The sluggish performance of the crypto market is continuing today as well. It’s actually getting worse as the BTC price now dipped 3% again today and is trading around $55k.

Ethereum is also down 3.3%, now trading around $2.3k. Seems like Bitcoin ETFs outflows are putting a lot of selling pressure on crypto right now.

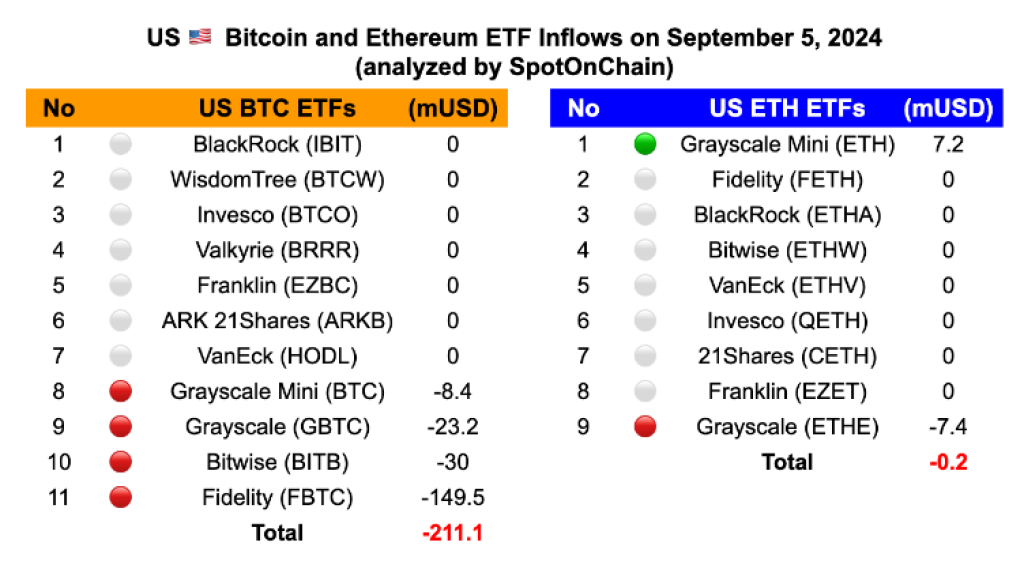

The US Spot ETF Net Inflows on September 5, 2024, are recorded at -$211M for BTC and -$0.2M for ETH.

What you'll learn 👉

ETF Outflows and Market Trends

The crypto market has been experiencing a persistent downturn, with several key indicators pointing to a bearish trend. The net flow has remained negative for seven consecutive days. This trend is particularly evident in the performance of US Bitcoin ETFs, none of which experienced an inflow yesterday.

One notable development was the massive outflow of nearly $150M from the Fidelity Wise Origin Bitcoin Fund (FBTC). This significant withdrawal has contributed to the overall negative sentiment in the market. Additionally, BlackRock’s iShares Bitcoin Trust (IBIT), a major player in the crypto ETF space, has reported $0 net flows for the past four trading days.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Despite these recent setbacks, it’s worth noting that the cumulative total net inflow after 164 trading days still stands at an impressive $17.06B. This figure suggests that the current market’s downturn can be only temporary.

Stock Market Correlation and Stablecoin Trends

Another factor contributing to the crypto market’s decline is the stock market performance, which continues to plunge as well. For instance, S&P 500 price is down 0.3% today and over 5% this week.

While Bitcoin and altcoins are not doing well, Tether’s market cap is at ATH. This means a lot of traders “ran away” to USDT as they wait for better market conditions. The liquidity is there, just not invested in Bitcoin and altcoins.

Read also: Why Bitcoin (BTC) Price Could Dip Further

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.