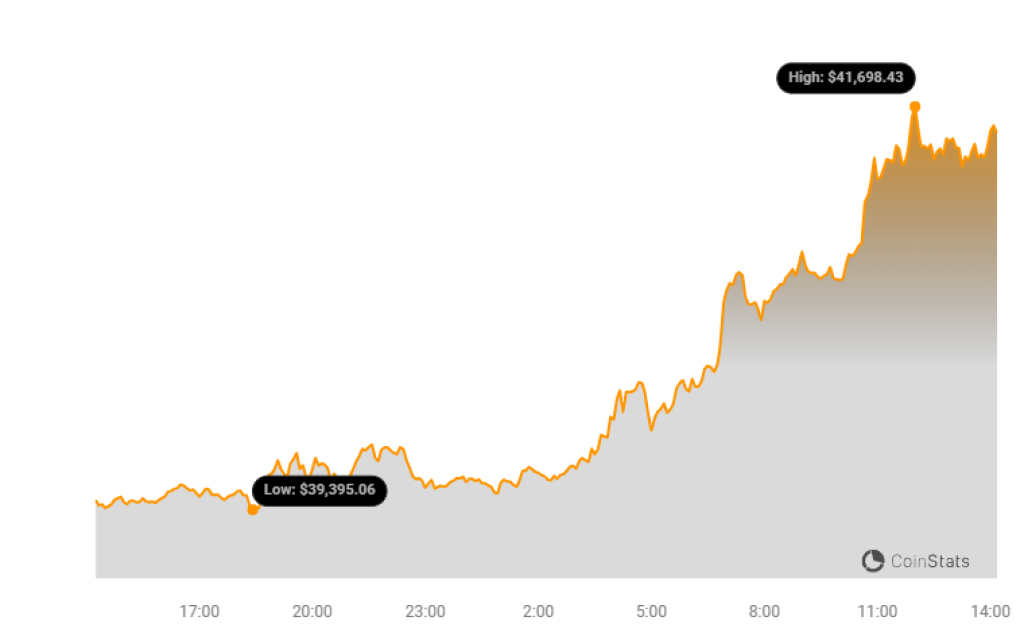

Over the weekend, the cryptocurrency market witnessed a surprising surge as Bitcoin leaped past $40,000, ultimately reaching $41,500 on Monday. Ethereum, not one to be left behind, also joined the rally, surpassing $2,260 in a broader market upswing. But what’s the driving force behind this crypto resurgence?

What you'll learn 👉

Top Factors Fueling the Market Rise

December has ushered in positive vibes for the crypto realm, propelling various digital currencies upward. The recent spike in prices could be attributed to the mounting anticipation for the approval of a Spot Bitcoin ETF, the upcoming Bitcoin halving in 2024, and an overall positive sentiment in the market.

Adding to the bullish momentum, recent dovish remarks from Federal Reserve officials have played a role in the gains observed across the digital asset space.

At present, Bitcoin stands at $41,246, marking a 5.3% increase, with a market cap of $806 billion. Ethereum has also seen an uptick, reaching $2,205. While most top-10 cryptocurrencies experienced modest gains, BNB, linked with Binance, saw a marginal decrease of 0.1%.

Source: CoinStats – Start using it today

FOMO Buying Into Bitcoin

Simultaneously, the crypto industry is closely monitoring applications submitted by major players, including BlackRock Inc., for the introduction of the first U.S. spot Bitcoin ETFs.

As inflation cools down, investors are speculating that the Federal Reserve may not raise interest rates further, and there is growing speculation about the possibility of rate decreases, which bodes well for global markets.

This surge is noteworthy as it marks the first time Bitcoin has surpassed $40,000 in 18 months, leaving many curious about what might unfold next. Analyst Layergg shared some of the key crypto updates in his tweet.

Read also:

- Ethereum (ETH) Flexes Its Muscles: What the Recent Rally Means for Traders

- Why Ripple Is Better than Ethereum for Investment: Expert Urges Timely XRP Accumulation

- Why Galaxy Fox Might Be The 100x Star in Play-to-Earn Crypto Presales

Crypto Updates and Market Highlights

- CME BTC Futures Gap: A gap of $1,190 in CME BTC futures remains open.

- Binance Airdrop: Binance hints at an airdrop, urging users to install the Binance Web3 wallet.

- Osmosis + Umee: Osmosis and Umee UX Chain propose a merger, potentially involving a token swap.

- Arbitrum “Backfund” STIP: Arbitrum DAO approves a $23 million ‘Backfund’ for projects that missed the initial grant.

- $AERGO Token Split: A proposal for the Aergo token split has been rejected.

- $BEAM ERC-20: Beam Privacy’s Ethereum bridge launch is imminent, enabling BEAM ERC-20 trading.

- $DIA Annual Treasury Governance: DIA plans its annual treasury snapshot vote, discussing options for token unlock, repeating the 2023 release, or strategic asset burn.

- $OSMO + Umee UX Chain Merger: Osmosis and Umee UX Chain propose a merger.

- Blast TVL Surpasses $700M: Blast achieves a total asset value surpassing $700 million.

- The EU’s AI regulation proposal faces potential delays and opposition as France, Germany, and Italy express reservations.

- This week, key economic indicators, including the PMI index, employment, unemployment rate, GDP, and wage index, will be announced, reflecting the economic outlook.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.