Polkadot’s DOT token has seen impressive gains recently, up 15% today to trade around $9. Several factors seem to be driving this latest price surge.

According to crypto analyst Cris Pap, Polkadot is seeing increasing usage and development activity. The launch of Snowbridge, which facilitates transfers between Polkadot and other blockchains, is driving millions of daily transactions.

Dotordinals and memes built on Polkadot are sparking interest. GameFi and decentralized finance (DeFi) activity on Polkadot is also blooming, with all key metrics trending up. Across crypto social media, bullish sentiment abounds about Polkadot’s potential as developers continue building new projects. Pap describes Polkadot as a “multicore supercomputer warming up,” poised to capture more attention.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Further validating the surge in usage on Polkadot, crypto analyst asynchronous rob recently tweeted that the Polkadot relay chain facilitated over 1 million transactions on a single day. This tops the previous record high of 941,000 transactions seen on May 5, 2021. Habermeier attributes the influx of activity to the ongoing inscription process, in which DOT holders can reserve slot names that will identify their accounts once the network transitions to Statemine, Polkadot’s first parachain.

With inscriptions driving record transaction volumes, it’s clear that user activity and engagement on Polkadot is accelerating as its ecosystem expands. This growing utilization helps justify the recent price gains and suggests there is more room for DOT to run.

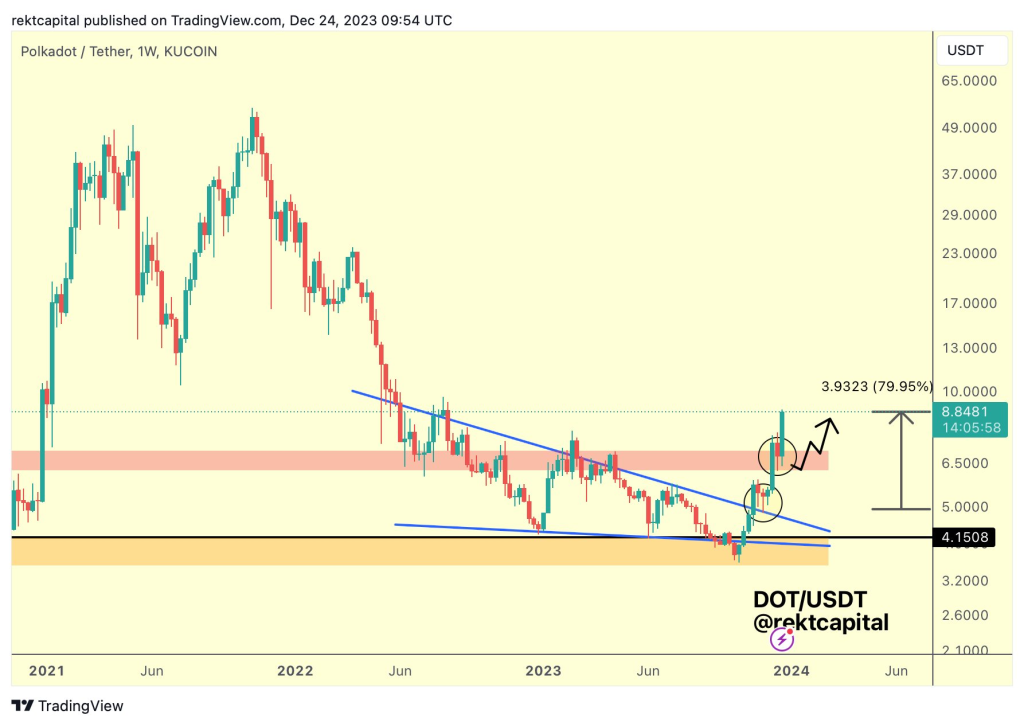

Elite crypto analyst Rekt Capital also notes Polkadot’s rally, with prices up 79% since his call on December 11th predicting a continued surge to 100% returns soon.

On the technical side, Polkadot’s daily RSI (relative strength index) now stands at 72. RSI is a momentum indicator that measures the speed and rate of an asset’s price movements. A reading of 70 or above generally signals an asset is overbought, having risen too far too fast and due for a pullback.

This aligns with past peaks this year on November 20th and December 10th, when DOT similarly hit RSI levels above 70 and then underwent brief price corrections.

In summary, a mix of positive fundamentals and technicals as well as market excitement seem to be fueling Polkadot’s outstanding performance the past weeks. A near-term breather would not be surprising, but the long-term outlook remains very bullish.

You may also be interested in:

- Will Solana (SOL) Flip ‘Dead’ Ethereum?

- Why Being Bearish on Kaspa (KAS) For Now Is a Wrong Move

- Exploring Fresh Crypto Options: $NUGX’s Promising Presale Picks Up Steam Among PEPE and DOGE Enthusiasts

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.