In a recent video by Altcoin Daily, a cryptocurrency channel boasting over 1.3 million subscribers, the spotlight was cast on Bitcoin’s burgeoning role in the global financial landscape. The video featured Dylan, an astute cryptocurrency analyst, who meticulously dissected why Bitcoin is not just another asset but a necessity in today’s volatile economic environment.

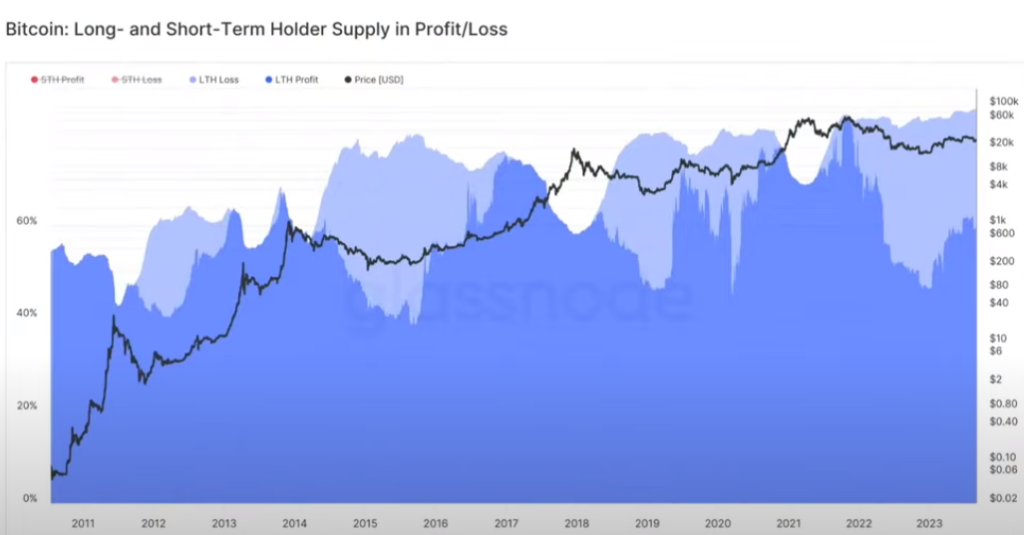

The narrative that Bitcoin is merely a speculative asset has been debunked. With its realized price showing less volatility and a more accurate valuation, Bitcoin is proving to be a stable and growing asset. Long-term holders, or “hodlers,” have been identified as the backbone of Bitcoin’s market cycles, setting both the floor and the ceiling for its price.

On the macroeconomic front, Bitcoin’s correlation with global liquidity and the money supply cannot be ignored. The asset has shown a consistent relationship with these macroeconomic indicators, dismissing the notion that its price movements are random or solely dependent on halving events.

But what truly sets Bitcoin apart is its potential role in a world burdened by skyrocketing global debt. Traditional financial systems are showing cracks, and the hunt for hard assets has begun. Bitcoin, despite being a relatively new and small player, is rapidly gaining ground. Its monetization is not just a trend but a necessity for balance in a debt-laden world.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Dylan also discusses the growing global debt and how traditional finance systems are broken, making a strong case for hard assets like Bitcoin. He emphasizes that Bitcoin is still a “tiny blip” on the global balance sheet but is rapidly monetizing and will become increasingly important.

Financialization through ETFs and other instruments is on the horizon. While some may argue that this could dilute Bitcoin’s essence, the asset’s unique properties—such as instant global settlement—make it resilient against such financial maneuvers.

In conclusion, the race to invest in Bitcoin is not a matter of if but when. As traditional financial systems continue to falter, Bitcoin is poised to become an increasingly important asset on the global balance sheet. The entry of major financial players into the Bitcoin market is not just inevitable but welcome, signaling the asset’s maturation and its readiness to take on a pivotal role in global economics.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.