The post–Federal Reserve interest rate cut recovery in crypto prices was short-lived, with most major crypto trading in the red. Bitcoin (BTC), for example, traded above $93,000 as the Federal Reserve’s rate cut was meant to inject fuel back into the sector.

Rate cuts are one of the most notable catalysts as they incentivize investors to seek superior returns among riskier assets, especially crypto. This has been countered, however, by the Bank of Japan’s expected interest rate lift and potential confirmation of additional hikes ahead, which is spoiling risk-on momentum. Coupled with ongoing macroeconomic uncertainty, investors can’t be blamed for reevaluating their lists of the best cryptos to buy.

While major cryptos are printing red across the board, Digitap ($TAP), a crypto presale project, is bucking the trend by attracting fresh capital, even during the downturn.

What you'll learn 👉

Fed Cut Meets BoJ Hike Fears In A Confused Macro Picture

The initial lead-up to the Federal Reserve’s rate decision played out as expected. Bitcoin popped above $93,000, and most altcoins followed its lead higher. Traders and investors were right to conclude that cheaper money would increase demand for the top altcoins to buy.

But the rally faded because the market interpreted the decision as more of a “controlled easing” than confirmation of a new wave of liquidity. The rate cuts were framed as cautious or conditional, meaning prevailing logic doesn’t necessarily apply.

At the same time, the Federal Reserve’s counterpart in Japan looks poised to move in the opposite direction. The Bank of Japan’s expected rate hike on December 18 would tighten liquidity conditions through the yen channel. Japan has been a vital source of nearly free funding, with its rates trending close to zero since the late 1990s.

Meanwhile, recent U.S. inflation data confirms only uneven progress in price moderation. It’s undoubtedly not uniform enough for markets to price a smooth and predictable easing cycle.

Why Fragile Growth Keeps Crypto Squarely In The Firing Line

Simply put, the crypto market is down today because the Federal Reserve didn’t signal the “all clear.” Instead, investors received a mixed macro message and conflicting global interest rate signals. Mixed signals are always bad for risk appetite, especially in crypto, where rallies need conviction, liquidity, and leverage to sustain momentum.

Concerns over the economic outlook are translating into worries about whether the global economy will slow in 2026 and whether corporate earnings and consumer demand will hold up. In this environment, the shift from “growth is fine” to “growth is at best fragile” is not a good indicator for the crypto market.

The broader crypto market is still treated as a high-beta asset that investors look to trim first when they want to reduce risk. This appears to be playing out with the crypto market printing red as investors rebalance their holdings prior to the New Year. The list of altcoins to buy simply shrinks, and investors are forced to rethink their approach.

Digitap’s Banking Utility Appeals To Investors Seeking the Best Crypto To Buy

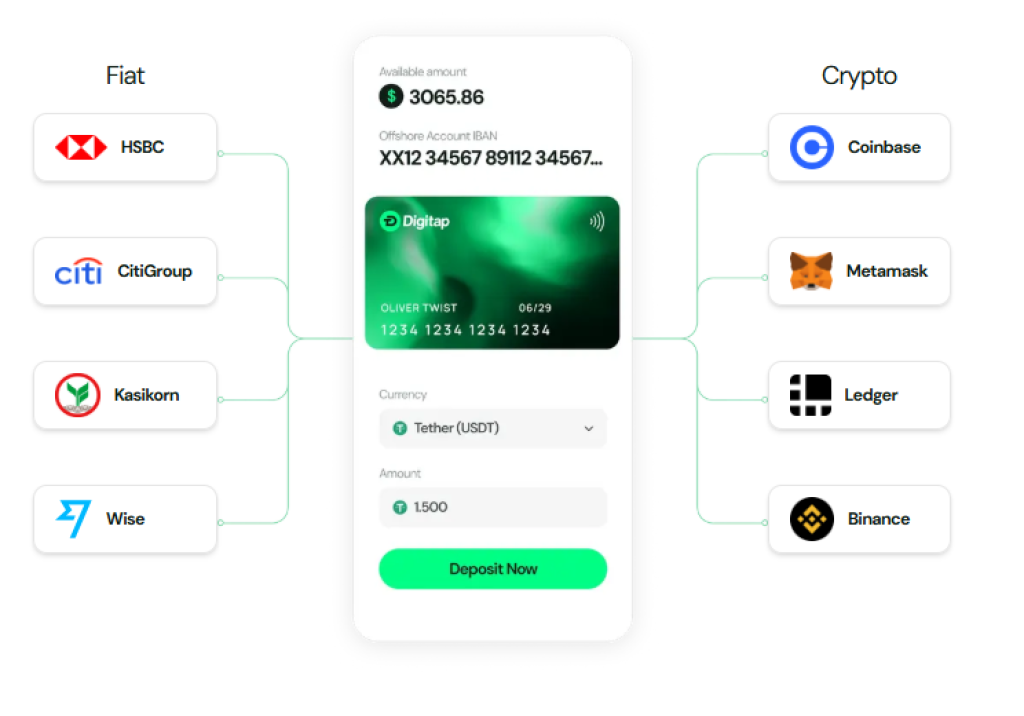

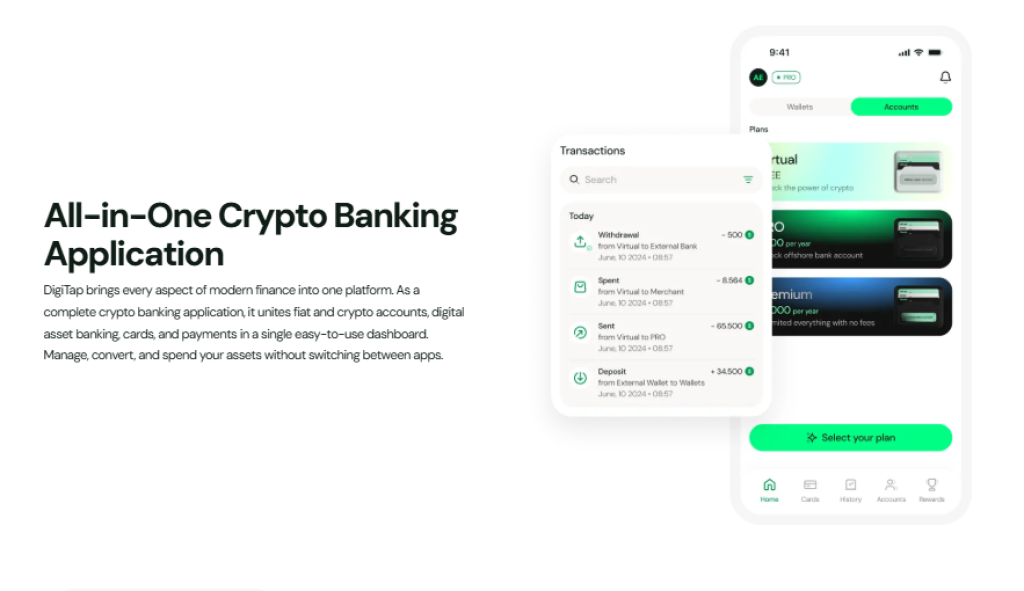

Digitap is one of the purest “banking” tokens in the crypto industry. It’s essentially a fintech app that blends traditional global fiat banking services with digital assets. Digitap’s live app lets users send, receive, store, save, hold, invest, and spend multiple fiat currencies via offshore IBAN accounts and transact with more than 100 cryptocurrencies.

What’s unique is that both fiat and crypto live and interact together in the same app. A Visa-powered debit card rounds out the suite of banking products and lets Digitap users spend their money on everyday purchases. In fact, users can even preload their Visa card with crypto, and the platform will instantly swap for fiat at the time of purchase.

The platform is dubbed a neobank but with full crypto integration and an emphasis on user privacy. An optional no-KYC signup process provides basic features to users who want to remain anonymous.

This is also a life-changing feature for the more than 1 billion adults worldwide who are underbanked or unbanked. Many of these people live in countries where access to proper identification is not possible.

Why Fixed Pricing Rounds Turned $TAP Into A Bear-Market Haven

Digitap’s ongoing crypto presale of its native $TAP continues to run strong despite the ongoing crypto selloff. The presale went live in late summer and saw its momentum pick up in the following months when the bull run came to an abrupt end.

Digitap’s presale is divided into tiers or stages. The price of $TAP is set at a fixed amount and offered until a round expires or sells out. The following round resets at a slightly higher price. The token was first sold at $0.0125 and has inched higher round by round to $0.0371, giving early investors a roughly 200% paper profit.

In a market that quickly shifted from bullish euphoria to fear, investors stopped chasing hype and promises. Instead, they found refuge in altcoins to buy that offered control, stability, and utility. Digitap’s core features, financial privacy, self-custody, and real-world usability, directly addressed the anxieties that the bear market amplified.

The numbers make it clear that Digitap’s presale has weathered perhaps the worst of the crypto market storm. The project has raised over $2.3 million and sold nearly 150 million $TAP tokens. The Digitap team recently confirmed it secured exchange listings for $TAP at an expected listing price of $0.14.

As $TAP inches toward a complete sellout and graduates from a crypto presale to a live token, the team is rewarding old and new investors with a holiday-themed event. With daily festive rewards, investors can take advantage of $TAP bonuses or platform rebates through Jan. 1. In total, 24 gifts are available to unwrap, but they are time-sensitive—once a deal expires, it’s gone for good.

Utility, Not Macro Noise, Drives Digitap’s Long-Term Case

Digitap’s crypto presale token offers a pure play on the next generation of banks, and its price is more insulated than major cryptos. Digitap is a “utility first, token second” crypto to buy as it is a real project with a real app that makes real profit.

This means Digitap’s value is more closely linked to metrics like app usage and transactions per user rather than Bank of Japan interest rate decisions. It’s a crypto you can buy as a rational hedge in the banking stack, not just another proxy for outside events and macro noise.

With its live and functional Visa card and comprehensive crypto banking app, Digitap stands out as a true winner in a challenging market.

Discover how Digitap is unifying cash and crypto by checking out their project here:

Presale | Website | Social | Win $250K

DISCLAIMER: CAPTAINALTCOIN DOES NOT ENDORSE INVESTING IN ANY PROJECT MENTIONED IN SPONSORED ARTICLES. EXERCISE CAUTION AND DO THOROUGH RESEARCH BEFORE INVESTING YOUR MONEY. CaptainAltcoin takes no responsibility for its accuracy or quality. This content was not written by CaptainAltcoin’s team. We strongly advise readers to do their own thorough research before interacting with any featured companies. The information provided is not financial or legal advice. Neither CaptainAltcoin nor any third party recommends buying or selling any financial products. Investing in crypto assets is high-risk; consider the potential for loss. Any investment decisions made based on this content are at the sole risk of the readCaptainAltcoin is not liable for any damages or losses from using or relying on this content.