The ORDI token of the Bitcoin protocol Ordinals has rallied over 11% in the past 24 hours, according to market data. ORDI facilitates issuing other digital assets directly on Bitcoin’s base layer by embedding tokenized data into BTC transactions.

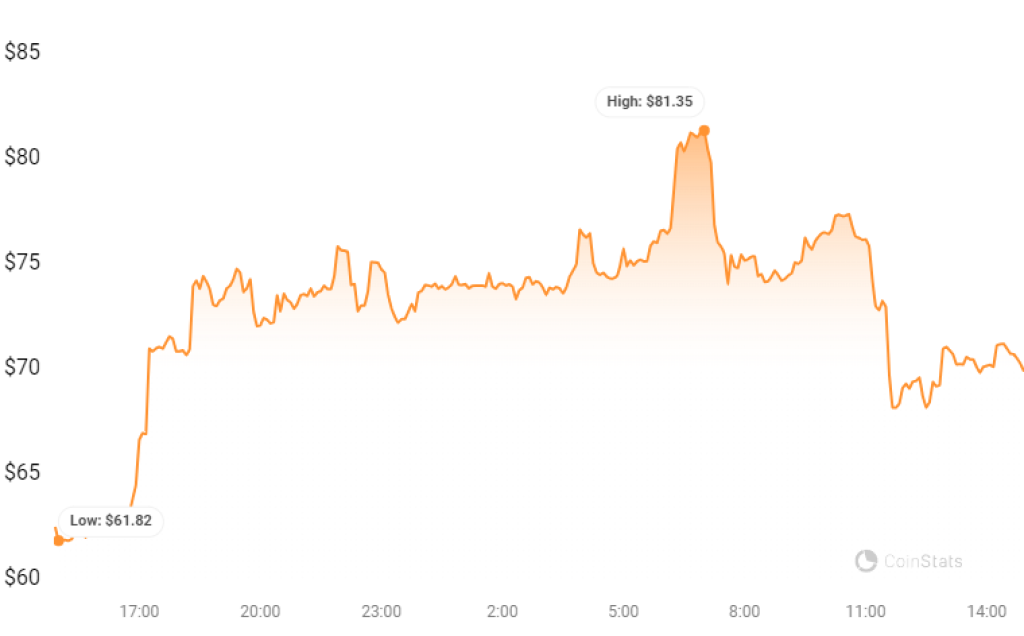

After ranging between $61.74 on the low end and $82 on the high side over the past day, ORDI last changed hands around $70, up from under $63 just yesterday. The sharp move higher comes amid choppy consolidation for Bitcoin itself near $42,600 as hash rate power reaches new all-time highs.

Source: CoinStats – Start using it today

No immediate catalysts seem responsible for ORDI’s double-digit intraday volatility. Likely, the broader strength of altcoins getting oversold combined with excess volatility from thin holiday liquidity has enabled rally attempts from oversold tokens like ORDI.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Additionally, peaking miner capitulation may bode well for firming Bitcoin’s price floor, which would restore interest in projects expanding functionality on Bitcoin’s backbone. With the largest cryptocurrency appearing to establish durable support around $42,000, BTC-based protocols like Ordinals stand ready to benefit.

Still, Bitcoin’s outlook remains murky as it continues to develop what analysts believe is an interim bottom. Further downsides can’t be ruled out yet if broader macromarkets roll over anew. Until BTC confines upside momentum, ORDI’s breakout requires confirmation before conclusively signaling a trend change, despite today’s rapid melt-up. If Bitcoin falters here, so too could Ordinals in short order.

You may also be interested in:

- DeFi Investor Unveils Top Crypto Picks for the Week Ahead Including BTC, AVAX and These Altcoins

- Will Bitcoin Traders Bet on Bullish or Bearish Outcomes This Holiday Season?

- Bonk Surpasses $1 Billion Market Cap As Solana Sets New 2023 High. Can Meme Moguls Catch Up?

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.