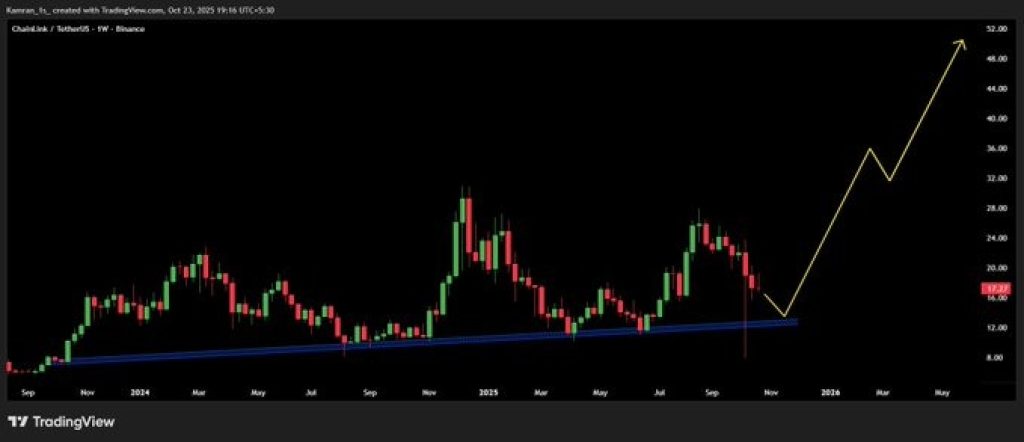

Chainlink price might be setting up for another one of its classic runs. On the weekly chart, LINK is once again testing the same long-term blue accumulation zone that’s acted as bulletproof support since early 2023.

Every time the price has touched this area, it’s triggered a strong move upward, and right now, the setup looks almost identical to the previous takeoffs.

As Crypto Batman pointed out, this might be the “last chance” for traders sitting on the sidelines. LINK has dipped toward the lower end of that accumulation band around $13–$14, but it’s already starting to show signs of strength.

Buyers are stepping in again, defending the same level that’s been a launchpad for each major rally over the past two years.

What you'll learn 👉

What the LINK Chart Is Showing

The story is told on the weekly chart. LINK has formed a consistent pattern of higher lows, and blue trendline is the bedrock upon which its long-term bull run has been built.

Even during periods of overall market selloff, this region remained firm, absorbing the selling pressure and regaining the momentum for the next higher leg.

This recent bounce is important in that it comes on the heels of a multi-week decline from the $30 area, the same area Batman identified as a key level of resistance.

If the LINK price makes it to stabilize here and re-establishes the support again, the next logical move would be a breakout to that $30 level, and then possibly a breakout higher to new all-time highs above $50.

Volume patterns also support the bullish view. There’s no sign of panic selling, and weekly candles are showing long wicks to the downside, a classic indicator of accumulation at key support levels.

Why This Support Zone Matters

This blue accumulation zone has effectively defined Chainlink’s market cycle for nearly two years. It’s where long-term holders have been quietly building positions while short-term traders get shaken out. Each retest has preceded a strong recovery phase, suggesting that institutional or high-conviction buyers see value here.

From a psychological standpoint, traders now recognize this zone as “the floor,” which further reinforces its strength. If LINK price stays above it, the narrative of a new bull phase becomes increasingly convincing.

Read Also: XRP Price Could Hit $6 Sooner Than You Think; Here’s Why

Chainlink Short-Term Outlook

In the near term, LINK price needs to hold above $13 to keep the bullish structure intact. A few more weeks of sideways consolidation here would actually be healthy; it would allow momentum to reset before the next leg higher. Once the $18–$20 zone is cleared with solid volume, LINK could move quickly toward $30.

Beyond that, if the pattern repeats as it has before, the next major rally could carry LINK price toward $45–$50 in the coming months. The market’s been here before; every touch of this zone has led to a run, and this time, the setup looks just as strong.

Chainlink might not be making headlines right now, but the chart says it all: accumulation, patience, and then acceleration.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.