After a shaky week for the crypto market, TAO is suddenly back in motion. The token bounced strongly from its recent lows, and this time, it’s not just another technical blip, there’s a clear fundamental story behind the move.

What you'll learn 👉

Grayscale’s New Filing Is Turning Heads

The biggest reason TAO price is up today comes from Grayscale. On October 12, the company filed a Form 10 with the SEC for its Bittensor Trust.

If approved, that would make it an official SEC-reporting entity, meaning more transparency, shorter lock-up periods, and easier access for institutions.

Why does this matter? Because this is the same strategy Grayscale used with its Bitcoin Trust years ago, which ended up being a huge liquidity driver for BTC.

Investors see this as a sign of serious confidence in TAO long-term potential, especially since it ties into one of the biggest narratives in crypto right now: decentralized AI.

If the SEC gives this the green light, it could open the door for more institutional capital to flow into TAO. For now, the next thing to watch is whether Grayscale gets that OTC listing for the trust.

TAO Finds Its Footing on the Chart

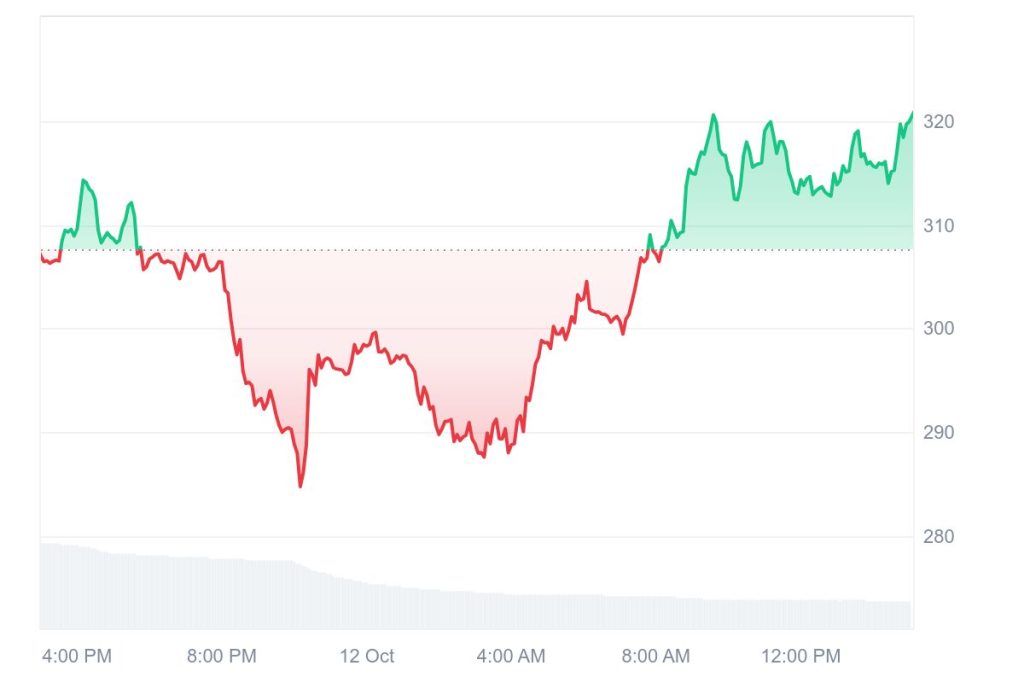

On the technical side, TAO price is bouncing exactly where it needed to. The token found support around $315, right above the 38.2% Fibonacci level at $307.32, and has been grinding higher since.

The RSI is sitting at 41.65, not quite oversold but hinting that sellers might be losing steam. The MACD is still negative but flattening out, another sign that the downtrend might be cooling off.

The one thing missing right now is volume. It’s down more than 60% in the past day, which shows that buyers are cautious.

A daily close above $323.50 (the 7-day SMA) would give a lot more confidence that this rebound has legs.

TAO Institutional Interest Keeps Growing

There’s also the quiet but important factor, institutional accumulation. Since July, Nasdaq-listed TAO Synergies and xTAO on the TSX Venture Exchange have together bought around 83,649 TAO, worth about $26.7 million.

That’s not retail activity. These are corporate treasuries treating TAO like a strategic decentralized AI asset, very similar to how MicroStrategy accumulated Bitcoin.

And many of these holdings are staked, earning around 10%+ annual yield, which effectively removes more supply from circulation.

Read Also: Bittensor (TAO) Nears 2x Rally as Price Enters Super Bullish Phase

The Levels That Matter Now

For traders, the immediate level to watch is $320. If TAO holds that, momentum stays on track. The next key test is around $327, which lines up with the 30-day moving average. A clean break above that could spark a stronger short-term rally.

If TAO price slips back below $315, though, it could turn into another period of consolidation before the next move.

For now, though, TAO strength is standing out. Between Grayscale’s regulatory progress, steady institutional buying, and a clean technical rebound, Bittensor is quietly becoming one of the most interesting altcoins in this market.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.