Just when the market thought there was a recovery and a sustained rally kicking off, the crypto market started to plummet again. The prices of Bitcoin (BTC) and Ethereum (ETH) have dipped by 5% and 7% respectively in the past three days, with the last two days closing in red (bearish).

These moves have affected the broader market, as the prices of BTC and ETH significantly influence the larger crypto ecosystem. Many other cryptocurrencies are also following this downward trend. But what could have been behind the sharp decline in price and market sentiment?

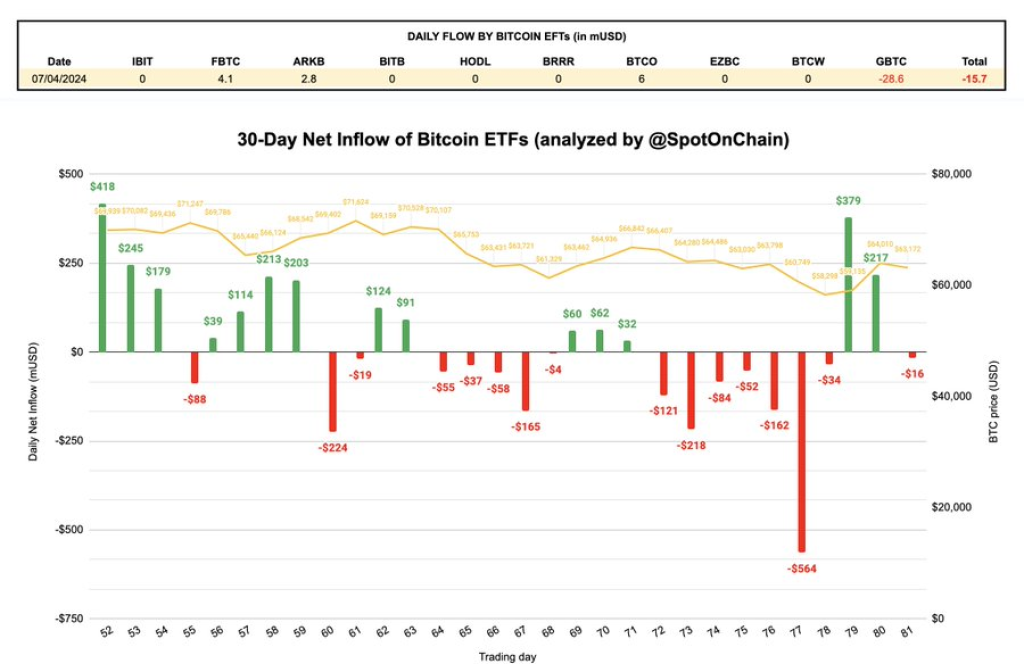

Outflow of Funds From Bitcoin ETF

According to data from Spot On Chain, a cryptocurrency analytics firm, the net inflow into Bitcoin exchange-traded funds (ETFs) turned negative on May 7, 2024, with a $16 million outflow. Notably, the Grayscale Bitcoin Trust (GBTC) experienced a single-day outflow of $28.6 million after two days of inflows. Overall, the single-day inflows and outflows of all ten Bitcoin ETFs slowed down significantly, with five out of ten ETFs, including BlackRock’s IBIT, experiencing zero flow.

Ethereum Negative Sentiment and Withdrawals

Grayscale, a prominent crypto asset manager, has surprisingly withdrawn its application for an Ethereum futures ETF, catching many in the industry off guard. This move occurred just weeks before the SEC’s deadline to make a decision on various spot Ethereum ETF applications. Grayscale’s withdrawal of its 19b-4 application for its Ether futures ETF was submitted on May 7, shortly before the SEC’s final decision date of May 30.

Additionally, there has been uncertainty surrounding the approval of Ethereum (ETH) spot ETFs, affecting the market sentiment around the token. A negative decision could potentially cause the market to dip further. The sentiment among the crypto community is similar, with 92% of participants on the New York-based crypto predictions platform Polymarket believing that spot Ether ETFs will be denied.

According to on-chain data from The Data Nerd, a smart money wallet (0x493) deposited 1,700 ETH (approximately $5.13 million) to Coinbase three hours ago. This same wallet had accumulated 12.96k ETH with an average entry price of $1,870 and earned $1.95 million ten months ago. Despite this recent deposit, the wallet still holds 3,743 ETH (approximately $11.33 million).

There have also been many large ETH movements for unknown reasons in the past 24 hours, as reported by Whale Alert. These include multiple transfers of 7,311 ETH (around $22 million) from Coinbase Institutional to unknown wallets, as well as transfers of 28,695 ETH (approximately $86 million) between unknown wallets and Coinbase Institutional.

Broader Market Impact

As Bitcoin and Ethereum usually lead the pack, their price movements tend to have a significant impact on the general crypto market. When these two flagship cryptocurrencies experience sharp declines, it often triggers a broader sell-off across the market, affecting the prices of other digital assets. Investors and traders closely monitor the price action of Bitcoin and Ethereum as indicators of the overall market sentiment and direction.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +The recent outflows from Bitcoin ETFs, negative sentiment around Ethereum ETFs, large sell-offs, and uncertainty surrounding regulatory decisions have contributed to the current bearish trend in the crypto market.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.