A detailed thread published by Bull Theory laid out what it describes as the full sequence of events behind the U.S. operation involving Venezuela and President Nicolás Maduro. Rather than reporting a sudden escalation, the thread explains how years of political decay, legal groundwork, and strategic pressure led to the outcome now drawing global attention.

Bull Theory traces the roots of the crisis back to 1999, when Hugo Chávez came to power and changed Venezuela’s political system.

How Venezuela Reached This Point

Over time, state institutions weakened, military influence over the economy grew, and corruption spread. During the 2000s, Venezuela also became a major transit route for cocaine, with senior military figures allegedly controlling ports, airports, and borders. Bull Theory argues this evolved into a state-protected trafficking system rather than isolated criminal activity.

When Nicolás Maduro assumed power in 2013, he inherited that structure. The situation worsened as Venezuela’s economy collapsed, oil production fell, and international sanctions increased. As legal revenue dried up, illegal revenue allegedly became more important to the regime. Bull Theory frames this period as one where drug transit routes became strategically valuable.

The legal foundation for U.S. action was laid in March 2020, when the U.S. Department of Justice indicted Maduro on charges including narco-terrorism and cocaine trafficking, placing a multimillion-dollar bounty on him. From that point, Bull Theory argues, Maduro was no longer treated by the U.S. as a conventional head of state.

Between 2020 and 2024, sanctions tightened and diplomatic isolation increased, but Maduro remained in power. Bull Theory links the timing of the latest events to domestic U.S. pressure in 2024–2025, particularly around drug-related deaths, alongside the political sensitivity of confronting Mexican cartels compared to Venezuela. Disputed elections and limited international backing left Caracas more exposed.

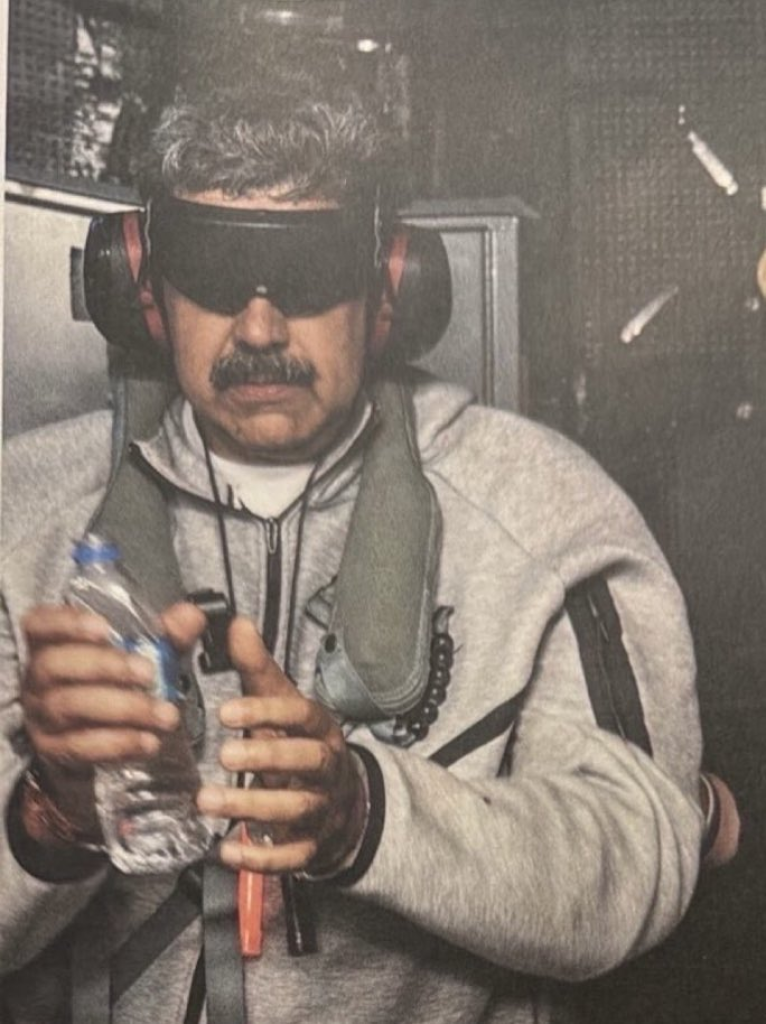

According to Bull Theory’s timeline, events accelerated overnight. Explosions were reported in Caracas, U.S. helicopters were seen over the city, and Maduro declared a national emergency. Bull Theory claims President Trump later confirmed that Maduro and his wife had been captured and that the U.S. would temporarily oversee Venezuela during a transition period, while allowing large U.S. oil companies to enter the country. These claims have not yet been independently confirmed by all parties, but they have already had an impact on global markets.

Bull Theory argues that oil is central to the story. Venezuela holds the world’s largest proven oil reserves, and a shift in control could increase global supply. Lower oil prices would not only affect energy markets but could also put pressure on countries like Russia, where oil revenue plays a major role in funding the state.

Read also: Best Altcoins to Watch Right Now: PEPE, ETH, and More

What This Could Mean for Crypto Markets

For Bitcoin and crypto in general, the implications are layered. In the short term, sudden geopolitical shocks often increase volatility. Traders tend to move quickly into or out of risk assets depending on how markets interpret the balance between instability and liquidity. If oil prices fall due to increased supply expectations, inflation pressure could ease, which historically supports risk assets, including cryptocurrencies.

At the same time, heightened geopolitical uncertainty can revive Bitcoin’s role as a hedge narrative, especially if trust in traditional systems weakens. Energy-sensitive mining economics could also shift if oil prices decline, indirectly affecting Bitcoin’s cost structure.

Over the coming weeks, crypto price action is likely to be driven less by Venezuela itself and more by how markets price in energy, inflation expectations, and broader geopolitical risk. If the situation stabilizes and oil supply increases, risk assets could benefit. If tensions expand or global alliances fracture, volatility may dominate.

What is clear is that this episode, as outlined by Bull Theory, represents more than a regional event. It sits at the intersection of energy, geopolitics, and global liquidity; all factors that Bitcoin and crypto are increasingly sensitive to as we get deeper into 2026.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.