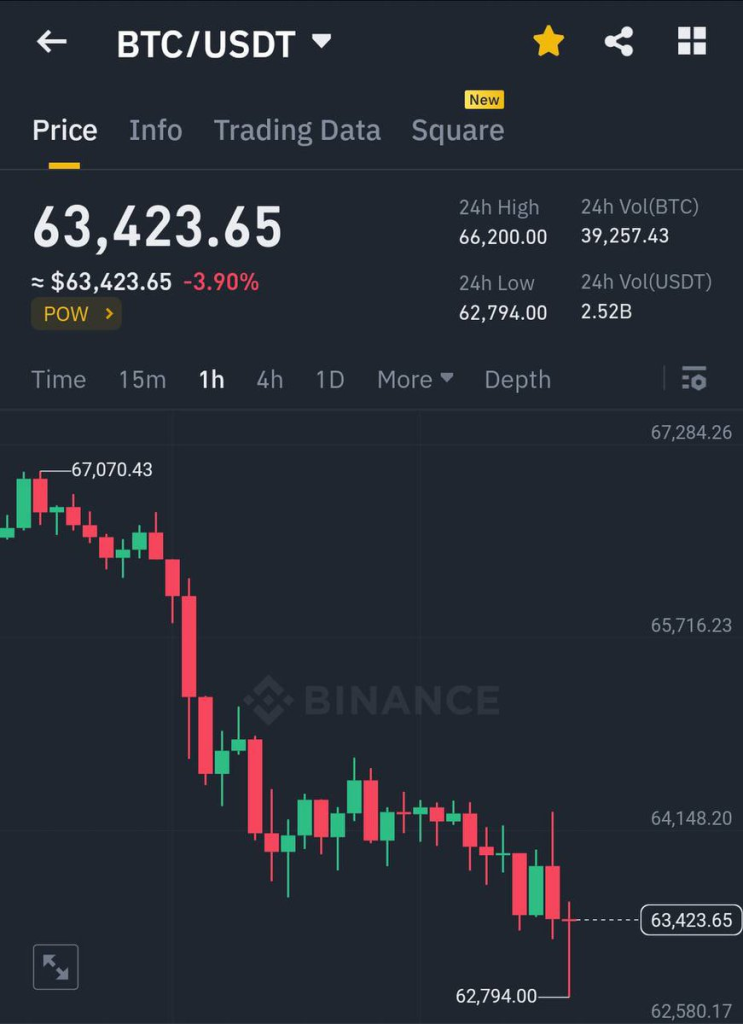

The price of Bitcoin, the world’s largest cryptocurrency, has experienced a recent dip, dropping from around $67,000 to $62,000 yesterday. However, it is currently trading at approximately $64,000 today, with the possibility of further declines. This volatility has caught the attention of analysts, one of whom, Ash Crypto (@Ashcryptoreal), has pointed to several factors contributing to the price movement and hinted at a potential buying opportunity for investors.

What you'll learn 👉

Why Bitcoin Is Dumping

- Historical Market Cycle: Ash Crypto notes that, historically, Bitcoin has undergone correction and price consolidation after a significant pump following the halving event. The recent surge from $15,000 to $73,000 is now being followed by a corrective phase, which is consistent with past market cycles.

- Lower-than-Expected GDP: The analyst highlights that the recently released GDP projections for the United States came in at 1.6%, lower than the expected 2.5%. This disappointing economic data has ignited fears of a potential recession, leading to a sell-off in the S&P 500, NASDAQ, and cryptocurrency markets.

- Biden’s Tax Proposal: Yesterday, President Biden proposed the highest capital gains tax in history at 44.6%, along with a 25% tax on unrealized gains for high-net-worth individuals. Historically, such proposals have triggered market dumps, and the current situation is no exception, as investors react to the potential impact on their investments.

- Geopolitical Tensions: The analyst points out that yesterday, Israel struck 40 Hezbollah sites in South Lebanon. Bitcoin has a tendency to price in potential war scenarios, leading to an immediate dump in response to such geopolitical tensions.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Golden Buying Opportunity Below $60k

Ash Crypto suggests that the low GDP numbers could actually be bullish for the market in the long run, as it may prompt the Federal Reserve to implement rate cuts. After the recent inflation data, it was expected that rate cuts could be delayed, but the GDP figures increase the probability of rate cuts once again.

Furthermore, the analyst believes that the $60,000 support level for Bitcoin remains strong, with a significant number of buy orders placed at that level. However, if a black swan event (an unpredictable and severe event) were to occur, Bitcoin could potentially dip lower, presenting a golden buying opportunity for investors.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.