PEPE price and Dogecoin price have both pushed higher in 2026, yet the charts tell two very different stories once the noise fades. One memecoin is shaping a clear continuation setup, while the other is still working through a slower recovery phase. That contrast sits at the center of why PEPE currently holds a technical edge over DOGE.

What you'll learn 👉

PEPE Price Structure Shows A Clear Short-Term Continuation Setup

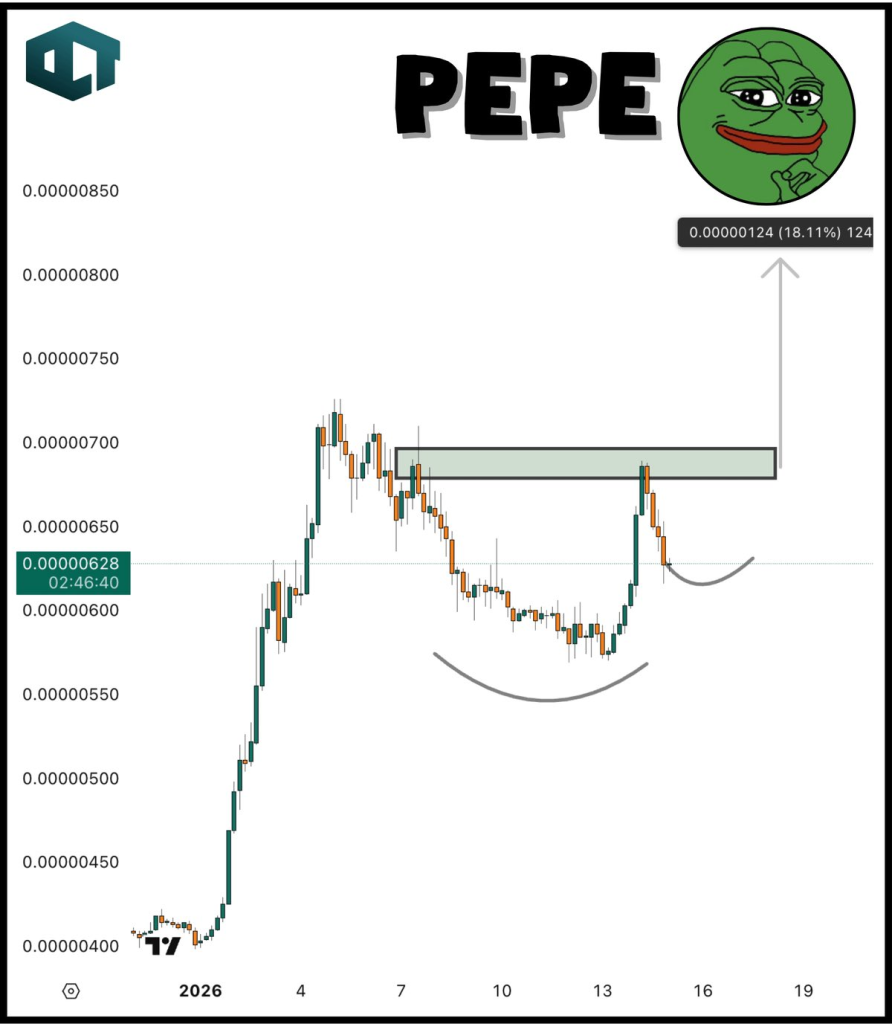

PEPE price action stands out due to the structure forming on the chart. Pepe Whale pointed out that PEPE is building a bullish cup and handle pattern, a formation often seen when momentum pauses before continuation. Price previously pushed higher, rounded out a base, and returned toward resistance without breaking structure.

Current consolidation near resistance looks controlled rather than aggressive. That behavior suggests pressure is being absorbed rather than rejected. According to Pepe Whale, a confirmed neckline break places an estimated move of about 18 percent from the breakout area, while upside from current levels stretches beyond 27 percent if momentum holds.

Pepe price behavior also reflects cleaner trend symmetry. Pullbacks remain shallow and organized, which keeps the broader structure intact. Short term focus stays on whether PEPE price can maintain this base without losing the handle formation.

Dogecoin Price Continues To Build After A Falling Wedge Breakout

Dogecoin price presents a different technical picture. DOGE recently broke out of a falling wedge, a bullish reversal pattern that often signals a trend shift. That breakout already played out, followed by sideways accumulation rather than immediate continuation.

Pepe Whale highlighted that DOGE is still consolidating, which keeps long term confidence intact but limits near term acceleration. Dogecoin price remains constructive, yet momentum has slowed as price works through overhead supply left from the previous decline.

DOGE price structure suggests stabilization rather than expansion. That distinction matters in the short term, especially when comparing relative performance across memecoins.

Short Term Momentum Currently Favors PEPE Price Over DOGE Price

The key difference between PEPE price and DOGE price lies in timing. PEPE is approaching a breakout phase, while Dogecoin is digesting a move that already occurred. Momentum tends to rotate toward assets closer to resolution rather than those already mid consolidation.

Pepe Whale described this contrast clearly, noting that long term belief still exists for Dogecoin, yet PEPE makes more sense right now based on chart positioning. That assessment aligns with how continuation patterns often outperform during brief market windows.

Pepe price also benefits from tighter risk definition around the handle structure. Clear invalidation levels make short term positioning more straightforward compared to DOGE price, which still lacks directional clarity.

What The Charts Suggest From Here

PEPE price holds the edge as long as the cup and handle structure remains intact. Sustained consolidation near resistance keeps breakout potential alive. Dogecoin price remains constructive, yet patience may be required before momentum rebuilds.

Read Also: Silver Price Near $100? Analyst Says This Is the Start of a Financial Crack-Up, Not a Bull Market

Both memecoins remain relevant, though chart structure suggests different timelines. Watching how PEPE price reacts near resistance may offer early clues about whether this technical edge turns into follow through.

Curiosity now shifts toward whether PEPE confirms its breakout first, or if Dogecoin finds fresh momentum that reshapes the comparison once again.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.