In a climate of heightened financial uncertainty, the cryptocurrency market is experiencing a notable downturn, with Bitcoin and Ethereum leading the descent.

The market is rife with speculation and conjecture as Bitcoin, the flagship cryptocurrency, faces rejection at its resistance level and is currently hovering near a $26,000 support. Concurrently, Ethereum (ETH) has also witnessed a decline, plummeting below the $1,600 mark.

What you'll learn 👉

Drop in crypto market cap

The total cryptocurrency market capitalization stands at a staggering $1.05 trillion, marking a 0.03% decrease over the last 24 hours. This decline is not isolated to individual cryptocurrencies but extends to crypto investment products managed by prominent asset managers such as CoinShares, Grayscale, 21Shares, Bitwise, and ProShares.

Crypto outflows on the rise

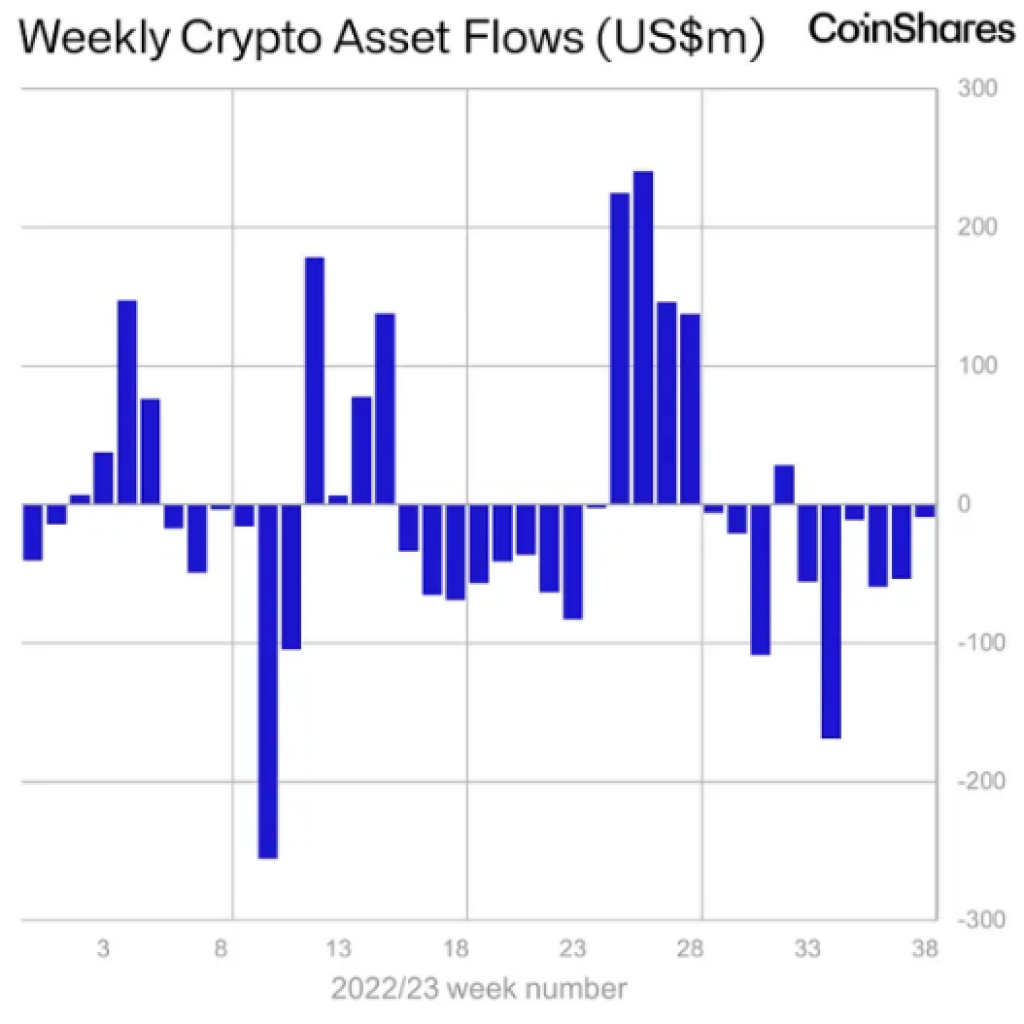

These entities have encountered a sixth consecutive week of outflows, with crypto funds experiencing a further loss of $9 million last week.

This recent outflow is a significant reduction from the $54 million observed in the preceding week. However, it contributes to a ten-week streak of aggregated outflows, culminating in a total loss of $464 million.

The trading volume has also experienced a downturn, falling to $820 million for the week, a notable decrease from over $1 billion in the previous week and substantially below the yearly average of $1.3 billion. This decline in trading volume mirrors a similar trend observed in the broader cryptocurrency market.

Despite the market’s current state, there has been no official news regarding the approval of exchange-traded funds (ETFs) related to cryptocurrencies. The absence of such announcements leaves market participants and potential investors in a state of anticipation, awaiting regulatory developments that could potentially impact the market’s trajectory.

Recent data shows declining cryptocurrency trading volumes and outflows from crypto investment products. This could indicate cooling interest and shifting sentiment among some investors.

The cryptocurrency market appears to be in a consolidation phase. Some market observers believe investors may be reevaluating positions and strategies given current conditions.

The reasons for the recent market slowdown are complex. The cryptocurrency market is inherently volatile, with prices subject to rapid change.

In times of market uncertainty, experts emphasize the importance of research and due diligence for investors. Monitoring regulatory developments and recalibrating approaches as needed can help investors make informed decisions.

While the cryptocurrency market faces challenges, its underlying technology continues to hold potential. Some investors likely remain confident in the long-term outlook.

Overall, the data reflects a period of decreased crypto market activity. This could represent a pause rather than a reversal of the market’s growth. Maintaining perspective and smart investing strategies can help investors navigate changing conditions.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.