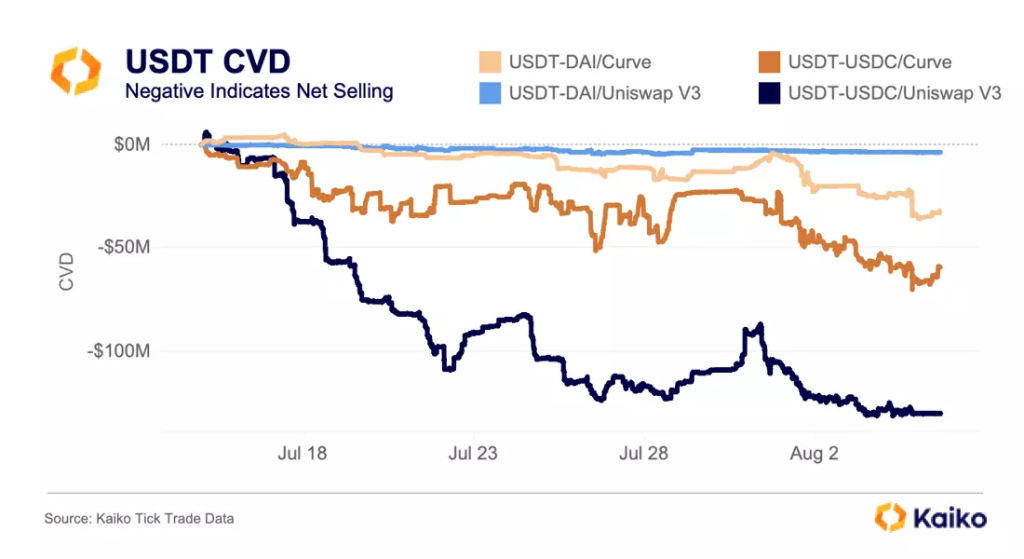

Recently, two of the most prominent decentralized exchanges (DEXs), Curve and Uniswap, have reported imbalances in their respective pools.

According to data from Kaiko, Curve’s 3pool, and Uniswap V3’s primary USDT-USDC pool witnessed significant imbalances as the weekend approached. This imbalance is attributed to an escalated selling of USDT.

Uniswap experienced a massive sell-off of about $40 million, while Curve saw a sell-off amounting to $35 million. As a result of this heightened selling pressure, Curve’s pool is now heavily skewed, holding a staggering 60% of USDT.

This disproportionate distribution raises concerns about the stability and efficiency of the pool, potentially affecting traders and liquidity providers.

What you'll learn 👉

Why the Imbalanced Pools?

The imbalance within the pools primarily stems from an abrupt influx of USDT selling. The rapid and substantial sell-off of USDT within a brief timeframe can upset the delicate balance maintained within the pools. This disruption can result in an uneven distribution of assets, with one particular asset, notably USDT in this instance, becoming overly dominant within the pool composition.

The surge in USDT selling has triggered a dissonance within the equilibrium of the pools. This disconcerting shift is a direct consequence of the heightened selling activity, which has caused USDT to be disproportionately represented within the pools. The increased prevalence of USDT within the pool composition can be attributed to its escalated sales, thus underscoring the critical role such sell-offs play in destabilizing the pool dynamics.

USDT Selling Pressure: The Underlying Causes

The precise catalysts behind the abrupt surge in USDT selling are subject to conjecture; however, various influences could account for this phenomenon. Among these potential factors are apprehensions regarding the underlying collateral supporting the stablecoin, mounting regulatory encumbrances, and the intricate interplay of market forces compelling traders to divest from or swap their USDT assets.

The surge in USDT selling is shrouded in a speculative veil, as the confluence of multiple variables makes pinpointing a singular cause elusive. It is plausible that anxieties about the stability of the assets backing the stablecoin have triggered this surge, alongside the mounting pressures of regulatory scrutiny. Furthermore, the intricate dynamics within the market ecosystem may also prompt traders to liquidate or exchange their USDT holdings, culminating in the observed spike in selling activity.

USDT’s Price Peg Concerns

Notably, alongside the disruptions witnessed within decentralized exchanges (DEXs), centralized exchanges (CEXs) have also observed a marginal depreciation in the value of USDT below its customary dollar peg.

USDT, akin to its stablecoin counterparts, is conventionally anticipated to uphold a steadfast 1:1 parity with the US dollar. Any variance from this established peg can trigger concerns regarding the coin’s robustness and traders’ trust in its consistency.

The recent developments around USDT offer a vivid illustration of the cryptocurrency market’s dynamic and frequently capricious nature. The interconnectedness of various factors, ranging from market sentiment to regulatory shifts, can precipitate swift and unexpected alterations in asset values.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +As such, traders and investors are well-advised to maintain a vigilant and informed stance, particularly when navigating the realm of volatile digital assets. By staying apprised of ongoing developments, market participants can make more prudent decisions and mitigate potential risks associated with rapid market fluctuations.

The oscillations observed in USDT’s value underscore the inherent volatility within the crypto landscape. This is a reminder that even stablecoins, designed to offer relative stability, can be subject to disruptive forces that challenge their anticipated peg. Navigating such an environment necessitates a combination of caution, adaptability, and a comprehensive understanding of the multifaceted factors that shape the cryptocurrency market’s trajectory.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.