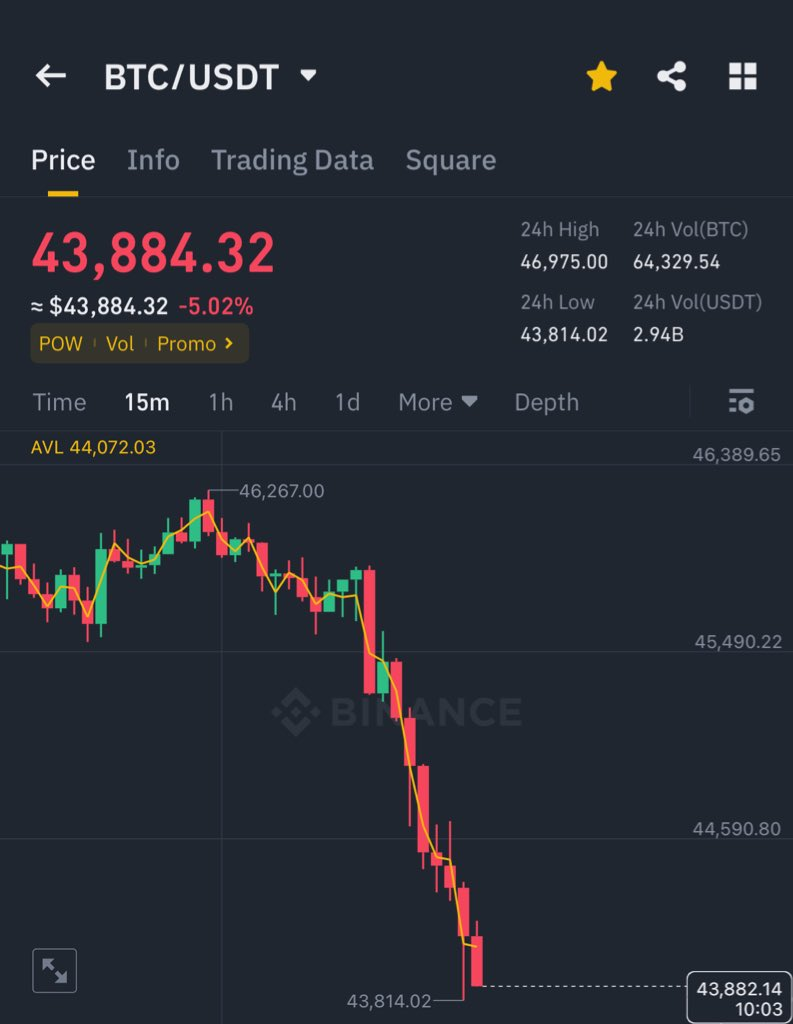

In a post shared on Twitter, crypto analyst Ash Crypto (@Ashcryptoreal) outlined several reasons why Bitcoin’s price has declined following the long-awaited approval of the first Bitcoin spot ETF in the US.

Dumping Despite Positive News “There was a strong speculation leading towards the ETF approval, now it’s approved people doesn’t have anything to speculate on and many expected it to pump towards $55k after approval coz that didn’t happen people are just taking profits or selling in disappointment,” Ash Crypto wrote. The approval of the Bitcoin ETF was viewed as very positive news for the crypto market. However, with the event now passed, some traders who expected an immediate price surge have sold off in disappointment when that failed to materialize.

Taking Profits and Rotating Into Altcoins In addition, Ash Crypto pointed out that Bitcoin’s price rallied significantly in the weeks leading up to the ETF approval, surging from around $15,400 to nearly $49,000. With Bitcoin hitting local highs, some traders have decided to take profits off the table. There may also be a rotation occurring, with money moving out of Bitcoin into other assets like Ethereum that have more room to run.

“People are selling BTC and buying ETH coz they know ETH spot ETF is coming next and ETH haven’t really pumped yet so they are moving to undervalued asset,” the analyst wrote. With Ethereum trading nearly 50% below its all-time high despite strong fundamental developments in areas like NFTs and DeFi, traders may be anticipating an Ethereum rally and rotating accordingly.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Long-Term Bull Case Intact While disappointing to some in the short term, Ash Crypto believes the Bitcoin ETF will have an overwhelmingly positive impact longer term. “My personal opinion – Bitcoin ETF will become more popular in Wall Street and we will see companies allocating billions to Bitcoin over time which will send BTC to $100k – $200k+ easily,” he wrote.

The COIN ETF saw massive trading volumes of $4.3 billion on its first day, setting a record for a new ETF product launch. As the ETF attracts more institutional investment over time, Ash Crypto is confident that the increased exposure and accessibility for Wall Street will send Bitcoin’s price flying upwards to between $100-200k.

So while the ETF approval may not have provided an immediate moonshot, long-term holders still have cause for optimism. “So hold tight and be patient,” Ash Crypto concluded. With the trust and regulatory approval signaled by the ETF, Bitcoin’s outlook remains conclusively bullish in the years ahead even if short-term price action is disappointing.

You may also be interested in:

- Ethereum (ETH) Becomes Bullish Across All Timeframes, Could Reach This Price in 2 Months

- XRP Price Struggles to Break Out Due to Mixed Signals as Ripple vs SEC Case Drags On

- Analyst Backs Pushd (PUSHD) Presale Over The Likes Of Dogecoin (DOGE) And Pepe (PEPE)

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.