JasmyCoin enters 2026 carrying a very different tone compared to the uncertainty that followed it through much of 2025. Price action alone never told the full story last year. Progress happened quietly, and patience often replaced excitement. That backdrop changed once Jasmy chain reached a key milestone that reframed how the project is viewed moving forward.

The launch of the Jasmy chain mainnet added a fresh layer of substance to JasmyCoin. Momentum now comes less from speculation and more from structure, which helps explain why 2026 feels like a reset rather than a continuation of last year.

Lee the Captain explains that Jasmy chain officially completing its mainnet marked one of the most meaningful developments for JasmyCoin so far. Jasmy chain operates as an EVM-compatible Layer 2, which connects JasmyCoin directly to the broader Ethereum ecosystem.

EVM compatibility matters because Ethereum remains one of the most recognizable Layer 1 networks in crypto. Jasmy chain being built on Arbitrum Orbit allows Ethereum functionality without forcing users to deal with persistent issues such as high gas fees and congestion. That design choice positions JasmyCoin within infrastructure discussions rather than keeping it limited to a narrow data storage narrative.

What you'll learn 👉

JASMY Price Narrative Shifts From Quiet To Constructive

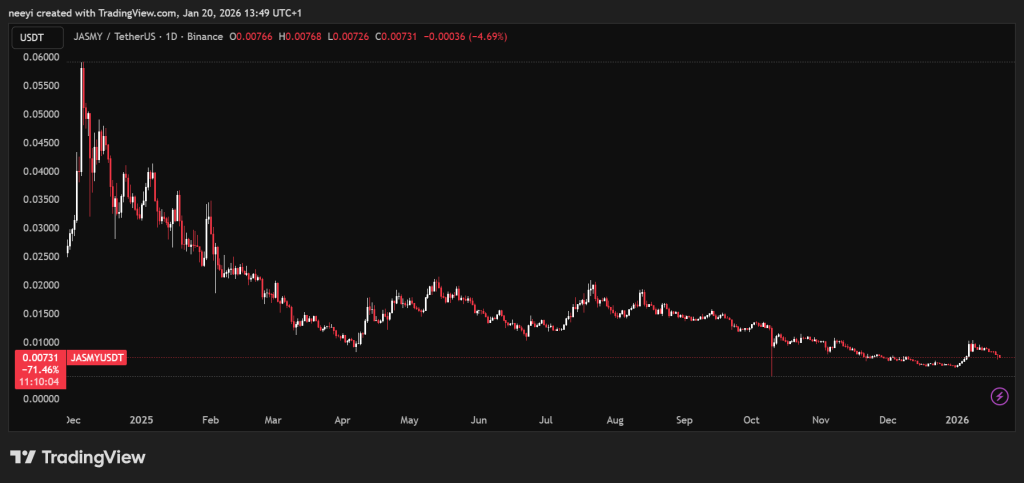

JASMY price spent much of 2025 drifting without a clear catalyst. That phase created the impression that development had slowed. The Jasmy chain launch challenges that assumption. Infrastructure additions often do not reflect immediately in price, yet they change how future cycles evaluate a project’s credibility.

Lee the Captain highlights that altcoin cycles often reward track record rather than short-term hype. Projects with visible execution tend to receive renewed attention once market conditions improve. JASMY price now reflects a token backed by an expanding ecosystem instead of a single use case.

JasmyCoin Fundamentals Look Clearer Heading Into 2026

JasmyCoin remains focused on data storage, a niche with fewer well known competitors than many other crypto sectors. Filecoin, Arweave, and Storj dominate mindshare, yet JasmyCoin continues to rank among the most recognizable names in that category. Longevity adds weight in environments where familiarity often guides capital flow.

Lee the Captain notes that recognition plays a role during broad market expansions. Investors frequently gravitate toward projects they already know rather than searching for obscure alternatives. JasmyCoin’s consistent presence inside the top 200 adds to that familiarity advantage.

JASMY Price Context Reflects Patience Rather Than Weakness

JASMY price still trades far below previous highs near $0.25. That gap can appear discouraging at first glance. Long term positioning often benefits from extended consolidation periods, especially when fundamentals improve during low interest phases.

Read Also: Why Is ARPA Price Pumping Right Now?

Lee the Captain frames this period as accumulation driven by patience rather than urgency. Dollar cost averaging strategies thrive in environments where time matters more than timing. Market cycles tend to move independently of individual expectations, which makes consistency more important than prediction.

JasmyCoin no longer relies solely on narrative potential. Jasmy chain introduces tangible infrastructure that strengthens the broader ecosystem. That shift explains why 2026 feels structurally stronger than 2025 despite muted price action.

Curiosity now centers on how JasmyCoin evolves as market attention cycles back toward infrastructure- and utility-driven projects. The pieces are in place, and the coming months may reveal how this quieter foundation supports the next phase of the story.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.