The cryptocurrency market is experiencing dips today, with major digital assets showing declines. Bitcoin, the leading cryptocurrency, dropped by 3%, while Ethereum and Solana saw even steeper falls of 4% and 5% respectively. This downturn has left many investors questioning the reasons behind the market’s current state.

What you'll learn 👉

Bitcoin ETF Net Outflows Continue

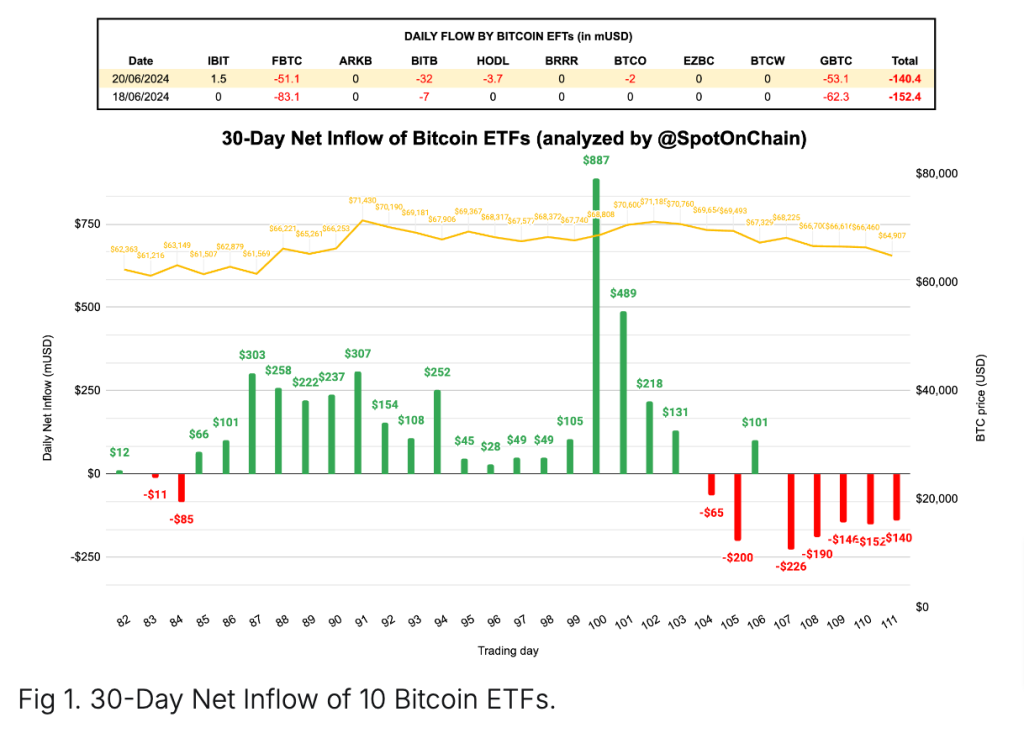

Based on onchain metrics by Spot on Chain, one of the primary factors contributing to the market’s decline appears to be the ongoing negative net inflows for Bitcoin Spot ETFs. As of June 20, 2024, the Bitcoin Spot ETF Net Inflow recorded a negative $140 million, marking the fifth consecutive day of outflows.

Read Also: Here’s Why Metal DAO’s MTL Crypto Price Is Pumping: Analysts Share Price Targets

Key statistics from the 10 Bitcoin Spot ETFs reveal:

- BlackRock’s iShares Bitcoin Trust (IBIT) was the only ETF to experience a positive inflow, albeit a modest $1.5 million.

- Grayscale Bitcoin Trust (GBTC) faced the highest daily outflow at $53 million, accumulating a total outflow of $232 million over the past five days.

- Fidelity Wise Origin Bitcoin Fund (FBTC) has seen the largest cumulative outflow, totaling $413 million in the same period.

- After 111 trading days, the cumulative total net inflow for all Bitcoin Spot ETFs has decreased to $14.67 billion.

These ongoing outflows suggest a temporary shift in investor sentiment towards Bitcoin-based investment products, potentially influencing the broader crypto market.

Market Sentiment: A Mixed Picture

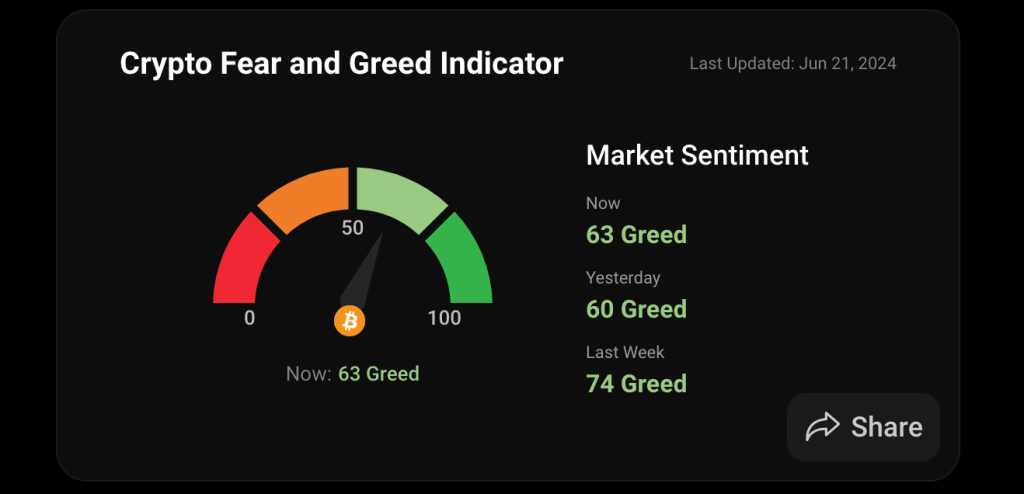

Despite the current downturn, the general market sentiment remains relatively positive. The Fear and Greed Index from Coinstats currently stands at 63, indicating a state of “Greed.” This reading suggests that despite the short-term price declines, many investors maintain an optimistic outlook on the crypto market’s future.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +The contrast between the current price action and the overall bullish sentiment presents an intriguing dynamic. It may indicate that while some investors are taking profits or reallocating their assets in the short term, there is still substantial confidence in the long-term prospects of cryptocurrencies.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.