DASH price is up 28% today and trades near $75.38. Trading volume jumped more than 200%, making DASH the top gainer in the market at the time of writing. Capital rotated into privacy assets as market conditions improved, sending valuations sharply higher across the sector.

Privacy coins rose about 15% on November 1, with DASH leading the move. This follows increased demand for financial anonymity during the ongoing push toward CBDCs and stricter regulation.

Dash’s optional PrivateSend feature helped position it as a preferred hedge in the privacy segment. The total privacy coin market cap reached $24.3B, the highest since 2022. Short-term sentiment remains strongly bullish while regulatory reactions remain uncertain.

Moreover, open interest surged 55% to $45.65M. The long/short ratio flipped positive for the first time since October. This shows traders are adding leveraged long exposure to chase continuation.

However, the funding rate moved above zero (+0.0087%), increasing the cost of holding longs. Around $4.32M in realized gains hit the market during the rally, meaning volatility risk remains elevated if momentum slows.

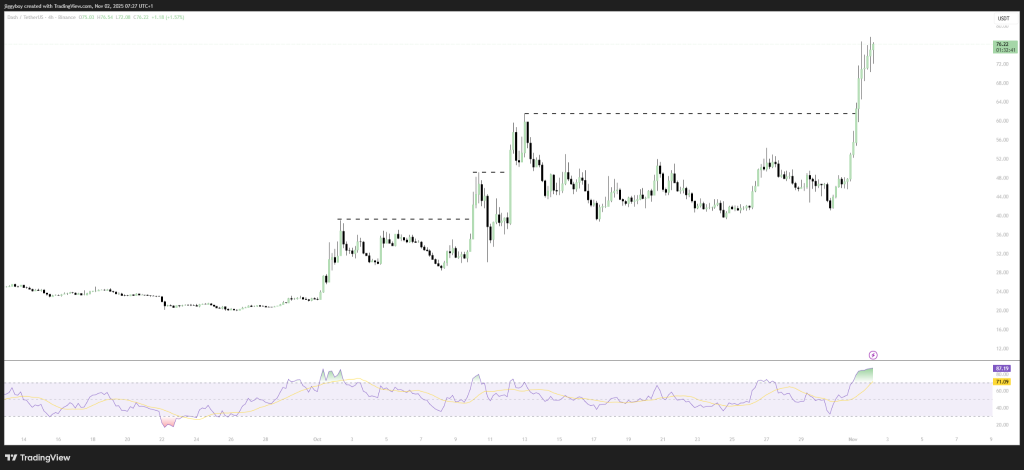

What the DASH Chart Is Showing

The 4H chart shows a clear multi-stage breakout. Price moved above previous resistance levels at $44, $55, and $64 before accelerating above $72 into the current highs. The breakout candle structure reflects strong momentum buyers entering aggressively.

The DASH price has now reached $76+ with minimal consolidation, signaling a powerful continuation move from a long base.

Each prior consolidation zone has flipped into support, creating a steep upward staircase trend. As long as price remains above $72, buyers maintain clear control of the market structure.

RSI on the 4H timeframe printed 87.19. This places DASH deep in overbought conditions, showing momentum strength but also indicating potential for cooling.

Volume expansion confirms the breakout is supported by strong participation rather than thin liquidity. Dash continues to follow a healthy trend of higher highs and higher lows.

Read Also: Why Is ASTER Price Down Today?

Short-Term Outlook for DASH Price

If current strength continues, the price could target $82 next. Breaking that level clears a path toward $90, where major supply last appeared. If sentiment weakens, first support stands at $72. Losing that opens a deeper retracement toward the prior breakout region near $64.

The trend remains constructive while DASH price stays above $72. With sector rotation favoring privacy coins and derivatives activity supporting upside, DASH enters this week with a strong bullish tailwind.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.