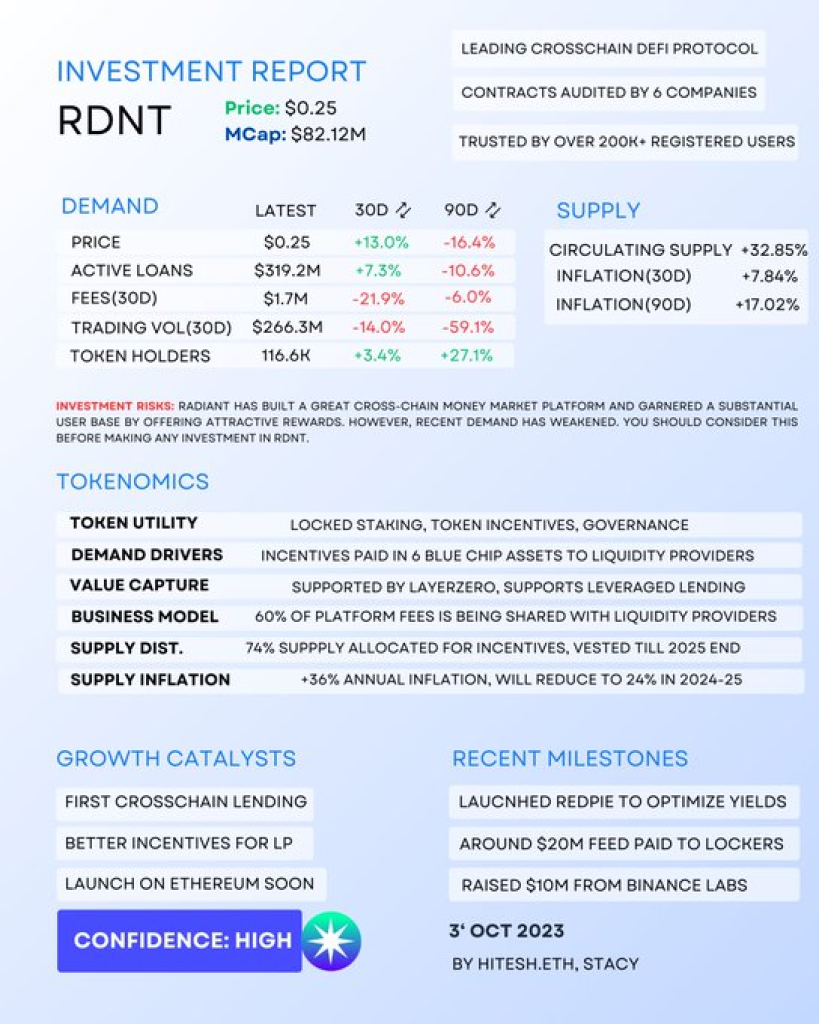

Radiant Capital’s fundamentals stand out as remarkably solid relative to other sub-$100 million market cap cryptocurrencies, according to crypto analyst Hitesh.

In his investment report on RDNT, Hitesh summarizes Radiant’s product strengths that resonate with users and liquidity providers. The service offers attractive yields on blue-chip crypto assets, expanding beyond just stablecoins.

Additionally, Radiant employs sound tokenomics via incentives that will fully unlock over the next three years. Over 74% of the total supply is allocated to provide these yield farming rewards.

Hitesh notes Radiant is expanding operations to Ethereum, which could drive further platform adoption and demand for the RDNT token. However, on-chain activity has declined recently across volume and fee generation metrics. The Ethereum migration may reverse this trend.

Overall, Hitesh only flags the supply inflation rate outpacing on-chain demand growth as a potential concern. But the prudent incentive structure and loyal user base mitigate the typical risks seen in smaller-cap tokens.

Given Radiant’s respectable fundamentals and adoption trajectory, Hitesh believes the overlooked project warrants more attention among investors seeking value. As the platform evolves, Radiant Capital has credible potential to deliver outsized returns compared to crypto peers of similar size.

For prudent portfolio diversification, allocating to promising micro-cap standouts like Radiant can enhance returns while minimizing downside exposure. Hitesh makes the case that RDNT offers an ideal asymmetric risk-reward bet within this often-overlooked niche.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.