Bitcoin hit its 2023 peak price of around $31,500 in July after a favorable SEC ruling. However, since the cryptocurrency market crash in mid-August, Bitcoin has been trading in a range between $25,000 and $28,200. This recent volatility has sparked divided opinions on where Bitcoin’s price may go next.

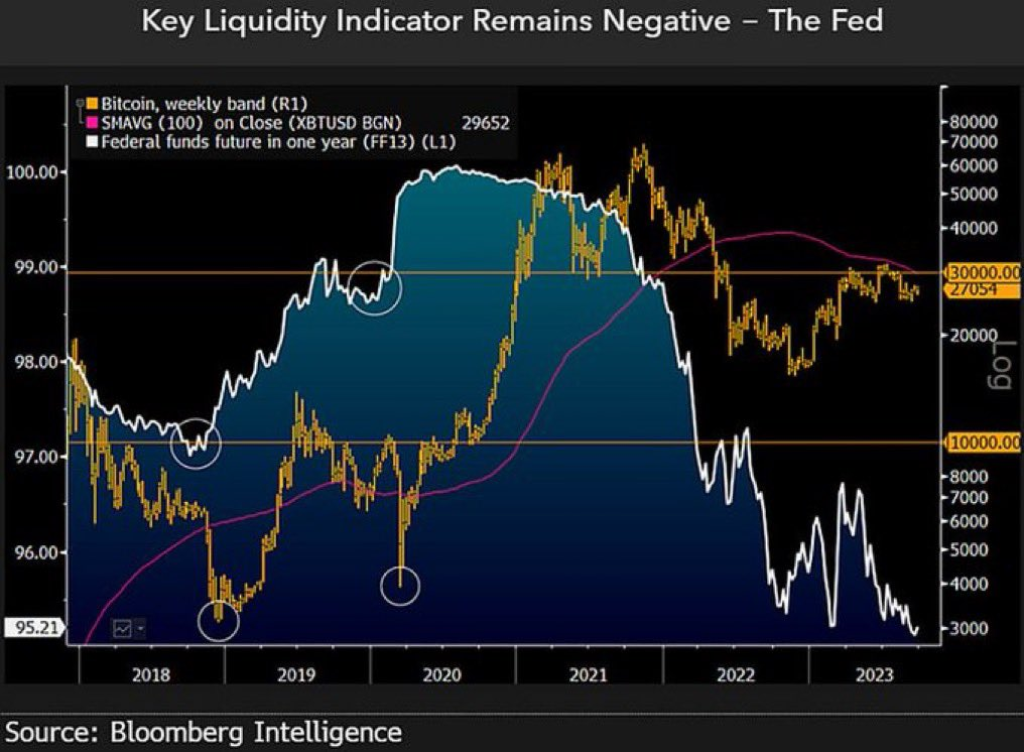

Bloomberg Intelligence’s Mike McGlone predicts Bitcoin’s price could crash another 60% from current levels around $28,000. He cites tightening liquidity conditions and ongoing interest rate hikes by global central banks as headwinds for Bitcoin. With rising rates making risky assets less attractive, Bitcoin could face strong selling pressure.

Global central banks like the Federal Reserve have been aggressively hiking interest rates in 2023 to combat high inflation. These interest rate hikes are seen as a headwind for Bitcoin’s price. Higher interest rates raise the opportunity cost of holding Bitcoin, which does not offer any yield. As interest-bearing assets like bonds become more attractive amid rising rates, it can prompt investors to move money out of Bitcoin and into fixed income, putting downward pressure on Bitcoin’s price. If central banks continue their current trajectory of rate hikes, it could continue weighing on speculative assets like Bitcoin, as McGlone notes.

However, some are more optimistic. Crypto analyst Crypto Rover believes that if Bitcoin can surpass the $31,500 resistance level, it will signal a resurgence of the bull market. Historically, $31,500 has acted as a key pivot point between bull and bear phases. After consolidating below this level for over 500 days, Crypto Rover thinks a breakout is nearing.

“This price point essentially delineates bull and bear markets.” – said Rover.

The path forward remains uncertain. While macro conditions pose challenges, Bitcoin has recovered from major drawdowns before. At the same time, breaking key resistance levels could revive bullish sentiment. As the cryptocurrency market remains highly volatile, traders should watch critical chart levels and news developments to gauge Bitcoin’s next major move.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.