Over the last 24 hours, MUBI, the native token to the Multibit cross-chain bridge, has erupted over 48% alongside a 100% spike in trading volume. Fuelling the vertical move which has started a few weeks ago, analysts highlight a series of recent utility expansions making MUBI more appealing for investors.

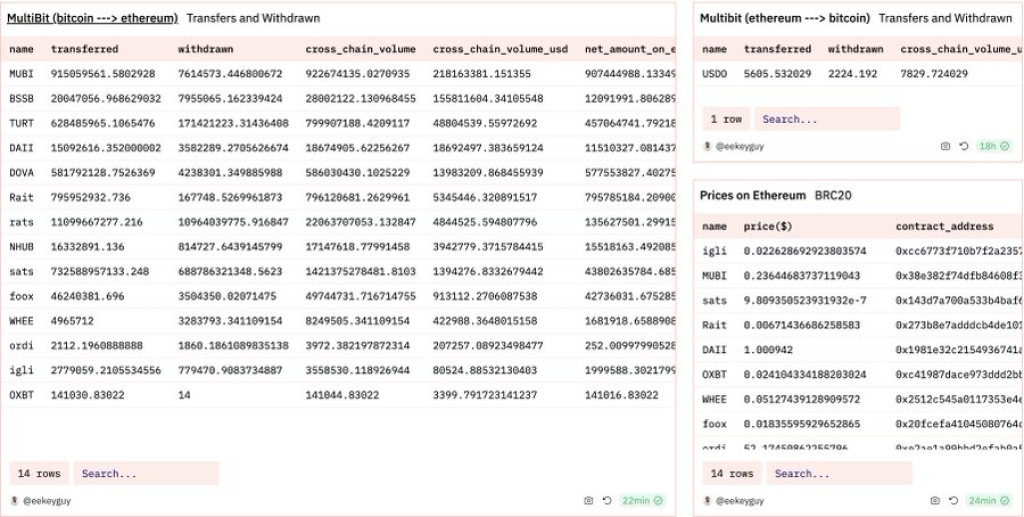

Recently, Multibit unveiled an explorer for monitoring bridge transactions, a revamped project listing process requiring MUBI staking, and a delegation incentive program over the past two weeks. These upgrades aim to expand use-cases for the token.

With the protocol now boasting over $472 million in monthly transfer volume as the third-largest third-party bridge, per analyst Hitesh Malviya, rampant speculation in the upgraded MUBI token now appears underway. Prices have detached from intrinsic value, riding instead on hype and future potential.

Over $9 Million in Unrealized Profit

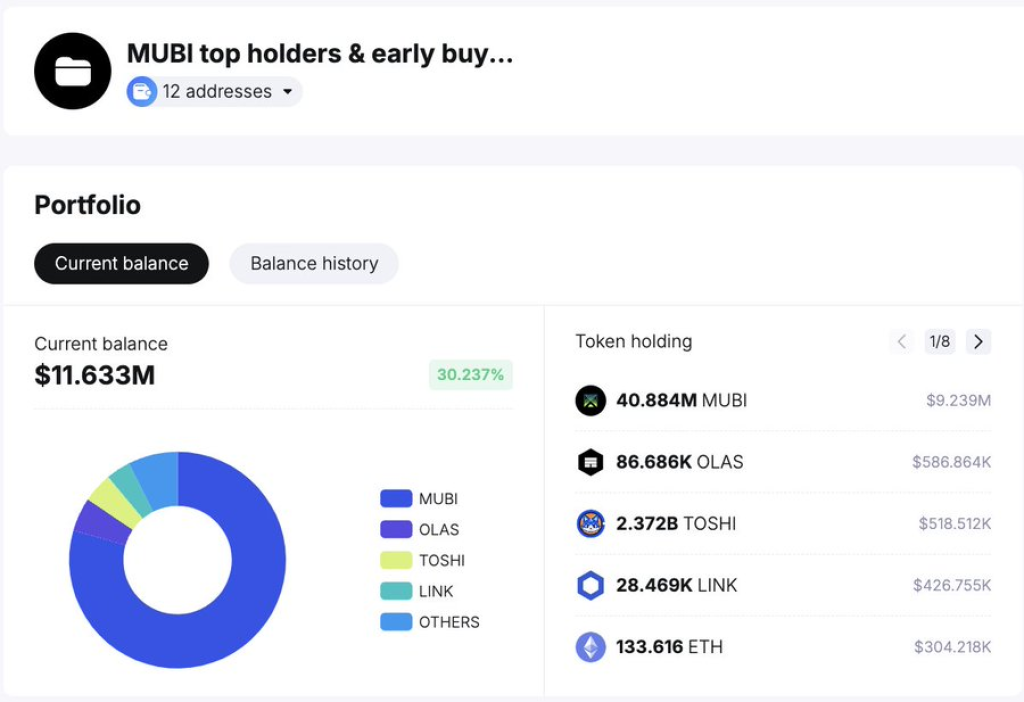

According to on-chain analytics provider Spot On Chain, MUBI’s 11 largest holders excluding exchanges have accumulated over $10 million worth of the token. As prices exploded 76% higher over the past day, these major investors now hold a collective $9.3 million in unrealized profit.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Spot On Chain notes these holders began accumulating approximately one month prior to the vertical ascent, suggesting prescient conviction in the token’s prospects. Now with their MUBI allocations multiples more valuable, the potential for profit-taking looms.

As major investors lock in gains, significant selling pressure could stall the parabolic climb. Despite the positive developments fundamentally, speculation has carried prices beyond reasonable levels given the protocol’s current scale. Once the frenzy subsides, gravity could reassert itself.

Nonetheless, building utility and soaring usage underpin a constructive long-term outlook for Multibridge. While the crucial $10 million threshold may cap the token’s near-term ascent, expanding volume and staking participation point to ongoing value capture over the strategic horizon. Once speculators shift focus, true believers can reorient towards the project’s strengths.

You may also be interested in:

- Top BTC Analyst Explains Why Another Big Bitcoin Move is Imminent, Reveals the Key Support to Look Out for

- Polkadot (DOT) to Continue Upward Rally as Critical Retest Proves Successful: Here Are the Next Price Targets

- BorroeFinance Sets Sights on Outperforming Cardano (ADA) and Polkadot (DOT)

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.