The cryptocurrency market is in a slump today, with the total market capitalization dropping to $1.02 trillion, a 1.33% decrease in the last 24 hours.

Investors and traders are scratching their heads, wondering what’s driving this downturn. Let’s delve into the key factors contributing to the market’s current state.

What you'll learn 👉

Bitcoin and Ethereum Take a Hit

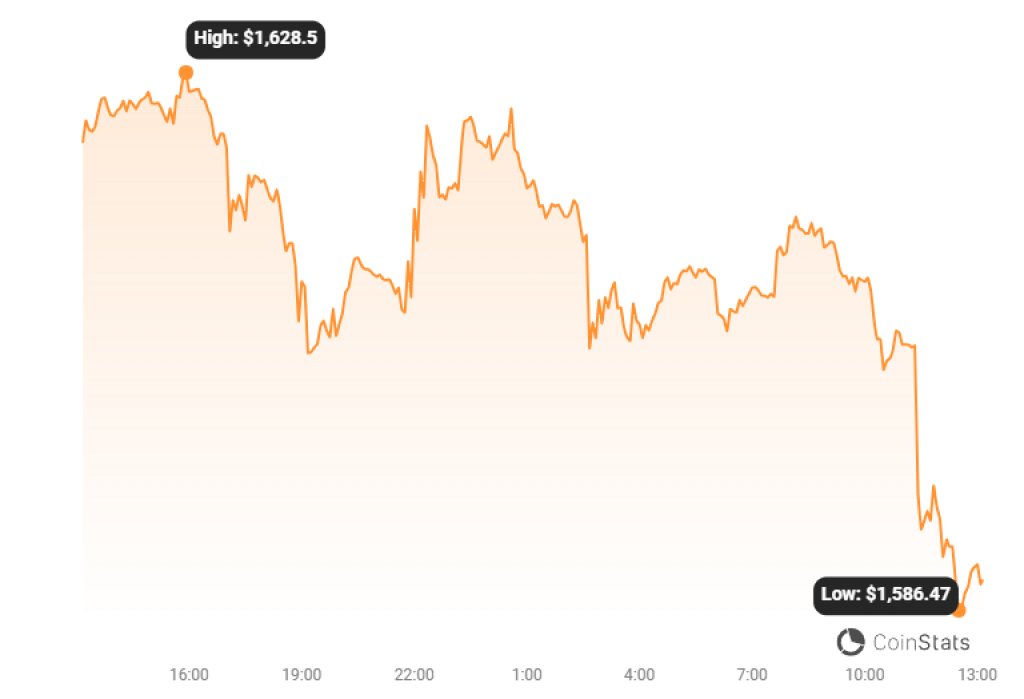

The two juggernauts of the crypto world, Bitcoin and Ethereum, are both trading at lows not seen in months. Ethereum is currently trading below $1,600, a level it hasn’t seen since March. Bitcoin, on the other hand, is trading below $25,700, its lowest point since June.

Source: CoinStats – Start using it today

Historically, September has not been kind to Bitcoin. The cryptocurrency has seen an average decline of 5.5% in this month over the years. In fact, only twice has Bitcoin closed September in the green—once in 2015 and again in 2017. The most significant September downturn occurred in 2014, when Bitcoin plummeted by 19%. Given this historical context, it wouldn’t be surprising to see further declines before the month is out.

FTX Liquidating Assets Creates Market Jitters

CaptainAltcoin reports that FTX is set to receive court approval to liquidate $1.8 billion worth of crypto assets on September 13th. This news has instilled a sense of fear among traders and investors. But is this fear justified?

Contrary to the drama circulating online, the liquidation process won’t happen overnight. Regulatory bodies like the SEC and CFTC would never allow such a hasty move. Instead, there will be a structured framework for selling these tokens, potentially at a rate of $200 million per week.

Furthermore, the liquidation is likely to be handled by an underwriter, who will ensure compliance with laws and regulations while negotiating the terms of the sale, most likely through over-the-counter (OTC) transactions. This process could take months, and the market’s immediate reaction may be more of a self-fulfilling prophecy of fear, uncertainty, and doubt (FUD) than a rational response to the news.

Missed Opportunities with Regulatory Wins

Despite some recent positive news, like (Grayscale winning a lawsuit against the SEC), the market simply failed to capitalize on these victories.

While there was a brief positive reaction, it quickly gave way to further consolidation and a continued downtrend.

Conclusion

The crypto market is complex and influenced by a myriad of factors. While today’s downturn can be partly attributed to historical trends and recent news, it’s essential to remember that the market is highly volatile and can be subject to rapid changes.

Investors should exercise caution and conduct thorough research before making any decisions. Whether this is a temporary slump or a sign of more significant issues to come remains to be seen, but for now, it’s crucial to keep a level head and not succumb to market hysteria.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.