Solana (SOL) has recovered well today after the recent market crash, with its price up around 8% to trade around $85 at the time of writing. However, SOL is still down 15% over the last 7 days, in line with plunges seen across other altcoins.

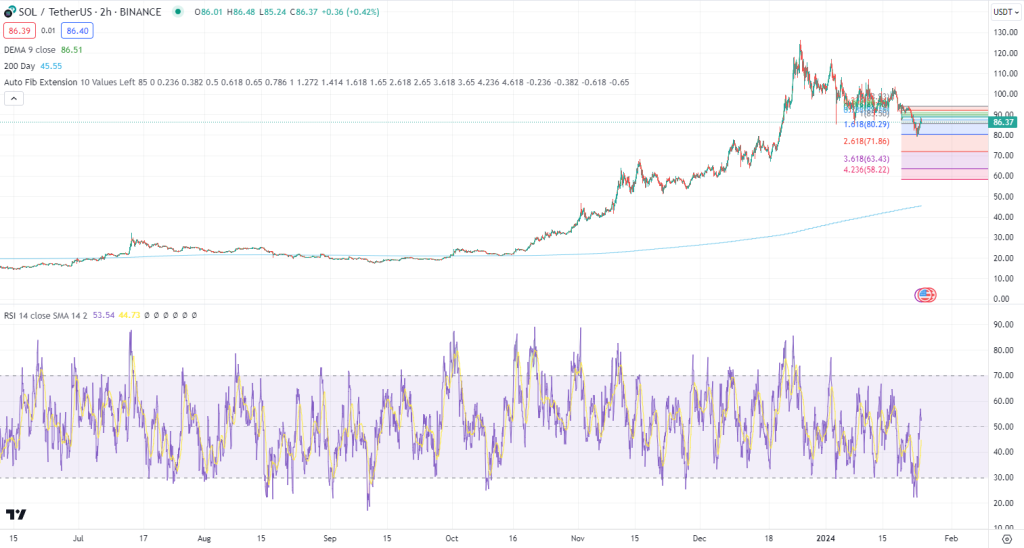

Technically, the signs are pointing towards continued upside potential for SOL in the short to medium term. The Relative Strength Index (RSI) on all timeframes is floating between 45 and 50, indicating SOL is no longer oversold and has room to move higher after becoming extremely oversold during the crash.

Additionally, SOL has strong support around the $80 level. This is not only a psychological support point, but lines up with the 1.618 Fibonacci retracement level. SOL has bounced nicely off this zone so far.

The 200-day moving average also comes into play around $45. This will likely act as strong support on any pullbacks for SOL. As long as SOL holds above the 200-day MA, the overall technical uptrend remains intact.

According to technical analysis from altFINS, SOL remains in an uptrend on the medium to longer-term timeframes, despite some shorter-term consolidation. Specifically, SOL is trading within what looks to be a bull flag continuation pattern on its chart.

This suggests the previous uptrend is likely to resume, especially on a decisive breakout above the pattern resistance around $100. The measured move upside target from this bull flag stands around $125, so that will be the next major test if SOL can regain its bullish momentum. Support to watch is around $80-$85, with key downside invalidation trigger being a drop back below $80.

So in summary, SOL’s price recovering today is likely due to the oversold bounce and key support holding for now. If $80 continues to hold as support, technically SOL looks set to move higher back up to test pattern resistance around $100 in the near term. Upside conviction really builds on a bull flag breakout and close above $100 for measured move target closer to $125 next.

You may also be interested in:

- RAY Stays Strong Above $1, Analyst Says Raydium Is ‘Practically the Backbone of Solana Shitcoin Season’

- Bitcoin Crash Continues, But Experienced Crypto Trader Spots Buy Opportunities – Here His Outlook

- Which Crypto Coin Will Pump Next? 7 Trending Altcoins To Watch In 2024

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.