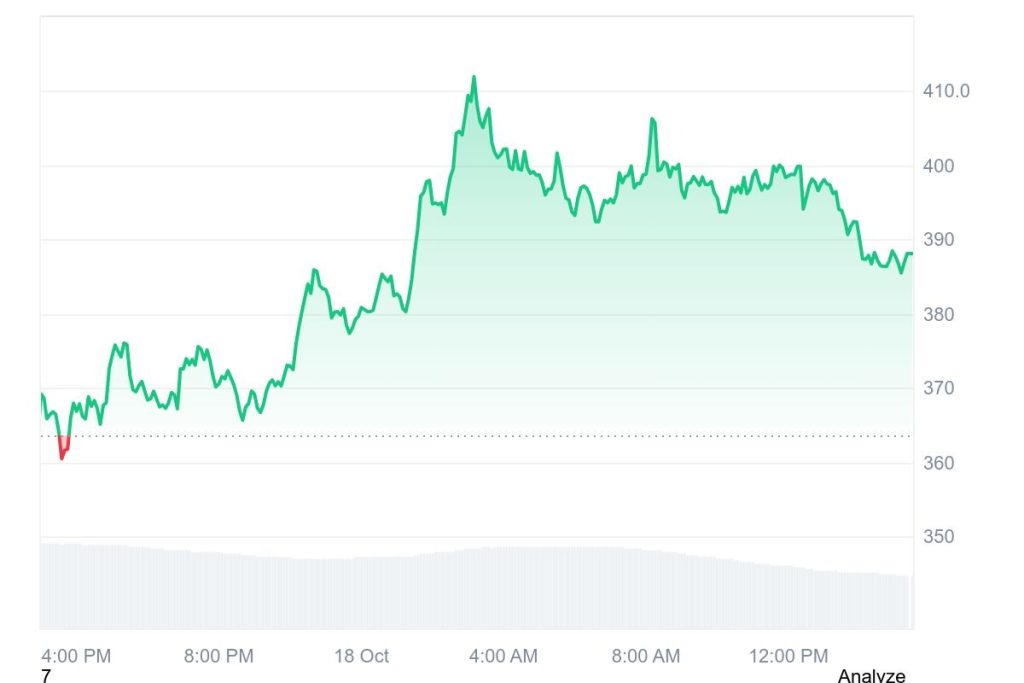

TAO price is back on the rise, and it’s not just a random bounce. After the decline earlier in the week, TAO has picked up good momentum again, reclaiming the $370 resistance and moving towards the $400 levels.

There are a number of factors behind the push, and together they are a picture of growing institutional demand, regained buying pressure, and strong technical rebound.

What you'll learn 👉

Institutional Interest Is Heating Up

The biggest catalyst right now is Grayscale’s new filing for a Bittensor Trust. The company submitted Form 10 with the SEC on October 12, signaling plans to open the door for traditional investors to buy into TAO.

That’s huge. It means TAO could soon be available to the same kind of institutional money that once flowed into Grayscale’s Bitcoin Trust.

It’s also coming after TAO Synergies’ $10 million purchase in July and xTAO’s 41,538-TAO treasury, so the institutional momentum has clearly been building for months.

With a 21 million TAO supply cap and the first halving scheduled for December 2025, the narrative around scarcity is getting stronger. If the SEC gives Grayscale the green light, it could unleash a new wave of demand that retail traders won’t want to ignore.

Read Also: Crypto Analyst Explains Why Bittensor (TAO) Could Become a Trillion-Dollar Asset

TAO Spot Buyers Are Back in Control

Even with all the headlines, what really matters is the money flow, and this week, spot demand has been impressive.

After a sharp 15% drop on October 17 caused by $48 million in derivatives outflows, spot traders quickly jumped in to buy the dip, adding $13.7 million in inflows in just one day.

Data from Binance and OKX shows 2.33 and 1.15 bullish volume ratios respectively, showing that real buyers are overcoming leveraged shorts.

The funding rate also went positive, i.e., the traders now pay to keep longs, typically a bull sign after huge liquidations. If such spot inflows continue, TAO price might be gearing up for a much bigger move.

TAO Chart Looks Strong Again

On the technical side, TAO chart looks healthy. The price reclaimed its pivot at $371.4 and is comfortably above the 30-day SMA at $338.65, a clear sign that buyers are defending key levels.

The MACD histogram turned positive, showing momentum building in favor of bulls, and the Money Flow Index (MFI) sits around 52, indicating there’s still plenty of room before TAO becomes overbought.

The next resistance is currently at $394, and a break there could easily send TAO price up to $410. The RSI at 55 indicates moderate strength, not red hot, but certainly trending upward.

The Bottom Line

TAO’s rally today isn’t just a technical bounce, it’s a mix of institutional confidence, spot buying strength, and bullish market structure.

There’s still volatility in the derivatives market, but with Grayscale stepping in, a halving on the horizon, and solid support forming above $370, the bias remains to the upside.

If TAO price breaks through $410, it could confirm the start of the next leg higher, and given how scarce this asset is, even small bursts of demand could send it climbing fast.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.