The cryptocurrency market has been rattled by a significant sell-off, with Bitcoin, the world’s largest digital asset, experiencing a sharp decline of 7% in a single day. At the time of writing, Bitcoin’s price has plummeted from $64,500 to $60,000, raising concerns among investors and traders alike.

According to Ash Crypto (@Ashcryptoreal), a prominent crypto analyst, several factors have contributed to Bitcoin’s recent downward spiral. Chief among them is the escalating geopolitical tension between Iran and Israel, which has raised the specter of a potential conflict that could even escalate into World War III.

In a recent statement, the former Mossad intelligence chief hinted at the possibility of striking Iran’s nuclear facilities, a move that could have far-reaching consequences. Ash Crypto suggests that this development has fueled panic in the market, prompting investors to offload their Bitcoin and cryptocurrency holdings.

Another factor weighing heavily on the market is the hawkish stance adopted by Federal Reserve Chairman Jerome Powell. During his testimony yesterday, Powell expressed uncertainty about the inflation trajectory, indicating that the central bank might keep interest rates elevated for a more extended period than previously anticipated.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +This statement contradicted market expectations of a potential rate cut in June, further exacerbating the sell-off. Ash Crypto notes that the probability of a rate hike has now increased to 1%, a development that has likely contributed to the market’s downward pressure.

Ash Crypto also points to the resurgence of retail greed as a potential catalyst for the current market turmoil. Despite recent corrections, the funding rate, an indicator of market sentiment, remained positive, suggesting that retail investors were still eagerly longing every dip with high leverage.

According to Ash Crypto, unless a full market reset occurs, resulting in a negative funding rate for some time, the market could continue to experience sideways or downward movement.

Bitcoin Could Potentially Reach $100,000 in 2024

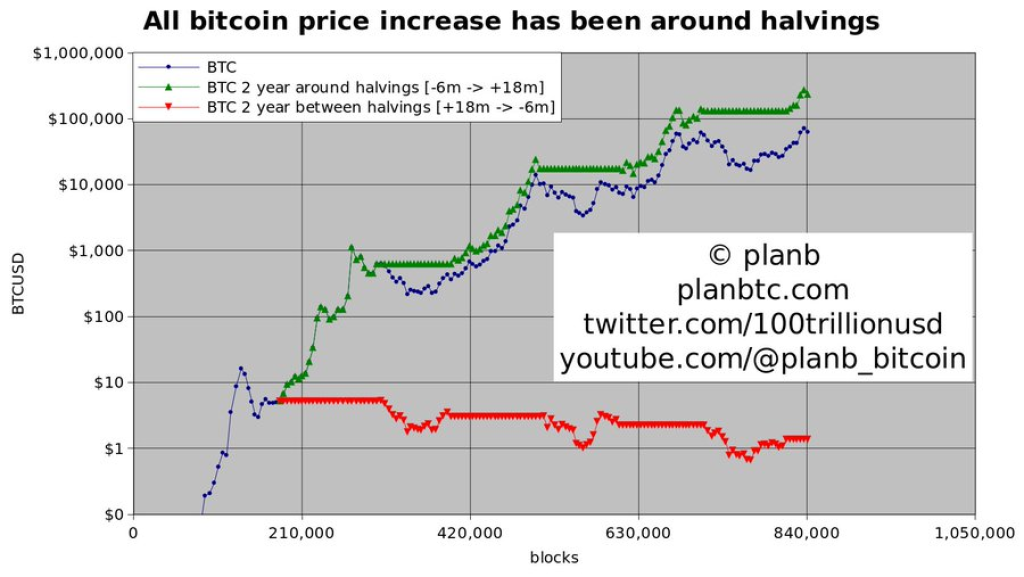

Despite the current market turbulence, some analysts remain optimistic about Bitcoin’s long-term prospects. PlanB (@100trillionUSD), a well-known Bitcoin analyst, believes that the upcoming Bitcoin halving event, scheduled for 2024, will not deviate from historical patterns.

PlanB predicts that Bitcoin’s price increase will once again be concentrated around the halving event, with the optimal strategy being to buy six months before the halving and sell 18 months after. According to PlanB’s projections, this approach will outperform a buy-and-hold strategy, and Bitcoin could potentially reach $100,000 in 2024, with a top of $300,000 expected in 2025.

While the recent sell-off has undoubtedly shaken investor confidence, the cryptocurrency market has proven its resilience time and again. As geopolitical tensions ease and the Federal Reserve’s stance becomes clearer, the market may find its footing once more, potentially paving the way for the bullish projections outlined by analysts like PlanB.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.