The price of various cryptocurrencies has been down today. Bitcoin, Solana, Ethereum, DOGE, ONDO, among many others, are down by 1.5% to 7% over the past 24 hours.

Several factors could be behind this dip, but the most obvious one right now seems to be shifting sentiment around Bitcoin and Ethereum. Technical signals and resistance rejections from both major assets are starting to weigh heavily on the broader market.

What you'll learn 👉

BTC Price Breaks Support as Selling Pressure Builds

The Crypto Express shared a telling chart this morning showing Bitcoin (BTC) breaking down from an ascending triangle after getting rejected near a key horizontal resistance zone around $105,000. The BTC price has now slipped below that rising support trendline, which had previously held for days. This kind of break can often signal the start of a short-term bearish trend.

#BTC/USDT ANALYSIS

— The Crypto Express (@TheCryptoExpres) May 15, 2025

BTC was rejected at the horizontal resistance and is now breaking down from the ascending triangle. A successful retest below the triangle would confirm a short-term bearish trend.

The price is also approaching the 200 EMA support level. A reversal from this… pic.twitter.com/G4psXOrjZh

In the chart, BTC is hovering near its 200 EMA (Exponential Moving Average), a major technical support level. If Bitcoin fails to hold this line, it could confirm a deeper pullback. On the other hand, if buyers step in around the 200 EMA and manage to push the price back above the broken triangle, there’s still a chance for a rebound.

According to The Crypto Express, this breakdown is critical. They warn that unless BTC quickly reclaims the trendline, we could see lower prices in the near future.

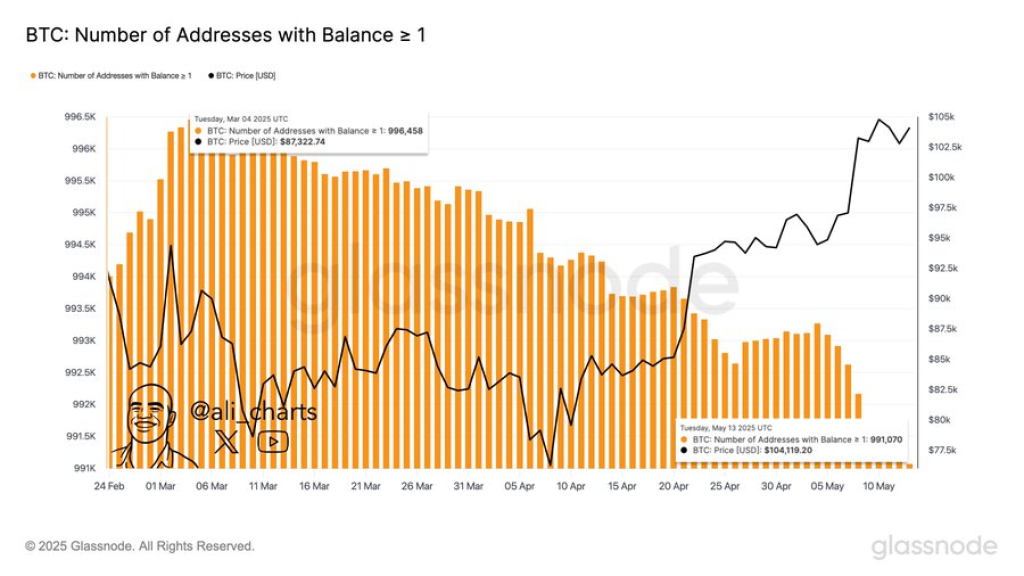

Ali, a popular crypto analyst on X, also pointed out that the RSI is flashing overbought signals, suggesting the Bitcoin price was due for a breather. To add to the bearish narrative, Ali also noted that the number of wallets holding at least one Bitcoin has dropped by 5,000 over the last two months. That’s not a great sign for long-term sentiment.

Ethereum Price Eyes Correction After Rejection

Ethereum (ETH) has been running hot recently, but according to Ferit Birkan Devletoğlu (@BtcFerit), it might be time for a pause. After rallying hard, the Ethereum price hit resistance at $2,677 and failed to break through. It’s now consolidating just above $2,600 and appears to be forming a potential lower high.

If ETH can’t hold the $2,584 support level, Ferit believes we could see a drop to the $2,455 area. And if things get worse, there’s even a chance ETH falls to $2,201, which lines up with a major demand zone from a previous breakout. If buyers completely lose control, further downside could take ETH toward $2,087 or even $1,978.

But it’s not all doom and gloom. If Ethereum manages to bounce from its current levels and break through $2,677 with strong volume, the bullish trend could continue, potentially pushing the ETH price above $2,800.

Crypto Market Sentiment Is Shaky

Right now, crypto sentiment feels shaky. While the overall trend in the past few weeks has been bullish, today’s correction seems driven by a combination of technical rejection at resistance zones and some fading momentum. Both Bitcoin and Ethereum are still up significantly from their lows, but in the short term, the market might need to cool off a bit before making another move higher.

Read Also: Pi Coin Price Crashes – Why Pi Network’s Core Team Is Losing Community Trust

For now, all eyes are on whether BTC can hold that 200 EMA and whether ETH bulls can defend $2,584. The next few days could be key in deciding if this is just a healthy dip or the start of a deeper correction.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.