The cryptocurrency market is experiencing a downturn today like it has been doing for some days. Bitcoin (BTC), Ripple (XRP), Ethereum (ETH), and Solana (SOL) are down by 4%, 4%, 3%, and 7% respectively. Many other cryptos are also showing similar declines.

One of the primary factors contributing to the market decline appears to be Bitcoin price movement. The $90,000 level has been seen as a psychological barrier. Trading below $90,000 has been seen as a bearish signal by many investors, affecting market sentiment across the board.

Bitcoin is currently trading at $81,952, showing a slight recovery of 1.54% after bouncing off the support level at $80,000.

The BTC price previously dropped below $84,000, which has been identified as a resistance level. This confirms it as a key barrier to further upside momentum. If Bitcoin manages to break and sustain above $84,000, it could indicate a potential bullish recovery.

In a bearish scenario, a drop below $80,000 could trigger significant bearish sentiment, potentially leading to further declines. If bears take control, the next possible downside targets could be $77,500 or even $75,000, depending on selling pressure.

Read Also: Kaspa (KAS) Could Still Be a Better Cryptocurrency Than Pi Coin: Here’s Why

Big Liquidations Causing Crypto Market Dip

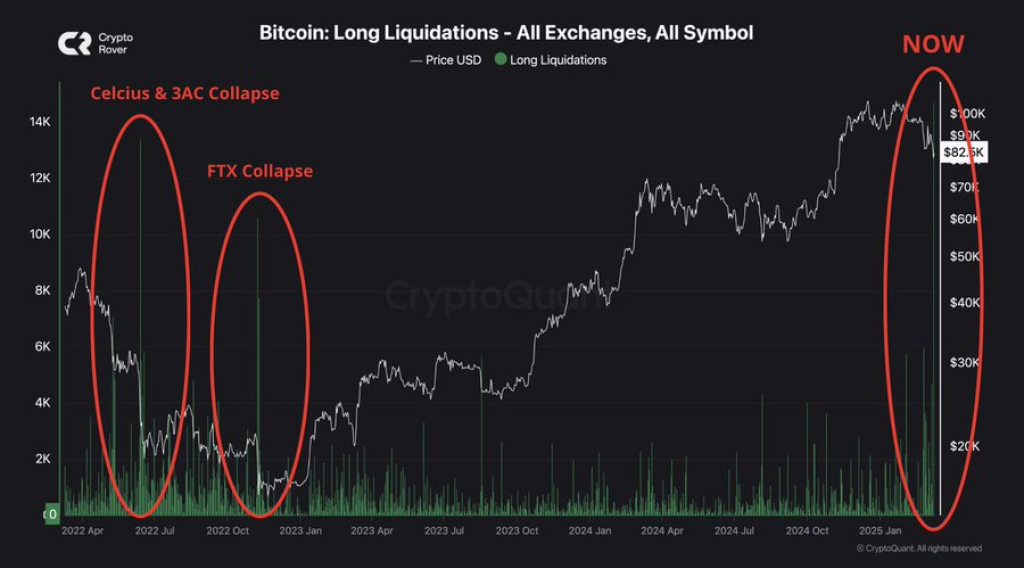

The current market downturn has led to massive liquidations. Mikybull Crypto noted that we’re seeing the biggest liquidation event since the FTX crash. The market sentiment is currently at levels comparable to previous cycle’s historical lows. This could mean either more pain before the bottom formation or that the bottom is already in.

Biggest liquidation than the FTX crash

— Mikybull 🐂Crypto (@MikybullCrypto) March 10, 2025

The market sentiment is at this level with the previous cycle's historical low.

Either more pain before the bottom formation or the bottom is in. pic.twitter.com/ykdA8O97oO

Adding to this perspective, Crypto Rover reported that this event marks the biggest Bitcoin longs wipeout since the Celsius and FTX crypto crash, attributing some of the market sentiment shift to political factors related to the Trump administration.

These liquidations have amplified the downward pressure on prices as leveraged positions are forcibly closed, creating a cascade effect throughout the market. When large numbers of long positions are liquidated simultaneously, it typically leads to sharp price drops as seen in today’s market activity.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.