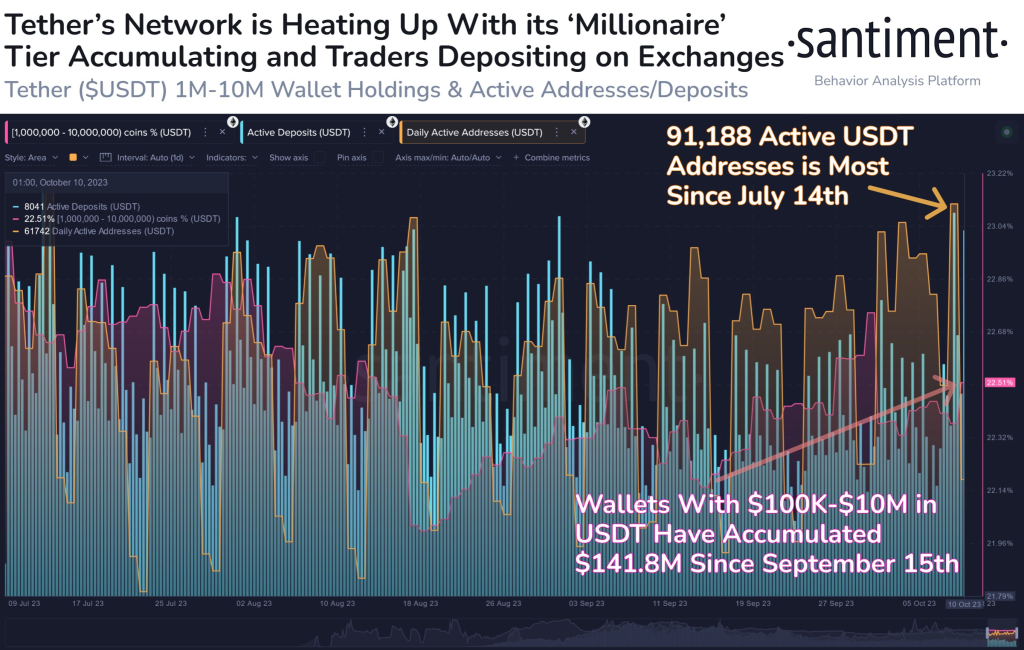

Based on the analysis from Santiment, it appears that some of Tether’s largest holders have started accumulating more USDT tokens recently. This could signal that these large holders anticipate needing more Tether liquidity in the near future, likely to purchase crypto assets.

A few key points:

- Addresses holding between $1M-$10M worth of USDT are accumulating more tokens. These are considered Tether’s largest holders.

- There has been an increase in Tether deposits to exchanges. This suggests holders are positioning USDT on exchanges in order to trade it.

- Active addresses for Tether are at a 3-month high, indicating increased on-chain activity.

When large Tether holders begin accumulating tokens, it often precedes increased demand to purchase cryptocurrencies. These major holders may have insider information or believe prices of crypto assets will rise soon. By stockpiling Tether, they ensure they have ample liquidity to buy the dip when prices drop or take advantage of anticipated gains.

Source: Santiment – Start using it today

This increased USDT accumulation comes at a time when many altcoins have seen declining prices and have lost key support levels. For example, Ethereum is now trading around the $1560 mark, with almost a 6% decrease over the last 7 days. With altcoin prices slumping, Tether whales may be anticipating an opportunity to buy cryptos at discounted prices.

The uptake in USDT could signal these major holders are getting ready to buy the dip across cryptocurrencies like Ethereum that have experienced recent sell-offs. By having USDT liquidity on hand, they can swiftly purchase tokens if prices drop further.

In summary, the recent accumulation of USDT by major holders may signal that there is growing confidence in higher crypto prices in the near future. These holders are likely getting ready to buy the next dip or rally. Of course, this remains speculative until actual trading activity confirms it. But it’s a notable on-chain signal to monitor.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.