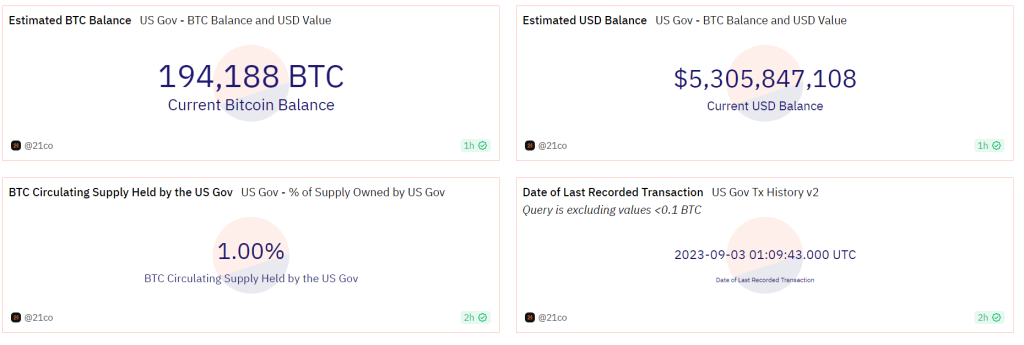

Through a series of high-profile cryptocurrency seizures, the United States government has accumulated a massive Bitcoin stash, now estimated to be worth over $5.3 billion.

According to blockchain analysis by 21.co, the US currently holds at least 194,188 BTC across wallets associated with seizures of funds from Silk Road, Bitfinex, and James Zhong. Despite auctioning off some coins this year, Uncle Sam remains one of the largest institutional bitcoin holders in the world.

The seized assets are kept offline in secure storage under the Department of Justice and IRS. While the government took possession of huge amounts of crypto in 2022, sales cannot occur until courts issue final forfeiture judgments.

In the past, the US Marshals Service held public bitcoin auctions, including 30,000 BTC purchased by Tim Draper in 2014. More recently, however, exchanges like Coinbase have been tapped to sell coins, as when 9,118 BTC were offloaded in March 2022.

As crypto crime persists, the US government must strategize how to securely hold and liquidate seized digital assets. With bitcoin prices volatile, timing auctions is critical. The fed’s quiet status as a bitcoin whale also raises questions about the appropriateness of government entities holding crypto.

Some argue the US government accumulating and holding bitcoin is a positive development that lends further legitimacy to cryptocurrencies. With the directly owning a massive stake, it may have incentives to see crypto values rise over time. This whale status could support market confidence and prices. However, as a regulatory agency, it also has duties to wield economic influence responsibly.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.

![Singapore’s MetaComp Raises Pre-A+ Round Backed By Alibaba, Closing Total US$35 Million Pre-A Funding in 3 months to Accelerate Asia’s Regulated Web2.5 Pay and Wealth[1] Group-Level Platform](https://captainaltcoin.com/wp-content/uploads/2026/03/Second_funding_months_brings_total_raised_US_35_mi_1773366308VpHX8WGLCD-336x220.jpg)