Uniswap (UNI), the governance token of the leading decentralized exchange (DEX) on the Ethereum blockchain, has been on a tear recently, with its price surging by 116.5% over the past week and 157.5% in the last 30 days. A combination of new developments, technical breakouts, and rising optimism among traders and analysts have driven this impressive performance.

What you'll learn 👉

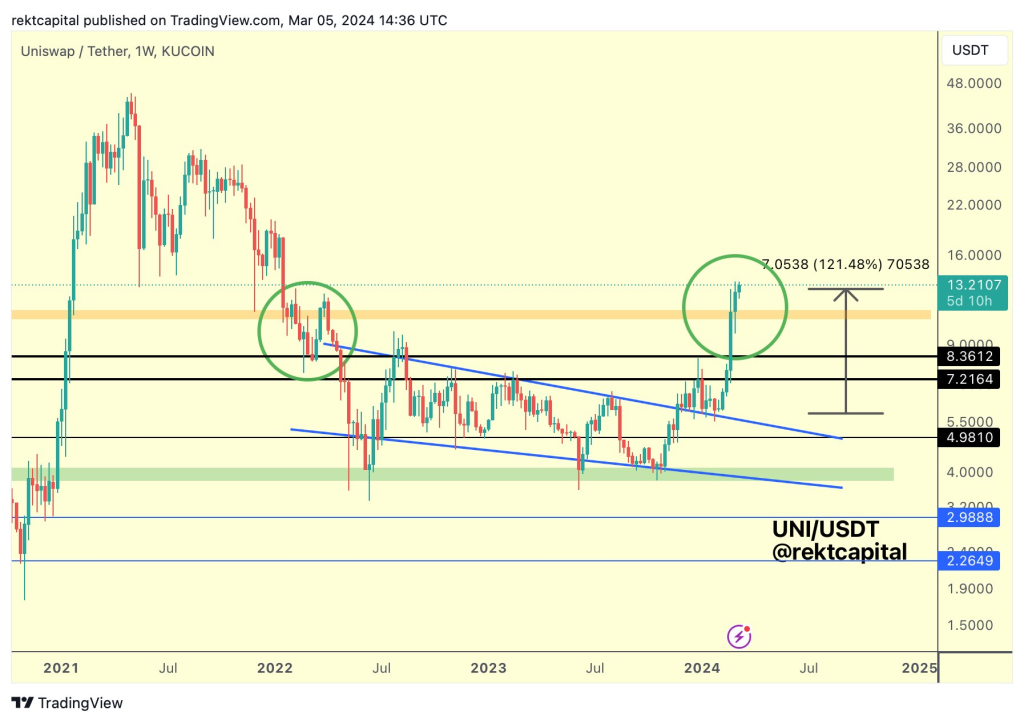

Successful Retest of Support Bodes Well for Further Upside

Renowned analyst Rekt Capital has highlighted UNI’s successful retest of a key support region on the weekly timeframe, which is depicted in orange on their chart. This bullish development suggests that UNI is well-positioned for further upside continuation over time, as long as the token maintains price stability around these levels.

A successful retest of support often indicates that buyers are stepping in to defend a crucial price level, increasing the likelihood of a continued uptrend. With UNI now trading above this key support area, the path may be cleared for further upside momentum.

Wallet Extension and Limit Orders Fuel Price Surge

According to trader YG Crypto, the recent release of Uniswap’s wallet extension and the introduction of Limit Orders have been significant catalysts behind UNI’s price surge.

These new features have enhanced the user experience and functionality of the Uniswap platform, attracting more users and increasing demand for the UNI token.

On lower timeframes, YG Crypto notes that UNI is respecting a key support area and forming a tight trading range, suggesting that the token is consolidating before a potential breakout.

However, YG Crypto also cautions against chasing pumps and recommends waiting for the dust to settle and confirming that support holds before entering new positions.

Breakout Above $13 Resistance Opens Door to $18 and $33 Targets

Trader Ualifi Araújo has expressed a particularly bullish outlook on UNI, highlighting the token’s recent breakout above the crucial $13 resistance level.

Araújo believes that this breakout has set the stage for UNI to target the $18 price level in the near term, with the potential to rise further towards $33 in the coming months.

Araújo expects the $13 level to now act as strong support, with the price unlikely to dip below this threshold.

The trader also draws comparisons between UNI and another prominent DEX token, SushiSwap (SUSHI), predicting that SUSHI will soon follow in UNI’s footsteps and break above its current resistance levels at $1.87 and $2.10.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +UNI’s Impressive Price Performance

Over the past 24 hours, UNI has gained 16.4%, extending its impressive rally. The token’s performance over longer timeframes is even more remarkable, with a 116.5% increase over the past week, a 157.5% surge in the last 30 days, and a 144.7% gain over the past year.

As Uniswap continues to innovate and expand its offerings, the growing adoption and user base of the platform are likely to drive further demand for the UNI token.

You may also be interested in:

- Top 7 Token Unlocks to Watch This Week: Ethereum Name Service(ENS), Near Protocol (NEAR), and More

- Theta Network’s (THETA) Price Rallies: Expert Highlights Potential Retest Level, But There’s a Catch

- Advertising Potential Propels DeeStream (DST) Presale As 100X Rumours Circulate Post Binance Coin (BNB) & Cardano (ADA) Whales Buy-In

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.