Ethena, dubbed the “fastest growing stablecoin of all time,” has faced a recent decline in its ENA token value, leaving many puzzled by the downturn. An analysis by Delphi Digital sheds light on the factors influencing Ethena’s performance and its unique approach to the synthetic dollar. Additionally, insights from user @GammaPure highlight the involvement of early venture capitalists (VCs) and investors in the recent dip.

According to Delphi Digital, Ethena has pursued a fundamentally different path compared to existing stablecoin models dominated by Tether and Circle, which collectively hold 90% of the market share. Unlike stablecoins that rely on traditional collateral such as real-world assets (RWAs) or collateralized debt positions (CDPs), Ethena’s USDe is collateralized by a long staked ETH position offset by an equivalent ETH-PERP short position. Moreover, Ethena has integrated BTC as additional collateral, further enhancing its scalability.

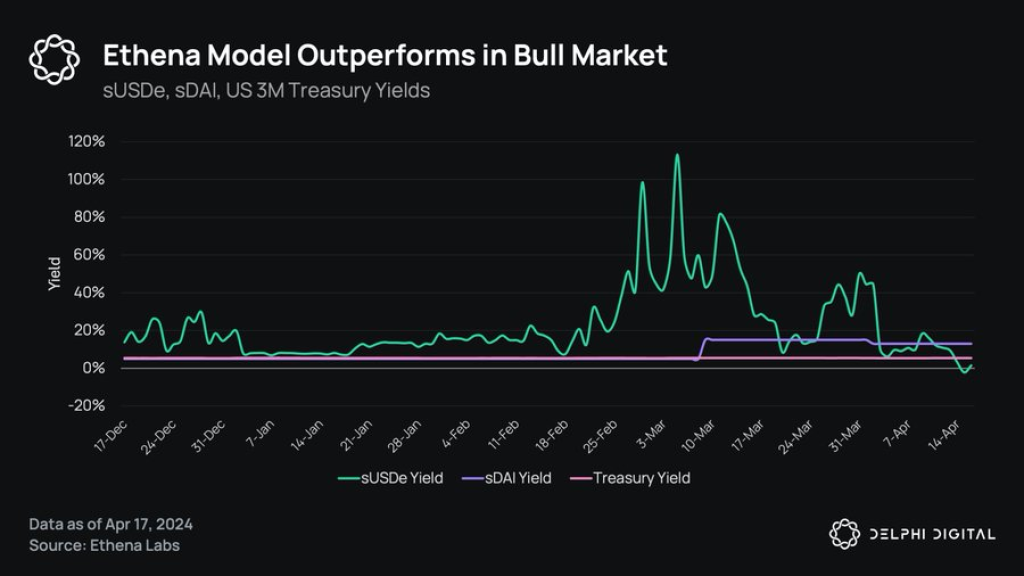

The delta-neutral backing of USDe offers two structural advantages over other yield-bearing stablecoin designs. Firstly, it is more capital efficient, requiring only $1 of collateral to mint 1 USDe, enabling Ethena to scale efficiently. Secondly, USDe harnesses the high-yielding sources of staked ETH and perpetual funding rates, capturing attractive yields from both. This novel design allows Ethena to cater to the market’s demand for yield while reaping the benefits of being a synthetic dollar.

Ethena’s architecture revolves around three core mechanisms: minting, redeeming, and staking USDe. End-users interact with liquidity pools or Ethena’s front-end, while authorized participants (APs) handle the minting and redemption processes. Swaps create arbitrage opportunities for APs, who rebalance pools by minting or redeeming USDe based on market demand. To earn yield, users stake USDe for sUSDe, which accrues value over time.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Despite its unique approach, Ethena’s success is accompanied by certain risks. These include counterparty risk, negative funding risk, redemption and liquidity risk, and auto-deleveraging (ADL) risk. Delphi Digital’s comprehensive report delves deeper into each risk, along with the measures implemented by the Ethena team and potential outcomes during adverse events.

Ethena’s impact extends beyond its own ecosystem. By democratizing access to the delta-neutral trade and enabling composability, Ethena is reconciling yields across decentralized finance (DeFi), centralized finance (CeFi), and traditional finance (TradFi). The recalibration of DeFi’s baseline interest rates has prompted reactions from protocols such as Frax Finance, Ajnafi, Synthetix, and MakerDAO, which has collaborated with Morpho Labs and Sparkdotfi. MakerDAO’s recent moves are evaluated in the report through a “risk-adjusted” lens.

The deep dive by Delphi Digital also covers Ethena’s scalability, profitability, early competitive advantage, the utility of its native token $ENA, and the potential collaboration between Ethena Labs and Pendle Finance, which could lead to DeFi’s first scalable yield curve.

Why Is Ethena’s ENA Dipping

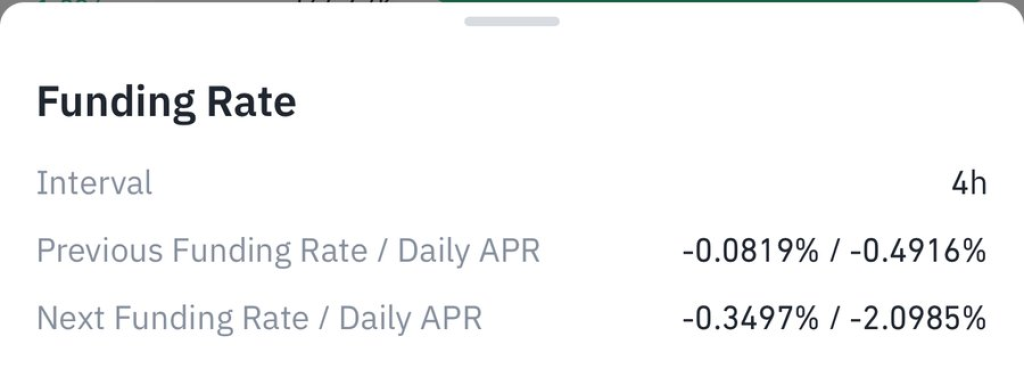

Twitter user @GammaPure offers additional insights into the recent dip in Ethena’s ENA token value. The decline is attributed to early VCs and investors hedging their positions, leading to high futures short positions and substantial funding costs.

Despite the substantial returns they have already seen, these investors’ tokens are locked until January 2025, prompting them to hedge for immediate profits. Retail investors face challenges as they buy at higher levels in the secondary market due to market-making activities and the transfer of large amounts of $ENA to exchanges, causing downward pressure. However, it is noted that Ethena’s market capitalization remains relatively low compared to other stablecoins like UST and LUNA, leaving room for potential growth.

The future trajectory of Ethena’s ENA token and its ability to overcome these challenges remain uncertain. As the market continues to evolve, Ethena aims to solidify its position as a groundbreaking synthetic dollar, with its unique approach and potential for further growth in the DeFi space.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.