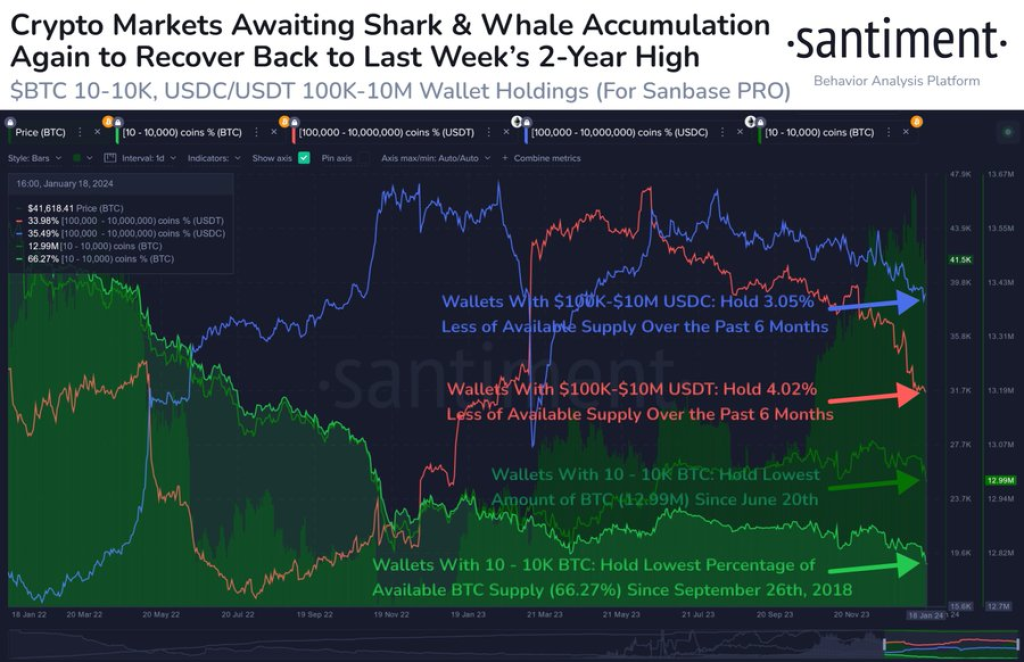

As the weekend began, popular on-chain analytics platform Santiment noted that bitcoin and stablecoin balances for large “shark” and “whale” crypto holders remained down.

Santiment reported that wallets holding between 10-10,000 bitcoins contained 66.27% of supply, down from recent levels. Major tether and USDC stablecoin whales, with balances from 100,000 to 10 million coins, were also down to 33.98% and 35.49% of supply respectively.

According to Santiment, several catalysts could still trigger another crypto bull cycle as seen in recent months. However, they view further accumulation of bitcoin, tether and USDC by these large players as a key bullish signal needed before that occurs.

Source: Santiment – Start using it today

The report comes as the long-awaited bitcoin halving approaches in roughly 14 weeks, an event some think could ignite the next major bitcoin bull run.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Meanwhile, crypto analyst Ash Crypto claims a massive outflow from the Grayscale Bitcoin Trust (GBTC) over the past week is creating consistent selling pressure on bitcoin. According to him, since the launch of a spot bitcoin ETF in October, GBTC has seen 51,582 BTC worth $2.2 billion leave its coffers.

On Friday, Ash notes that all other spot bitcoin ETFs combined saw an inflow of $448 million, while GBTC alone experienced an outflow of $579.6 million, purportedly explaining why the overall crypto market has struggled to gain upside momentum. Until GBTC outflows stabilize, this headwind may persist.

In Summary

So in essence, the crypto market seems to be struggling due to a lack of new accumulation happening amongst whales and large long-term holders. Without fresh inflows coming from these major players, upside momentum has stalled according to on-chain analytics tools.

At the same time, a consistent wave of selling pressure is originating from the Grayscale Bitcoin Trust after falling out of favor versus new spot bitcoin ETF entrants. The combination of declining whale and institutional demand is creating the perfect bearish storm, explaining why bitcoin and the broader crypto market have trended downwards heading into the weekend. Until demand dynamics shift, prices may continue facing resistance moving higher.

The key factors are the lack of new whale and institutional accumulation per on-chain data, as well as persistent outflows from GBTC that are essentially dumping bitcoin back on the spot market. With demand drying up from those key cohorts, it’s creating selling pressure and preventing a meaningful bounce as the weekend begins. Please let me know if these summary paragraphs accurately capture the key points from the posts!

You may also be interested in:

- Top Onchain Analyst Explains What Will Trigger Bitcoin’s (BTC) Price Rebound: Watch Out for These

- Arbitrum’s Record-Breaking Revenue Month Proves ARB’s Long-Term Potential

- BitPay Expands Payment Options to Include Binance Coin and Chainlink

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.